Hedge Funds Extremely Bullish Heading into Q2

All 30 of the funds tracked by the HVI increased their 13F exposure during Q1

With the Form 13F deadline past us, retail investors are now able to view the equity positions of institutional investors and hedge funds as of March 31. As of then, the S&P 500 had returned an impressive 7.46% YTD. Keep in mind that Information Technology within the index was up 21.82%, and without it, the index would have only returned 2.71%.

Still, the high returns may have pressured fund managers to increase their market exposure. At the same time, rate hikes, the inverted yield curve, and fear of an earnings recession could have influenced them to stay put or reduce their exposure.

Let’s take a look.

First, I track a sample of 30 hedge funds with a history of outperformance in order to get a better gauge of market exposure. Each of the hedge funds have a holding period of at least 4 quarters, which improves the accuracy of the estimation.

Here is the list, which I call the Hedge Vision Index (HVI):

Next, I use their estimated quarterly 13F profit or loss and combine it with the change in their holdings value, which captures net buys/sales, to calculate the overall estimated increase/decrease in market exposure. A high number of funds increasing their exposure is a bullish signal, while a high number of funds decreasing their exposure is a bearish signal.

Every single fund in the HVI increased its holdings exposure, by an average of 23.89%, when not accounting for gains/losses. That’s a rare sight to see.

After accounting for gains/losses, every single hedge fund in the HVI still had an overall increase in market exposure, an even rarer sight to see. The average increase was a significant 24.12% in just a single quarter.

Coatue and Light Street led the pack, with both funds increasing their holdings value by over 50%. Whale Rock trailed close behind with a 48.54% increase.

Aggregate 13F Filer Data

To gauge the activity of the overall institutional industry, we can track the total market value of all 13F long positions:

The market exposure of long only 13F positions increased for the second consecutive quarter to $37.8 trillion, up 2.44% compared to $36.9 trillion during Q4 of 2022.

On top of that, net buyers subtracted by net sellers among long 13F filers also increased for a second consecutive quarter:

Hedge Funds are Buying the Dip

Combined, these signals point to one glaring message: Hedge funds bought the dip heading into Q2. Further gains for market indices would likely mean that managers on the sidelines are pressured to match the benchmark return in order to satisfy their clients, which could result in further investment inflow.

Plus, even the naysayers among managers bought in. Stanley Druckenmiller, who has called for a flat market over the next 10 years, increased his holdings value by 14.23% during Q1.

“There's a high probability in my mind that the market, at best, is going to be kind of flat for 10 years, sort of like this '66 to '82 time period.”

-Stanley Druckenmiller, Sep. 2022

Here are his top 25 positions:

The right individual stocks will still have the ability to reward investors generously, even in a situation where markets are flat for the next ten years. That certainly seems to be what Druckenmiller is doing, as he owns a total of 48 stocks with a top ten position concentration of 70.78%.

Insider Activity Turning Bullish

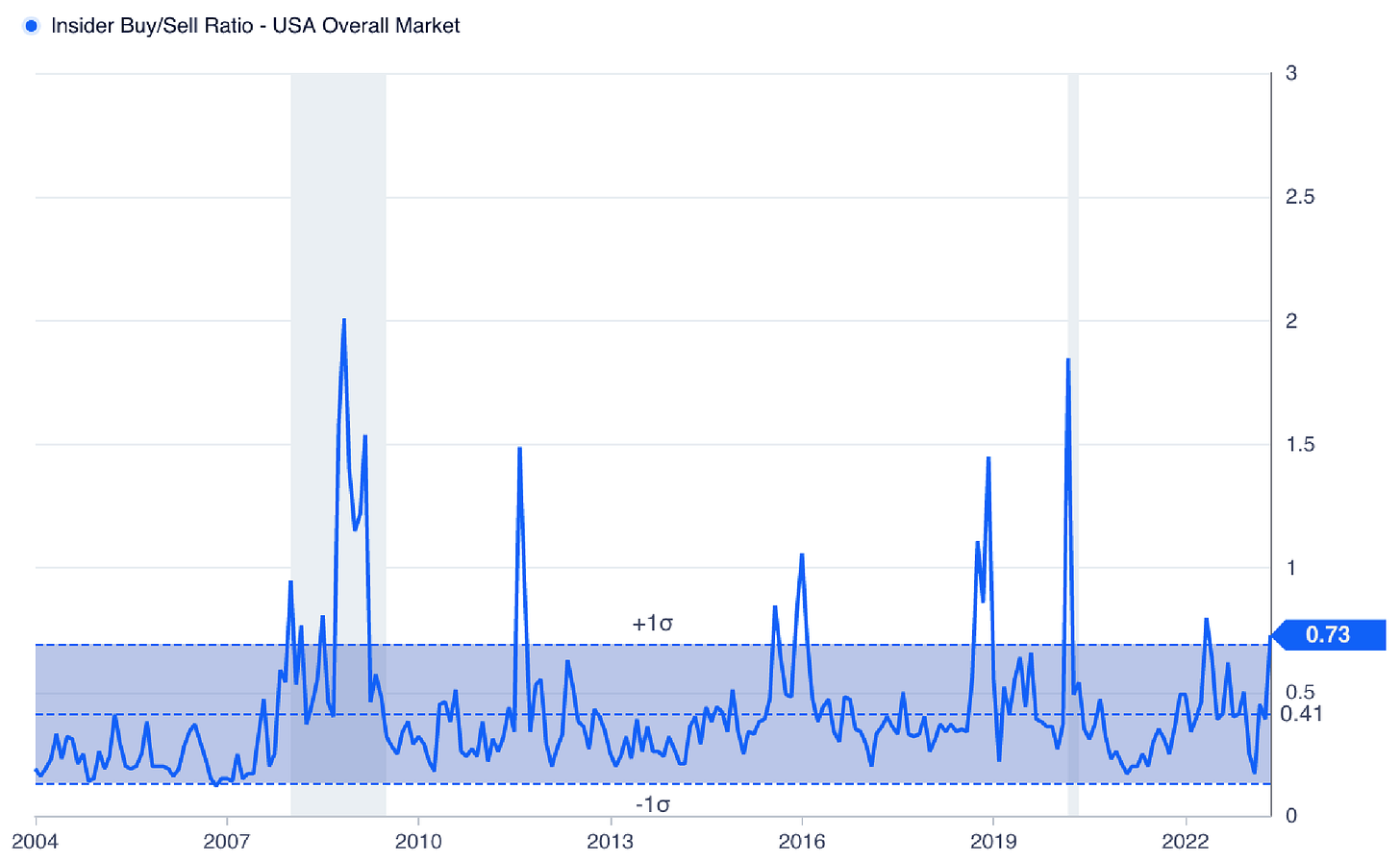

Another sector of investors who may have an upper hand in company-specific information is gradually growing bullish as well. Using the insider buy/sell ratio, buying activity has been on a steady uptrend since Feb.

The ratio clocks in at 0.73 as of May 21, with average values ranging between 0.19 and 0.65. A ratio above 1 is seen as very bullish.

Hedge Vision - Institutional Insights

Please don’t hesitate to send me topic recommendations, suggestions, or general questions. You can contact me by email: HedgeVisions@gmail.com, or by Twitter messages @HedgeVision

Good info, thanks

Great take, making an index is a great idea! Thank you! Cheers!