I’ll admit, I did not expect the market’s strong Q1 returns following an incredible 2023, but I am glad that I stayed the course.

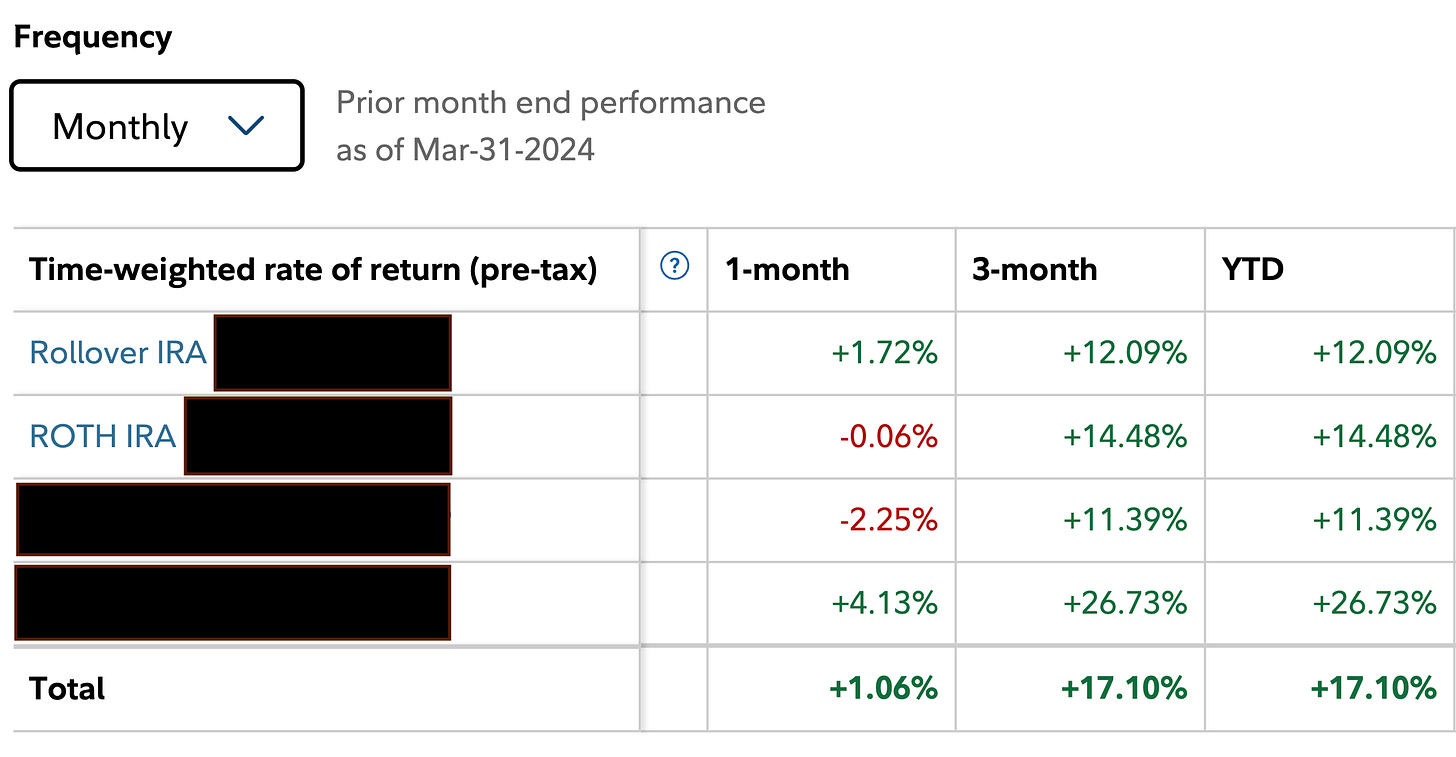

During Q1, the Hedge Vision portfolio returned 17.10% compared to the S&P 500’s return of 10.79% and the Nasdaq 100’s return of 10.56%.

Returns Since Inception:

2020 starting from May: +54.80%

2021: +0.33%

2022: -48.99%

2023: +69.13%

2024 Q1: +17.10%

Hedge Vision Portfolio as of March 31, 2024

Total Positions: 23 compared to 26 as of Dec. 31

Top 10 Positions Concentration: 75.9% compared to 73.8% as of Dec. 31

Cash: 11.5% compared to 6.8% as of Dec. 31

Watchlist: LULU 0.00%↑ at $340 or below, CELH 0.00%↑ in the $60s, NKE 0.00%↑ in the low $80s, BABA 0.00%↑ up until $80. Any of my other existing positions at the right price.

The top contributors to my Q1 returns were NVDA 0.00%↑ with a gain of 87.6% and CROX 0.00%↑ with a gain of 53.4%. I have no plans to sell out of Nvidia but may pare back my Crocs position in the coming months due to its outsized allocation. All of my real-time trades are shared with contributing subscribers on Substack Chat.

My cash position increased by 4.7% compared to Dec. 31 due to the liquidation of three positions offset by various buys. The three sales were AMD 0.00%↑, CRM 0.00%↑, and ESTC 0.00%↑.

AMD

I sold 75% of my AMD between $175 and $180 before earnings and the remaining 25% after earnings at $201, realizing gains of 225%+. I reasoned that the company’s valuation had gotten out of line, which was confirmed after AMD reported a weak Q4 earnings with a big guidance miss for Q1. To be fair, revenue is expected to accelerate later on this year to an estimated 26% YoY increase by Q4.

I may revisit AMD depending on the price and the outcome of its next earnings report.

