2023 was an unforgettable year, at least for the bulls. The S&P 500 returned 26%, more than double the average annual return of 9.90% since 1928.

These returns took Wall Street by surprise. In Dec. of 2022, Wall Street analysts had an average 2023 price target of just $4,080. The benchmark index ended up finishing the year at $4,769, meaning the average analyst was off by a significant 16.88%.

It was also a comeback year for my portfolio, which sank by nearly 50% in 2022. I ended 2023 up by 69%, led by top performers such as NVDA 0.00%↑, CRWD 0.00%↑, and MELI 0.00%↑.

Returns Since Inception

2020 starting from May: +54.80%

2021: +0.33%

2022: -48.99%

2023: +69.13%

Hedge Vision Portfolio as of Dec. 31, 2023

Total Positions: 26

Top 10 Positions Concentration: 73.8%

Cash: 6.8%

Watchlist for 2024: CELH 0.00%↑ at $50 or below, BABA 0.00%↑ up until $90, NKE 0.00%↑ at $90 or below.

Nvidia was the largest contributor to my gains in 2023. In my 2023 mid-year review, I wrote:

“I don’t believe the hype surrounding AI is over yet and will gladly sell out of my position around $500 if the stock reaches that. I believed NVDA was overvalued before its earnings run-up, and I believe it is overvalued now.”

While I have sold off about 20% of my stake in Nvidia since then, I no longer believe that the company is overvalued. During mid-2023, I hadn’t yet fully grasped the potential of AI and how much revenue it could generate for the companies leading the pack.

Below is a graph comparing the NTM price-to-earnings-to-growth (PEG) ratio of the “Magnificent 7” stocks. The ratio is calculated by dividing P/E by annual EPS growth and is a measure of valuation that accounts for EPS growth.

As you can see, Nvidia has the third lowest PEG ratio among the group and is just barely above Meta’s ratio. The company sits at the forefront of the AI revolution and has demonstrated strong sales growth and price action, despite restrictive U.S. government measures concerning advanced chip shipments to China. My prediction is that the AI hype will continue throughout the first half of 2024.

CROX 0.00%↑, the largest contributor to my 2022 returns, was a big disappointment in 2023, falling by 26%. Declining sales growth paired with lowered than expected HeyDude growth were big factors in Crocs’ disappointing returns. At the same time, I haven’t lost faith in the company.

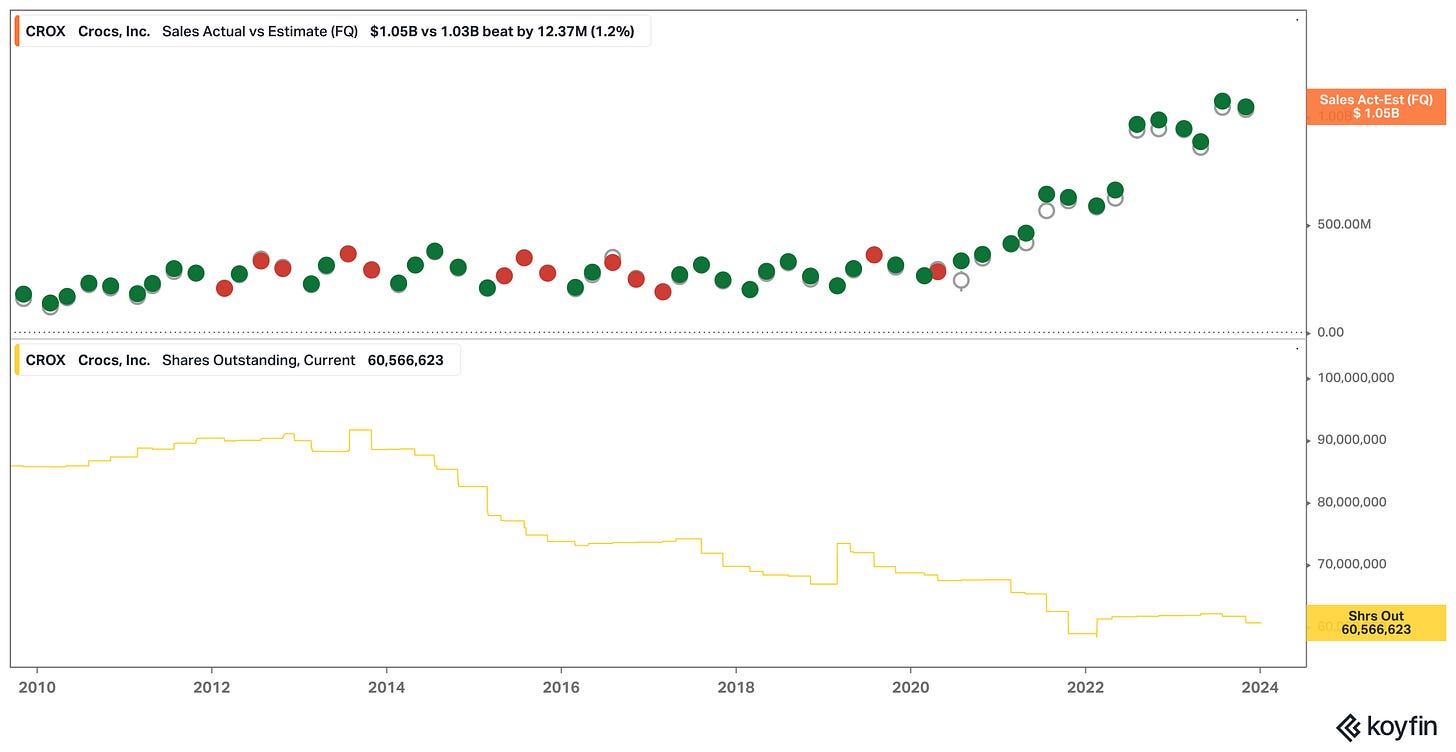

Crocs is known for providing conservative guidance and has beaten consensus analyst sales estimates for 14 consecutive quarters. The foam clogs company is also shareholder friendly with a track record of healthy buybacks. Since 2010, Crocs’ shares outstanding has declined by an average CAGR of 2.49%.

