Crocs (CROX) is a Gem Hiding in Plain Sight

A fast growing company trading at an EV/NTM EBITDA of just 5.5x

Disclosure

I am long CROX via common shares purchased at prices ranging between $67.50 and $70.50. I plan on increasing my position in the near future.

12-Month Price Target: $119 (see analysis further down)

Price as of April 8th Close: $71.88

Price Target Upside: 65%

Market Cap: $4.4 billion

52-Week High: $183.88

52-Week Low: $66.50

2022 has been a volatile year, although opportunities are starting to reveal themselves. Coupled with fearful investor sentiment, the market has presented investors with discounts in several high-quality companies. One of these is Crocs (CROX), the retail name notorious for its foam clogs. Last year, the company sold 103 million pairs of shoes, up 49% from 2020.

Take a stroll in your grocery store or local mall. Chances are, you’ll see somebody wearing the infamous comfort shoes.

Yes, you heard right. Behind the easy-going shoe manufacturer lies a company with excellent financials. In 2021, revenue increased by 66.9%, marking the fifth-straight year of growth. Meanwhile, gross profit grew by 62% year-over-year (YoY), while gross margins increased by 7.28% from the year prior. On top of that, operating income margins grew by an impressive 12.56% YoY. Talk about operating leverage.

Crocs has been consistently profitable and has beaten consensus EPS estimates 20 out of 22 times since 2017.

By 2026, Crocs expects annual revenue of $6 billion. This would imply a revenue CAGR of 21% until 2026. For 2022, Crocs expects “Revenue growth for the Crocs brand, excluding Hey Dude, to exceed 20% compared to 2021.” Hey Dude was acquired for $2.5 billion last December.

During Q4, adjusted earnings per share (EPS) came in at $2.15, beating estimates of $2.01. In addition, revenue came in at $586.6 million, up 42.6% YoY. Direct-to-consumer revenue grew 44.5% while wholesale revenue grew 40.3%.

Like many other companies, supply chain issues have affected Crocs. For example, Crocs estimates an incremental $75 million of air freight expense in the first half of 2022.

Hey Dude

Hey Dude produces casual, comfortable shoes for men, women, and children, and will operate as a standalone division. While the company was founded in Italy, 95% of its revenue comes from the U.S.

For 2022, Hey Dude is estimated to bring in $700 million to $750 million in revenue.

Crocs funded this acquisition with $2.05 billion in debt and $450 million in CROX stock to be paid to Alessandro Rosano, Hey Dude’s founder. Rosano will stay on at Hey Dude as a strategic advisor and creative director of product development.

In a presentation to investors, Crocs disclosed that 71% of its revenue comes from its foam clogs. After the addition of Hey Dude, revenue from foam clogs is estimated to fall to 57%.

In its 2021 “Taking Stock With Teens” survey, Piper Sandler ranked Hey Dude the #8 top brand among teens and called it “one of fastest-rising brands.” In 2020, it ranked #17, and in 2019, it ranked #54.

Moodys (MCO) downgraded Crocs’ senior unsecured notes rating to B2 from B1 after Crocs announced the acquisition of Hey Dude. However, the ratings company also stated that:

“Hey Dude’s margin and cash flow profile are similar to that of Crocs and the company has rapidly grown over the past few years. Global supply chain issues, inflation, freight costs and the discovery of new variants of the coronavirus increases the potential for earnings volatility but Moody’s expects the combined company’s free cash flow generation to remain strong and lead to deleveraging through debt repayment.”