CRM

As for Salesforce, I sold out for a minuscule gain in several transactions around $300 in order to reinvest the proceeds into MELI 0.00%↑ and BABA 0.00%↑ while keeping the remaining proceeds in cash given the euphoric positioning of the market. Salesforce remains a well-oiled machine with a 79.54% gross margin, although sales growth is expected to fall for the fourth consecutive year in 2024 to 9%.

ESTC

Elastic, which operates as an integrated search and data analytics platform, was a major loser for me because of its missed opportunity cost. I bought a small tracker position in late-2021 at around $120 during the peak of the ZIRP cycle and held through a 55% drawdown. In Q1, ESTC finally returned to my breakeven point, leading me to sell out. I didn’t hold enough conviction in the company to add at lower prices and wanted to consolidate my portfolio at the same time.

Predictions from January

I’d like to revisit the two predictions I made at the beginning of 2024 in my 2023 Portfolio Review, which can be found here:

Prediction #1: The AI Hype Rages On

The first prediction was that the AI hype would continue throughout the first half of 2024, which has turned out to be true thus far. At the same time, no other industry besides semiconductors and their supply chain beneficiaries have experienced a significant revenue pull from AI.

Analysts have noted that it could take several years for other industries to realize a material revenue boost from AI. A lack of this effect later on would be highly problematic for the market and prove a lot of smart people wrong.

“While we do not know the full effect or the precise rate at which AI will change our business — or how it will affect society at large — we are completely convinced the consequences will be extraordinary and possibly as transformational as some of the major technological inventions of the past several hundred years: Think the printing press, the steam engine, electricity, computing and the Internet, among others.”

- J.P. Morgan CEO Jamie Dimon, 2023 Annual Report

Prediction #2: Chinese Stocks Bottom

The second prediction was that Chinese stocks would bottom, which has proved to be true so far as well. Both the CSI 300, China’s mainland benchmark, and the iShares MSCI China ETF MCHI 0.00%↑ are above their respective yearly lows by over 10%.

My only exposure to China lies in Alibaba, which is 5.3% of my portfolio compared to just 1.1% at the beginning of 2024. Unfortunately, BABA hasn’t performed as well as the two indices with a Q1 loss of 3.21%. Still, the decline has allowed me to increase my stake to a full position.

I will continue to hold BABA with a 30% position stop loss in the $60s. My thesis is simple and bets on a gradual recovery of the Chinese economy and a multiple reversion to or around the mean. Historically, stocks have bottomed four to six months before the economy does.

Additionally, China has made it clear that they will provide a helping hand in providing liquidity to the market.

Earlier this month, the PBOC, China’s central bank, announced $69 billion in low interest loans to small and medium-sized science and technology companies.

In March, President Xi Jinping advised the PBOC to resume the purchase of treasury bonds, a measure that hasn’t been enacted in over 20 years. That came after February’s CPI data came in at +0.7% compared to the analyst estimate for +0.3%, a positive for China because China has been experiencing deflation.

The caveat with the CPI data is that February included the Lunar New Year, contributing to a surge in spending and the highest YoY growth in 11 months.

It’s still too early to conclude that China’s deflation woes are over. At the same time, its likely that Chinese stocks will trade higher compared to current prices when deflation becomes a worry of the past.

The Path Ahead

My cash position of 11.5% is noticeably higher than my Dec. 31 cash of 6.8% and is a direct indicator of having liquidity on hand in preparation of better prices. Both the S&P 500 and Nasdaq 100 were up by about 10% YTD as of Q1, basically equivalent to the average annual return of the market in a single quarter.

I expect a 10% drawdown at some point this year, but also a recovery into all-time highs right after.

Meanwhile, my most conflicted watchlist buy is LULU 0.00%↑ at $340. Shares of the athleisure leader are down by nearly 30% this year, leading to a NTM P/E of 25.4x. That’s a six-year low, although bears can rightfully argue that it’s due to slowing sales.

It’s worth noting that the company is at a pivotal stage due to its massive $45 billion market cap as well as ongoing pressure from competitors like Alo, Vuori, and Set Active.

“We ask investors to digest this simple thought... LULU's market cap is near the following companies in the S&P 500: Constellation Brands (-$50B), Ross Stores (-$49B), Aflac (~$49B), GM (-$52B), Hess ($47B), Allstate ($46B), Kraft Heinz (~$45B).”

-Jefferies analyst Randal Konik

An interesting piece of anecdotal evidence I received from an Equinox trainer mentions that Lululemon is “a classic and will never go out of style, but I definitely think that it is on the back burner of everyone’s mind,” similar to Starbucks and Uggs.

The main question an investor should ask themselves before investing in Lululemon is if the company can become a household name in the likes of Nike while expanding its portfolio of products through a growing audience reach. Because that’s what the valuation absolutely commands. I wouldn’t use more than 2% of my portfolio to start a position in Lululemon based on this factor.

Hedge Vision - Institutional Insights

Thanks for reading!

📖 Join the conversation on Substack Chat

🕊️ Get real-time insights on X/Twitter: @HedgeVision

📧 Old school is cool too: HedgeVisions@gmail.com

Really interesting, thank you! I'm curious about $LULU. Clearly, it's a premium to Gymshark, and from what I've seen in their stores, product is ok (although too expensive for what it is). Do you have any good comps? I can see insiders are buying, and clearly premium (but not luxury) sport clothes are correlated to the broader economy. People tend to buy less when things are tough at home.

He. Love the transparency. I see quite a few wide moat companies, so I was wondering, why Crocs? What are you seeing there? Especially since it's such a big holding.