Here's What Hedge Funds Bought in Q1

Portfolio updates on Druckenmiller, Buffett, the Tiger Cubs, and more

The latest 13F filings have arrived, showcasing the strategic and sometimes surprising moves of hedge funds.

Notably, both Stanley Druckenmiller and Tiger Global disclosed a new position in AppLovin (APP) while Warren Buffett completely exited two financial stocks and requested confidential treatment for a new stock ahead of his retirement.

Furthermore, Bill Ackman disclosed a new bet within his 11-position portfolio, the same stock that David Tepper can’t get enough of.

Let’s jump right in, starting with Druckenmiller’s portfolio.

Stanley Druckenmiller - Duquesne Family Office

Number of Positions: 52

Top New Positions: DOCU, CCCS, EQT, CZR, TWLO

Top Buys: TEVA, DOCU, TSM, FLUT, INSM

Top Sales: STX, SKX, SLM, UAL, X

Average 13F Holding Period: 2.92 quarters

Despite a 4.61% reduction, Druckenmiller’s top position has remained Natera (NTRA) for three consecutive quarters. NTRA is up 248% since Druckenmiller first disclosed a position in Q3 of 2022.

Furthermore, Druckenmiller also revealed 12 new positions, which include several high-flyers of 2020 and 2021 that have yet to reclaim their all-time highs: Docusign (DOCU), Twilio (TWLO), and Roku (ROKU). He also added a new position in APP, which is up by 40% since March 31.

As for his exits, Druckenmiller completely sold out of Palantir (PLTR), Palo Alto Networks (PANW), Nu (NU), and Vistra (VST), among others.

Tiger Cub Consensus Holdings

Meta Platforms (META) was the only company with a Tiger Cub consensus rating of 100% and it also had the highest average portfolio weight of 6.21%. Taiwan Semiconductor (TSM) and Amazon trailed behind, both with a consensus rating of 85.71% and average weights of 5.95% and 5.61%, respectively.

The Tiger Cubs continue to bet big on AI with a majority of the companies on the list participating heavily in the industry.

The non-AI companies on the list are Phillip Morris (PM), UnitedHealth Group (UNH), and Flutter Entertainment (FLUT). Even these companies utilize AI to some extent, reflecting the technology’s reach.

