The Hedge Vision portfolio returned 32.89% in 2024 compared to the S&P 500 and Nasdaq 100’s total returns of 25.73% and 28.02%, respectively.

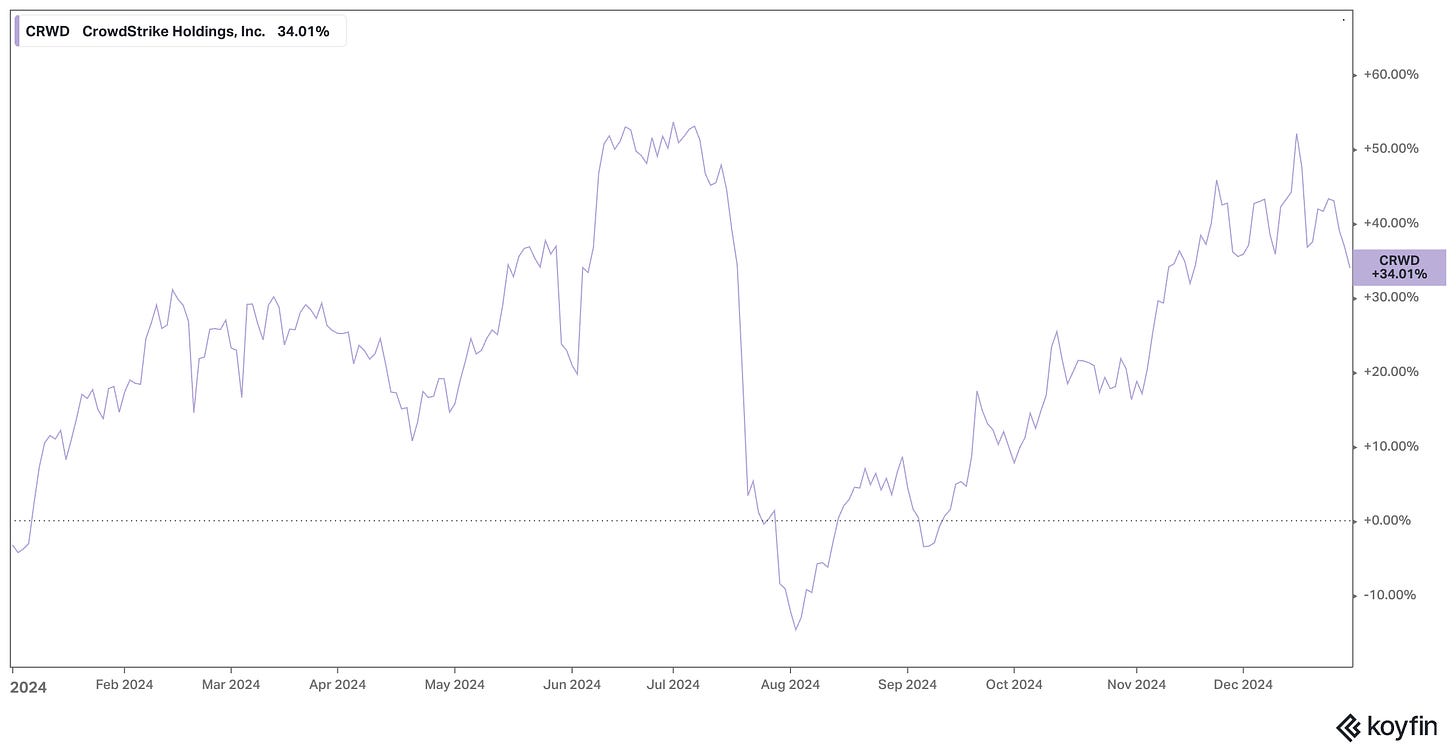

Nvidia (NVDA) was my top-performer for a second year in a row with a return of 171%. My #1 position, CrowdStrike (CRWD), also deserves a special shout-out after falling by 50%, recovering, and ending the year with a 34% return.

2020 starting from May: +54.80%

2021: +0.33%

2022: -48.99%

2023: +69.13%

2024: +32.89%

Hedge Vision Portfolio

Here is my portfolio from Dec. 31, 2023 for comparison:

Changes from Dec. 31, 2023:

New Positions: ELF, LULU, FXI, KWEB, UBER

Sold Positions: AMD, CRM, ESTC, MDB

2024 saw the S&P 500 return 20%+ for two consecutive years, the first time since 1998. During the year, I completely sold out of four positions while buying five new positions.

