It’s been a great year for the market so far, but the main focus remains on future returns. With the S&P 500 up 16.3% and the Nasdaq 100 39.7% YTD as of June 30, some would say the prospects for the remainder of the year look bleak. I disagree, although I do believe that the easy money has certainly been made already.

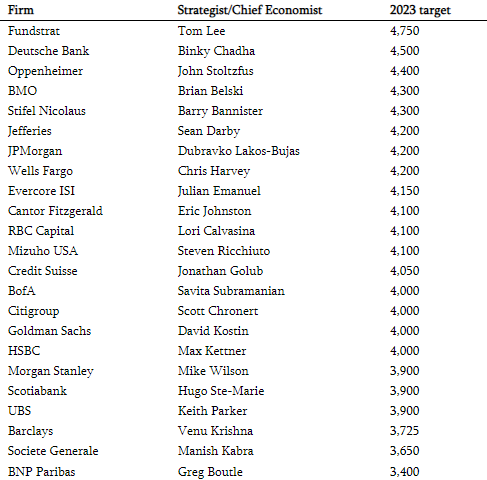

Back in December of 2022, Wall Street analysts had an average 2023 price target of just $4,080, led by Fundstrat’s street-high target of $4,750:

10 analysts out of 23 total had price targets at $4,000 or below, which has missed the bullseye when based on current prices. In fact, the S&P 500 exceeded $4,080 in January alone.

Wall Street analysts weren’t the only ones taken by surprise. Institutional and retail investors were left in the dust after inflation data pointed to a sustained slowdown, while employment remained resilient in the face of higher prices and rates. Inflation, the economy’s biggest foe, is finally losing its power.

By Q1, institutional investors had caught on. The Hedge Vision Index, which tracks 30 hedge funds with a history of outperformance and an average holding period of at least four quarters, showed that all 30 funds increased their market exposure. The average increase was a stunning 24.12% in just one quarter.

Even Stanley Druckenmiller, who called for a recession this year, increased his market exposure by about 10%.

I will be stunned if we don’t have recession in ’23. I don’t know the timing but certainly by the end of ’23. I will not be surprised if it’s not larger than the so called average garden variety.

-Druckenmiller, September 2022

From Q1 to Q2, the S&P 500 returned 8.0%, while the Nasdaq 100 returned 15.6%. You can read more about the HVI here:

2023 Mid-Year Portfolio Review

Total Positions: 26

Top 10 Positions Concentration: 77.8%

Top 15 Positions Concentration: 90.9%

Average Holding Period: 8.5 months

My portfolio is still primarily focused on technology, while the #1 contributor to my returns this year has been NVDA 0.00%↑. I don’t believe the hype surrounding AI is over yet and will gladly sell out of my position around $500 if the stock reaches that. I believed NVDA was overvalued before its earnings run-up, and I believe it is overvalued now. However, I’m not going to let that stop me from riding the momentum wave caused by the heavyweight champion in AI. Granted, I do feel nervous holding my current stake, which is my sixth largest position.

CROX 0.00%↑, which was the largest contributor to my 2022 returns, has been disappointing this year, returning 5.27% and underperforming the market. I plan on adding shares around $100, as my bull thesis remains unchanged.

There has been a lot of talk about a return to value, specifically energy, industrials, and healthcare. Historically, value stocks have outperformed growth stocks. Despite this trend, the rise in growth and tech stocks has continued to surge higher, rewarding investors who bought the dip during the past year.

I’m not arguing for a return to value, as evident by my portfolio, but I’m also not eliminating the possibility. Some value names I have in mind are DIS 0.00%↑, DHR 0.00%↑, and CP 0.00%↑. As the multiples for growth squeeze higher, I may take a deeper look at allocating my portfolio to value names trading at attractive valuations.

You may be wondering why I own so many positions with an allocation below 2%. These small positions are mainly the losers in my portfolio, a majority that stemmed from becoming too greedy following the pandemic surge. Many of these positions are also the result of starter positions that I decided not to average down on due to a change in confidence or other opportunities that I found to be more compelling.

I have my sustained heavy losses in these positions, although it has taught me to become more selective in my investment process. Looking back, I deeply overestimated the competitive advantage, scale, and management efficiency of ROKU 0.00%↑, PYPL 0.00%↑, and TWLO 0.00%↑, three of my largest losers.

Why haven’t I cut my losses yet in these positions? I admit, I suffer from a bad case of loss aversion. I have also not completely lost faith in some of these companies, although I do plan on cutting my losses in ZM 0.00%↑ and ESTC 0.00%↑ soon.

At the end of the day, my winners have outpaced my losers, which has led to positive returns this year. It hasn’t been a pretty process.

The Path Ahead

Moving forward, I plan on using my same investment strategy, which is holding stocks for the long term in a portfolio of ~25 companies. I’ve been hesitant to add to my market exposure as of late because I believe a drawdown of 5% or more is on the horizon.

I also own the S&P 500 in my employee 401K, which would be around a 14% allocation if included in my primary portfolio, making it my largest position.

As stated previously, the easy money phase is over. Moving forward, individual company health in the form of sustained profitability, revenue growth, and capital allocation will be more important than ever, as it should be. The fear of inflation has subsided and has been replaced with the more predictive fear of earnings.

Still, the glaring recession signal in the form of the inversion of the 2-year and 10-year yield curves has remained the elephant in the room. Since 1969, the inversion has preceded every U.S. recession with an average delay of about 15 months. At the same time, not every inversion has preceded a recession since 1969.

The yield curve has been inverted since July of 2022, while the S&P 500 has returned about 15% since then. 15 months past July of 2022 gets us to October of this year.

The inversion shouldn’t be used as a signal in isolation. Earlier this month, it was reported that U.S. weekly jobless claims had fallen to their lowest in 20 months, while first quarter real GDP growth was finalized at 2.0%, beating the Dow Jones consensus estimate of 1.4%. That would mark the third consecutive quarter of growth following two consecutive declining quarters.

A bear could counter that low weekly jobless claims can act as a recession signal. Recessions have a knack of being preceded by a cyclical low in unemployment:

The point is, you have all of these contrasting signals, which creates a ton of noise that is difficult to navigate through. Right now, the price trend of the market is up, and if second quarter earnings come above expectations, that will only add more fuel to the flame.

I remain cautiously optimistic for the remainder of the year with a 13% cash position ready to be invested in the event of a drawdown.

Hedge Vision - Institutional Insights

📖 Join the conversation on Substack Chat

🕊️ Get real-time insights on X/Twitter: @HedgeVision

📧 Old school is cool too: HedgeVisions@gmail.com

Excellent post! Well done on a great 2023 YTD performance.

awesome job, congrats!