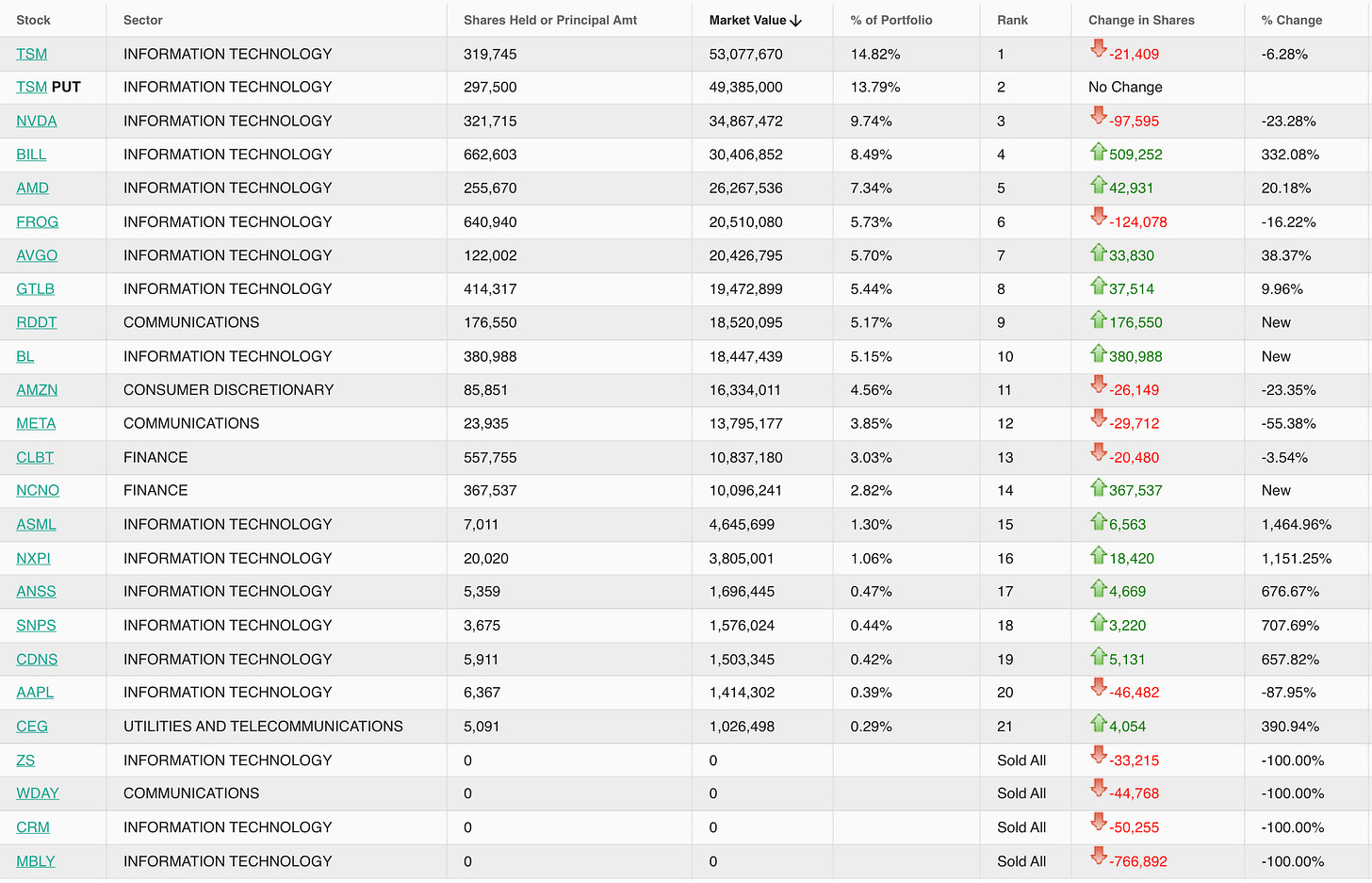

Glen Kacher’s Light Street is the Tiger Cub with the highest AI exposure, although he continues to hold TSM puts to offset his exposure. Still, Light Street has timed the AI wave exceptionally well, returning 45.7% in 2023 and 59.4% in 2024.

Light Street & Glen Kacher

Number of Positions: 21

Top New Positions: RDDT, BILL, NCNO

Top Buys: BILL, RDDT, BL, NCNO, AVGO

Top Sales: MRVL, META, CLS, GDS, CRM

You can read more about the top hedge funds of 2024 here:

Meanwhile, Chase Coleman’s Tiger Global is relying heavily on the Magnificent 7 after a rough few years. Following a 56% drawdown in 2022, the hedge fund returned 28.5% in 2023 and 23.8% in 2024. Even with consecutive 20%+ years, Tiger Global is still at a 30% loss compared to 2022.

The hedge fund’s new positions include APP and Block (XYZ), as well as a bet on both of Zillow’s tickers (Z, ZG).

Tiger Global & Chase Coleman

Number of Positions: 45

Top New Positions: APP, Z, GEV, XYZ, ZG

Top Buys: VEEV, APP, Z, MSFT, GEV

Top Sales: APO, QCOM, UBER, DDOG, TEAM

Average 13F Holding Period: 10.84 quarters

Philippe Laffont’s Coatue is another tech-heavy Tiger Cub, with META, AMZN, and TSM as his top positions. Coatue’s top buy was CoreWeave (CRWV), although this wasn’t an outright buy given that Coatue invested when the company was still private. CRWV has more than doubled since its IPO in late March.

Alibaba (BABA) was Coatue’s second-largest buy and is its 17th largest position out of a total of 70 positions.

Coatue Management & Philippe Laffont

Number of Positions: 70

Top New Positions: CRWV, PM, MPWR, CVNA, SWKS

Top Buys: CRWV, BABA, LRCX, PM, SPOT

Top Sales: VRT, ADBE, TSM, VST, NOW

Average 13F Holding Period: 10.86 quarters

Uber - A New Hedge Fund Favorite

Uber is Bill Ackman’s newest bet, and he didn’t waste any time picking up shares. The ride-hailing leader is now his largest and also newest position with a 17.71% 13F allocation.

Number of Positions: 11

Top New Positions: UBER

Top Buys: UBER, BN, GOOGL, HTZ

Top Sales: NKE, HLT, GOOG, CMG, CP

Average 13F Holding Period: 17.45 quarters

Ackman disclosed on X that he began buying shares in January and owned 30.30 million shares by February 7. His position has remained unchanged as of March 31.

“Some of the best investment opportunities occur when one has a contrarian view on a business or an industry. We believe Uber’s current valuation represents a significant discount to intrinsic value because some investors are myopically focused on the risk of AVs, without proper consideration for Uber’s strong value proposition and the potential for AVs to benefit the ecosystem.