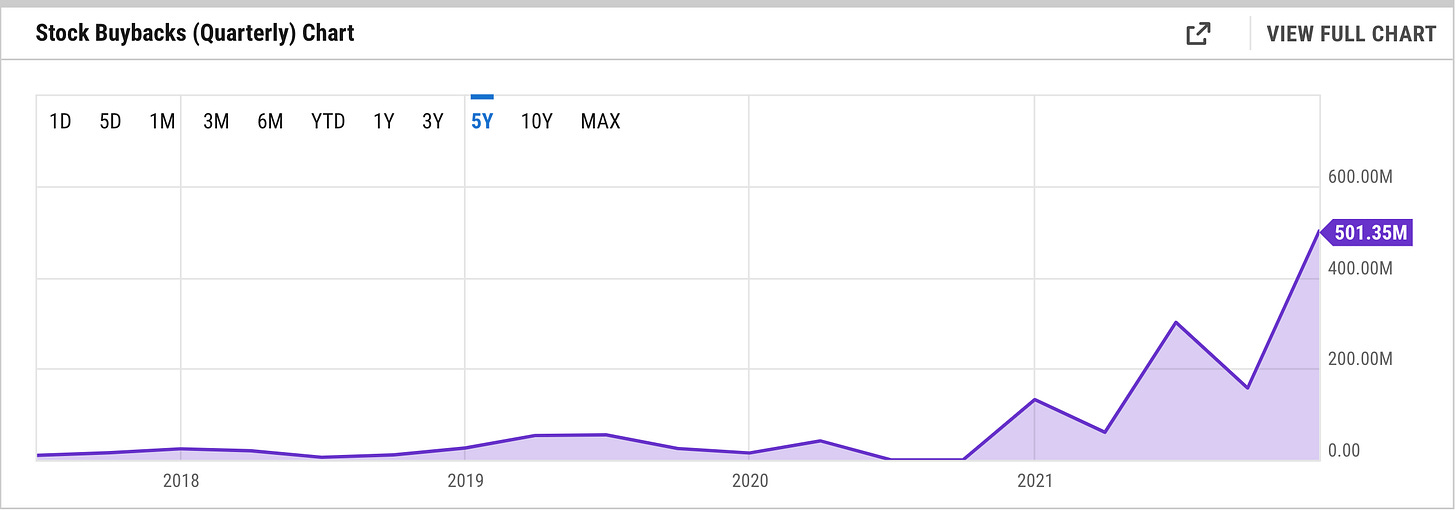

Crocs Buybacks/Number of Shares Outstanding

As of April 10th, there are 58.35 million shares outstanding, a decrease of 27.32 million shares since Jan 31st, 2010. That equates to a -3.14% CAGR in shares every year.

During 2021, the company repurchased $1 billion worth of stock, or 8.2 million shares. At year end, $1.1 billion remains in the buyback program. In Q4 of 2021, the company bought back a record high $501.35 million worth of stock. Crocs has stated that it will slow down its rate of buybacks in the near term in light of its recent buybacks and Hey Dude acquisition.

Buybacks help drive up earnings per share, as well as the stock price.

Risks

-Crocs are primarily made out of a proprietary closed-cell resin called Croslite. While the exact composition of Croslite is unknown, a majority of it consists of polymer. In turn, polymer is a product of crude oil. Crude oil prices have soared this year, in part due to the Russia-Ukraine war.

-Another risk, and possibly the greatest risk, is a change to consumer behavior. As of now, Crocs are accepted as a casual, comfort shoe. Despite Crocs being known as an “ugly shoe,” it’s hard not to notice the popularity of them in everyday life.

-Knockoffs are a risk, and a multitude of them exist. However, Crocs has performed well despite knockoffs, and brand power has been a huge factor in people wanting to purchase legitimate Crocs. Celebrity endorsers for Crocs have included Post Malone, Justin Bieber, Ariana Grande, and many more.

-Crocs is actively expanding into China, which is the world’s second largest shoe market. If geopolitical relations between the U.S. and China deteriorate, the company is at risk of losing investment dollars and revenue. On the bright side, the relationship between the two world powers seems to be growing stronger. Last month, China announced that it was drafting a framework to allow the more than 200 Chinese companies listed on U.S. exchanges to comply with U.S. regulations. Specifically, the Holding Foreign Companies Accountable Act (HFCAA), which was enacted in 2020, states that foreign companies may be delisted if they do not provide U.S. regulators with audited filings. If a company does not provide audited filings for 3 consecutive years, then they may be delisted.

Price Target of $119

The casual footwear market is estimated to have a total addressable market (TAM) of $305 billion. Based on revenue, Crocs comes in 4th place in this market. The top 3 leaders are Sketchers, Deckers, and Wolverine. Additionally, I have included fashion brands Nike and Lululemon since both competitors fit in the footwear/clothing industry, plus shoe brand Steve Madden.

-Enterprise Value: $5,150,360,000

-EV/LTM Gross Profit: 3.6x

-EV/NTM EBITDA: 5.5x

-Trailing Price to Earnings: 6.31x

-Forward Price to Earnings: 7.94x