Advanced Micro Devices (AMD)

AMD was easily my best sale of the year. As highlighted in my Q1 portfolio review:

I sold 75% of my AMD between $175 and $180 before earnings and the remaining 25% after earnings at $201, realizing gains of 225%+. I reasoned that the company’s valuation had gotten out of line, which was confirmed after AMD reported a weak Q4 earnings with a big guidance miss for Q1.

AMD finished 2024 down by 12.84% at $120.79.

e.l.f. Beauty (ELF)

2024 also saw my portfolio expand into a new industry: beauty and cosmetics. In April, I started a 1.1% portfolio position in e.l.f. Beauty (ELF) at $155. I quickly sold out the following month due to a disappointing earnings report, realizing a 4.83% loss in the process.

In Sept., I bought back in at $127.50 in light of a lower valuation and raised guidance. Using a dollar-cost average (DCA) strategy, I was able to buy shares for as low as $105. My ELF cost basis currently sits at $108.45 compared to the 2024 closing price of $125.44, or a gain of 15.66%.

Lululemon (LULU)

Lululemon (LULU) was another addition to my portfolio. While Nike (NKE) was on my watchlist at the beginning of the year, I couldn’t get myself to buy NKE when Lulu’s financials were much, much better.

My cost basis for LULU is at $276.49 compared to the 2024 closing price of $382.41, or a gain of 38.31%.

In my July 2024 Portfolio Review, I explained:

At current prices, LULU is a much better deal than NKE and has a solid lead in revenue CAGR, gross profit margins, and free cash flow per share. Yet, the market still rewards NKE with a much higher forward P/E multiple.

Why? It’s because Nike is one of the most recognized brands in the world, if not the most. However, its status as the sportswear leader has come under fire in recent years in light of new contenders, which include Lululemon, Alo, Hoka, and On.

Nike can absorb a few quarters of underperformance, but if the trend persists, its premium multiple will at risk.

Meanwhile, LULU is trading at its lowest forward P/E since 2009 and has shed 53% YTD. The company is still the leader of athleisure, a trend I expect to remain relevant for years to come.

Since then, LULU is up by 69% while NKE is up by 0.8%.

Uber (UBER)

Uber (UBER) was my last purchase of 2024 and accounted for 2.1% of my portfolio at year-end at a $60.65 cost basis.

My thesis for the ride-hailing company is quite simple and hinges on taking advantage of panic selling as a result of Waymo and Tesla’s (TSLA) Robotaxi.

As shared with Substack Chat members on Dec. 11:

As of October, Wayne offered 150,000 rides per week. That compares to Uber’s…wait for it…202 MILLION rides per week.

All of this signals that Waymo is still way early in the game and that it is way too early to tell or even guess if Waymo will be able to impact Uber’s market share significantly. Even if Waymo is successful in taking market share, it will likely be several years before that materializes.

That creates an opportunity to take advantage of short-term price action.

My last new positions are the iShares China Large-Cap ETF (FXI) and the KraneShares CSI China Internet ETF (KWEB). I wanted to diversify my China exposure outside of Alibaba (BABA). At the beginning of the year, my China exposure was less than 1%. As of Dec. 31, it was 9.3%.

Mistakes Were Still Made

2024 was a fantastic year for many people. Mistakes were still made.

MongoDB (MDB)

My first mistake was selling my entire MongoDB position at $221 in June compared to my cost basis of $209. MDB later rallied higher to $350 before finishing the year at $233 following an earnings plunge.

Salesforce (CRM)

My second mistake was selling Salesforce (CRM) in February between $299 and $300 at breakeven. CRM finished the year at $334, but not before falling lower to $218 in late May. The introduction of the company’s Agentforce and Einstein AI offerings were major factors in CRM’s recovery.

iShares China Large-Cap ETF (FXI) & KraneShares CSI China Internet ETF (KWEB)

Two of my new positions, FXI and KWEB, ended the year below my cost basis. FXI ended the year at $30.44 compared to my cost basis of $30.74 while KWEB ended at $29.24 compared to my cost basis of $30.39.