We anticipate Uber will generate 30% or more earnings growth over the medium-term with potential for multiple expansion as the ultimate industry structure becomes more clear.”

-Ackman, 2024 Annual Letter to Shareholders dated March 14, 2025

David Tepper’s Appaloosa was also busy buying Uber, increasing its existing stake by 1.7 million shares or 113%. Tepper’s portfolio is covered in detail in the next section.

Additionally, Uber is the top position within Saudi Arabia’s Public Investment Fund (PIF) and Altimeter’s fifth largest position out of 22 total positions. Other significant shareholders include Octahedron Capital, SoMa Equity Partners, Jericho Capital, and Toyota.

Is the China Trade Still Alive?

Michael Burry made headlines after dumping every single one of his equity positions except for Estee Lauder (EL). Burry, who rose to fame after making a fortune from the 2008 housing market crash, had previously allocated 53% of his 13F portfolio in Chinese stocks BABA, BIDU, JD, and PDD.

Now, he’s betting against those same companies, as well as Nvidia (NVDA) and a few other Chinese companies, with put options.

Scion Asset Management - Michael Burry

Number of Positions: 7

Top New Positions: NVDA puts, BABA puts, PDD puts, JD puts, TCOM puts

Top Buys: NVDA puts, BABA puts, PDD puts, JD puts, TCOM puts

Top Sales: BABA, BIDU, JD, MOH, PDD

Average 13F Holding Period: 1 quarter

*Reminder: 13F options positions are calculated on a notional basis. The market value of options as reported in 13F filings assumes the value of the underlying shares and not the value of the options themselves.

Now is a great time for this quarterly reminder: Burry is a highly active trader and changes his mind very frequently. His average 13F holding period is just one quarter with a quarterly turnover rate of 94.74%.

I would recommend anyone tracking Burry’s portfolio to view it as a form of entertainment instead of as guidance for investment decisions.

Let’s pivot to David Tepper’s Appaloosa Management, which has an average 13F holding period of 9.88 quarters, making his portfolio much more informative for retail investors.

Appaloosa Management - David Tepper

Number of Positions: 38

Top New Positions: SPYX puts, AAPL puts, DB, LHX, AVGO

Top Buys: SPYX puts, AAPL puts, UBER, DB, LHX

Top Sales: BABA, AMD, MSFT, FDX, PDD

Average 13F Holding Period: 9.68 quarters

*Reminder: 13F options positions are calculated on a notional basis. The market value of options as reported in 13F filings assumes the value of the underlying shares and not the value of the options themselves.

While Tepper reduced his BABA, PDD, and JD positions by over 20% and his FXI and KWEB positions by over 10%, Chinese stocks still account for 30% of his portfolio compared to 37% in Q4 and 38% in Q3.

Tepper’s largest position, on a notional basis, is put options against the SPDR S&P 500 Fossil Fuel Reserves Free ETF (SPYX). It’s probable that his largest position is still BABA when considering the true market value of the SPYX puts.

Estimated cost basis and P/L for Tepper’s China positions:

BABA - $80.87, +52% gain

FXI - $24.30, +47% gain

KWEB - $26.98, +27% gain

JD - $29.53, +14% gain

PDD - $122.41, -3% loss

BIDU - $115.88, -23% loss

Read more about Tepper’s call to buy “everything” China last September:

Meanwhile, Altimeter’s Brad Gerstner added exposure to China in the form of BABA with a 1.44% allocation. At the same time, Altimeter completely sold out of Salesforce (CRM), Duolingo (DUOL), and Google (GOOGL) while adding a bearish QQQ bet.

Number of Positions: 22

Top New Positions: QQQ puts, HOOD, CRWV, BABA, ARM

Top Buys: QQQ puts, HOOD, CRWV, BABA, FLUT

Top Sales: SNOW, GOOGL, TSLA, TSM, CRM

Average 13F Holding Period: 7.41 quarters

Other hedge funds that increased their BABA exposure include Bridgewater, Temasek, and Alphadyne.

Hedge Funds Snap Buying Streak

During Q1, the market value of long positions among institutional investors fell by 5.47% to $51.8 trillion, breaking a streak of five consecutive quarters of growth. This was likely a response to the uncertainty surrounding the Trump administration’s policies.

At the same time, dip-buyers continued to dominate with net buyers easily surpassing net sellers. The last time this indicator turned negative was in Q4 of 2022. Since then, the S&P 500 has increased by 61% while the Nasdaq 100 is up by 96%.