Crocs resumed its share repurchase program during Q3 of 2023 through the repurchase of $150 million worth of shares. It repurchased another $25 million during Q4. $875 million remains on the program.

With industry-leading margins and a discounted valuation in comparison to competitors like NKE 0.00%↑, DECK 0.00%↑, and SKX 0.00%↑, I continue to believe that Crocs will provide market-beating returns over the next few years.

2024: Will Chinese Stocks Finally Bottom?

I have made a few sales since Dec., such as CROX, NVDA, and MDB, but have not completely sold off any company. On top of that, I am cautious of what 2024 will bring given the returns in 2023. It has been difficult to find companies at compelling valuations in recent months.

That brings us to an extremely controversial part of the market: Chinese stocks.

Make no mistake, investing in Chinese stocks is still very risky given the restrictive standards imposed by the Chinese government. The Shanghai Shenzhen CSI 300 Index, China’s mainland benchmark, has been in a downtrend for 3 years now.

Meanwhile, a multitude of hedge funds, such as Tiger Global, Appaloosa, and Coatue, have tried to time the bottom in Chinese stocks to no avail.

Today, Chinese stocks still trade at low valuations in comparison to U.S. stocks due to the property crisis, which is a major issue because the majority of Chinese citizen’s wealth lies in that asset. That’s led to weak consumer sentiment and troubling deflation amid volatile U.S.-China tensions. Another variable to throw into the equation is the 2024 U.S. Presidential Election and how the upcoming President will handle the relationship between the two world powers.

I have my sights set on BABA, and my thesis is simple: if valuations return to the mean, or even somewhat close to the mean, then big returns lie ahead. Since 2018, Alibaba’s revenue has chugged along while its multiples have gotten slashed.

Furthermore, China seems to be taking a breather on its restrictive policies given the years-long slowdown in its economy.

For example, the China Securities Regulatory Commission (CSRC) announced a new campaign in Sept. to support the Chinese equity market. The new measures included reduced transactions costs, lower margin requirements, rules to protect retail investors, and the increased approval speed of mutual funds. The CSRC also advised mutual fund companies to lower management fees and has since provided guidance prioritizing the launch of equity funds over other types of funds.

In Dec., China proposed a plan that would impose strict restrictions on video games, such as placing a limit on in-game purchases and incentives based on activity, like logging in everyday. After the announcement caused gaming stocks like Tencent and NetEase to lose over $80 billion in value, China retreated on the plan and stated that it would make changes to it following public feedback. A top Chinese video game regulator official was also fired.

This doesn’t mean that I will sell off my current holdings in exchange for Chinese stocks. I currently don’t plan on increasing my overall portfolio allocation to Chinese stocks to more than 10%. But I believe that investing in an area of a market where many have already tried and failed can lead to surprising returns to the upside.

I highly recommend this report by University of Pennsylvania Economics Professor Hanming Fang for those interested in Chinese stocks. The following is a snippet from the report:

“However, whether China can realize such growth potential will likely depend largely on how leaders manage its internal political economy — specifically whether the state continues to play a large role in economic decision-making — and the relationship between China and the US-led West, which will determine China’s access to foreign technology, finances, and markets. If leaders continue the turn away from market-oriented reform in favor of centralized decision-making, top-down planned resource allocation, and marginalizing private businesses, then productivity and economic growth could deteriorate further. China, the United States, and the world would all suffer as a result.”

2024: There’s Always Something to Worry About

As always, uncertainty looms in the distance. In my 2022 review, the current fears were inflation, rate hikes, and high housing prices. While high housing prices largely remain in many real estate markets, inflation fears have largely been cast aside to the rearview mirror, while rate hikes seem out of the picture following a pause. Mortgage rates have also trended lower since Nov. of 2023, although the week ending in Jan. 5 ended the trend of 9 consecutive weeks of falling rates.

In fact, interest rate futures are currently pricing in a 63.8% chance that the Fed cuts rates during the March FOMC meeting.

Now, the biggest fear appears to be the risk of a recession due to the lagging effects of rate hikes. These fears have been driven by a perceived weakness in consumer sentiment through the earnings of specific consumer discretionary companies, like Nike, and the inverted yield curve, which has been inverted since July of 2022.

The past few recessions excluding the 2020 recession have actually occurred after the yield curve has normalized, which hasn’t happened yet. This is definitely a concerning signal and something that all investors should keep in mind in 2024, although it shouldn’t be considered in isolation.

However, the consumer seems quite strong and could grow even stronger when paired with weakening inflation. Consumer discretionary companies in the S&P 500 generated EPS growth of 24.3% in 2023, while consumer sentiment has remained in an uptrend since early 2022.

My investment thesis has stayed consistent throughout the years, which is to invest in ~25 top-performing companies at opportunistic valuations.

During drawdowns, I increase my stake in these companies or new companies if I find their valuation to be favorable. A 10% drawdown during the middle of the year isn’t uncommon, even in up years.

I fully expect a 10% drawdown sometime in 2024 and remain cautiously optimistic.

Hedge Vision - Institutional Insights

Thanks for reading!

📖 Join the conversation on Substack Chat

🕊️ Get real-time insights on X/Twitter: @HedgeVision

📧 Old school is cool too: HedgeVisions@gmail.com