However, I’m still very bullish on the future of China and will continue to hold these two ETFs. I believe that both of these ETFs, as well as BABA, will outperform the S&P 500 in 2025.

When Your #1 Position Falls by 50% in a Month

And the winner for the biggest head-fake, and also global outage, of 2024…. CrowdStrike.

CrowdStrike is one of my oldest holdings and was my #1 position at the end of the year with a 11.7% portfolio allocation and a cost basis of $144.66.

Between July and August, CRWD plummeted lower by 50% after the cybersecurity company caused a global outage that affected millions of Microsoft Windows devices, including those used by airports, banks, hotels, and many other businesses. CrowdStrike’s YTD return fell to as low as -14.6% on the news.

By the end of the year, CRWD finished with a 34% return, outperforming both the S&P 500 and Nasdaq 100.

I left my CRWD position completely unchanged in 2024. Yes, I regret not buying when the price dipped to $200.

At the same time, the thought of selling any shares never crossed my mind, despite the ramifications of the outage. Here’s a message I sent out to Substack Chat members on July 22 explaining my rationale:

“CrowdStrike is down another 12% today. My long-term thesis remains unchanged. Here's why.

-The proportion of the outage is being overblown. 8.5 million Windows devices were affected, or less than 1% of the Windows installation base across the world.

-People are acting like this is the first ever major outage event attributable to a single company. It's not. NET, OKTA, MSFT, and AMZN have all been responsible for similar situations.

-Yes, CrowdStrike will likely receive lawsuits and fines. This is an implication that will put the company in the penalty box in the short-term while also hurting margins.

-CrowdStrike will likely offer credits to its affected customers while its reputation will take a hit. That will affect sales.

-Here's CrowdStrike's liability policy in all of its contract agreements, courtesy of @FIREDUpWealth on X:“The liability limits in CrowdStrike's terms and conditions specify that CrowdStrike’s total liability for any claim arising out of or related to the agreement will be limited to the amount paid by the customer for the specific product or service giving rise to the claim during the 12-month period immediately preceding the event causing the claim. Additionally, CrowdStrike is not liable for any indirect, special, incidental, consequential, or punitive damages, even if advised of the possibility of such damages."

-Yes, it sucks to be down 30% in a single week. If you're a trader, it would make sense to get out. I'm an investor. CrowdStrike's short-term price action will likely be volatile for a few months.

-Again, this was NOT a breach or hack and says nothing about the efficiency of CrowdStrike's cybersecurity products. The outage was a direct result of a faulty sensor configuration update, not because of a product vulnerability.”

Plan for 2025

At first glance, Wall Street appears to be bullish. Analysts across the board have an average 2025 S&P 500 price target of $6,534, implying upside of 11.1% from the Dec. 31, 2024 close of $5,881.63.

However, 11% gains convey a normal year for the index given average returns of about 10% since 1965 and about 11% during the past decade.

Meanwhile, animal spirits and euphoria have returned to the market. Some examples:

-Groups like “Irresponsibly Long $MSTR” popping up on X and boasting 25,000 members, despite rampant dilution and the lack of an actual business.

-The return of unprofitable space, quantum computing, and eVTOL stocks with no plan for profitability in sight. Who remembers what happened to Virgin Galactic (SPCE) in 2021? Hint: Down by 99% since.

-Software stocks trading at 50x forward EV/Sales.

That comes as the S&P 500 avoided a 10% correction in 2024. The index saw a 10% drawdown during intraday trading in 2024, although the official definition uses daily closing prices.

Regardless, the lack of a major decline has created a lot of confidence in the market. When the next inevitable 10% drawdown eventually happens, it could result in a flood of panic selling from newer investors, amplifying the fall in the process. That’s healthy for the market.

As a long-term investor, none of this impacts my investment strategy, and I would welcome a 10%, 15%, or even 20%, market drop with open arms.

My strategy is to invest in innovative industry leaders at opportunistic valuations, and a lower stock price means more shares for my portfolio.

Best of luck to everyone in the New Year! 🤝

Hedge Vision

Thanks for reading!

📖 Join the conversation on Substack Chat

🕊️ Get real-time insights on X/Twitter: @HedgeVision

📧 Old school is cool too: HedgeVisions@gmail.com

Nice to see the discussions around mistakes which are seldom talked about