13F Filings From Top Hedge Funds

For the readers who prefer to just look at 13Fs, here are ten portfolios from top-performing hedge funds:

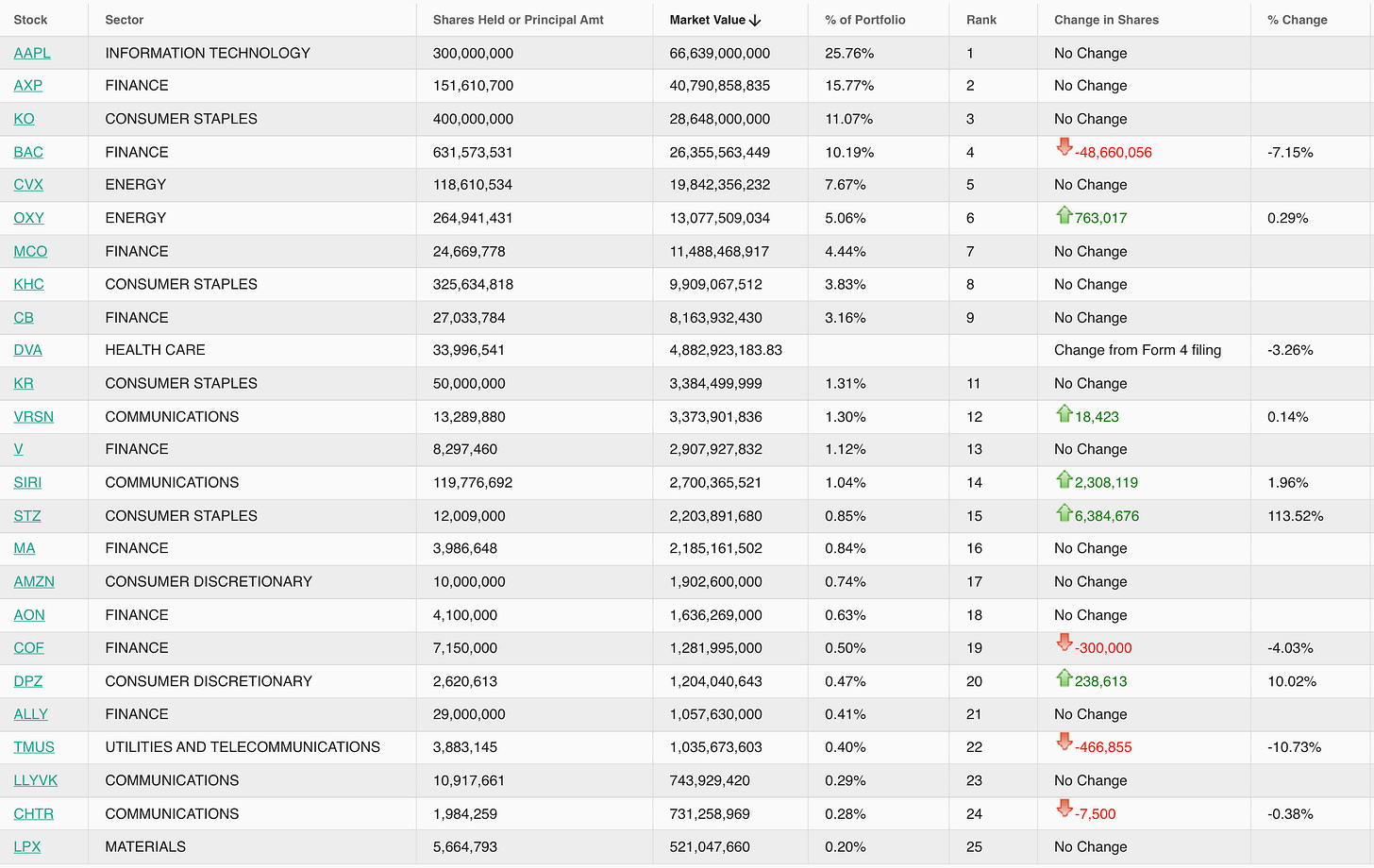

Berkshire Hathaway - Warren Buffett

Number of Positions: 36

Top New Positions: None disclosed

Top Buys: STZ, POOL, DPZ, SIRI, OXY

Top Sales: BAC, C, NU, FWONK, DVA

Average 13F Holding Period: 26.17 quarters

*Note: The SEC granted Buffett confidential treatment for one or more new positions in his Q1 13F.

