In May, the Hedge Vision portfolio increased by 10.74%. In comparison, the S&P 500 increased by 5.63% while the Nasdaq 100 rose by 7.95%

The portfolio has now returned 11.92% YTD while the S&P 500 and Nasdaq 100 have returned 1.28% and 2.06%, respectively.

Total Positions: 26 compared to 27 as of December 2024

Top 10 Positions Concentration: 74.0% compared to 75.9% as of December 2024

Cash: 8% compared to 1.5% as of December 2024

May marked an extremely strong showing for the market. In fact, it was the S&P 500’s best May in 35 years. That came after the benchmark index plunged by as much as 11.5% in April before President Trump began to ease on his tariff threats. Still, both the S&P 500 and Nasdaq 100 have had tame performances on a YTD basis.

CrowdStrike (CRWD) and MercadoLibre (MELI), my top two positions, have bucked the trend. As of the end of May, CRWD had returned 35.7% YTD while MELI was up by 45.2%. Both of these stocks have witnessed significant multiple expansion, and I don’t plan on buying more at current levels.

My other cybersecurity holding, Zscaler (ZS), returned 21.4% in May, bringing its YTD performance to 51.7%. That comes after falling 18.5% last year. The message here is that patience and knowing what you own pays off, although it was admittedly difficult to hold through 2024 while everything else was rocketing higher. I took that opportunity to increase my position throughout the year, with my ZS allocation at 5.4% compared to 2.9% in May 2024.

As I’ve stressed in previous portfolio reviews, it’s looking more and more likely that 2025 will be the year of international stocks. Alibaba (BABA), my third-largest position with a 7.9% allocation, has returned 34.0% YTD. I wouldn’t be surprised if it ends the year with 50%+ returns given the company’s status as the e-commerce, cloud, and AI leader in China. The company is also widely insulated from Trump’s tariffs given its small presence in the U.S. and continues to buy back its own shares at a reasonable valuation.

May also marked the deadline for hedge funds to file their first quarter 13Fs. If you missed it, here’s how top hedge fund managers, like Stanley Druckenmiller, David Tepper, and the Tiger Cubs, navigated through the volatility:

May 2025 Buys

New Positions: None

Increased Positions: None

May 2025 Sales

Exited Positions: None

Reduced Positions: None

My buys and sales in real time, as well as further analysis and commentary, are shared with contributing members on Substack Chat:

Outlook for June

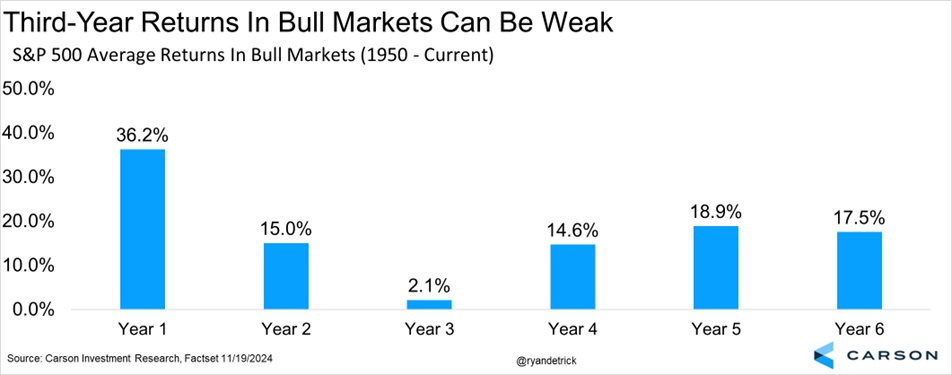

The third year of a bull market tends to be weak, and 2025 is shaping out exactly like previous bull markets. My prediction is that the S&P 500 ends the year with a return between -5% and +5% given persistent economic uncertainty. Stock-picking will be key to beating the market.

Meanwhile, my cash position sits at 8.2%, largely because of a major cash deposit equivalent to 6.67% of my portfolio in April. As evident by my lack of activity in May, the recent “lock-out rally” did catch me by surprise, and I wasn’t able to buy as much as I would have liked. Of course, that’s all hindsight bias.

Nonetheless, I’ll continue to remain patient with BABA and The Trade Desk (TTD) at the top of my watchlist. I would also like to start a new position in ServiceNow (NOW) at the right price.

Hedge Vision

Thanks for reading!

📖 Join the conversation on Substack Chat

🕊️ Get real-time insights on X/Twitter: @HedgeVision

📧 Old school is cool too: HedgeVisions@gmail.com