Lone Pine- Stephen Mandel

Number of Positions: 24

Top New Positions: CVNA, TOL, CDNS, WING, APP calls

Top Buys: CVNA, TOL, CDNS, INTU, APP

Top Sales: PM, PTC, SPOT, WDAY, CEG

Average 13F Holding Period: 6.54 quarters

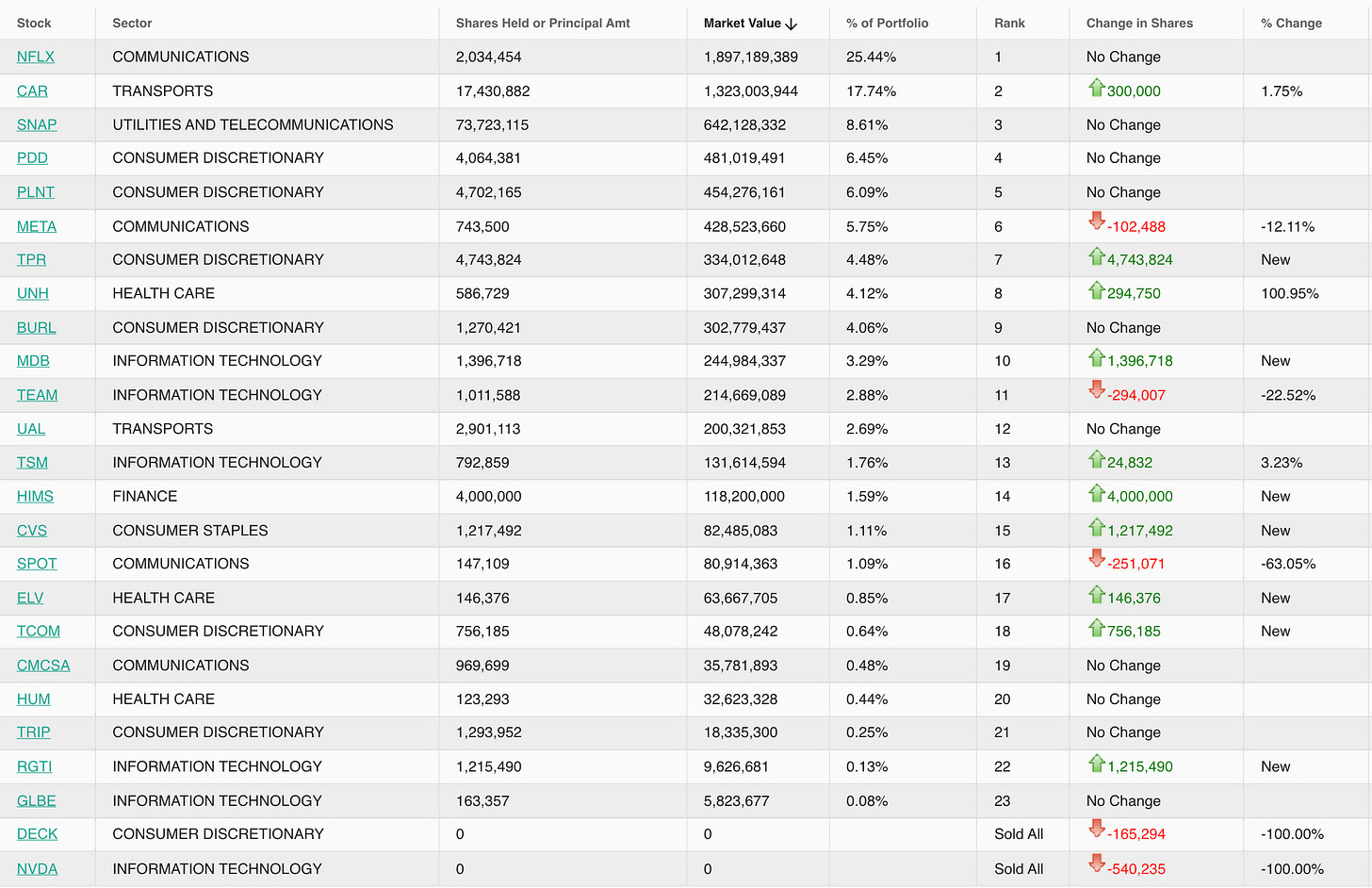

SRS Investment Management - Karthik Sarma

Number of Positions: 23

Top New Positions: TPR, MDB, HIMS, CVS, ELV

Top Buys: TPR, MDB, UNH, HIMS, CVS

Top Sales: SPOT, NVDA, TEAM, META, VSCO

Average 13F Holding Period: 10.52 quarters

SCGE Management - Jeff Wang

Number of Positions: 15

Top New Positions: None

Top Buys: SE, RDDT, PANW, TSM, TEAM

Top Sales: NOW, META, CVNA, HUBS, FICO

Average 13F Holding Period: 13 quarters

Whale Rock - Alex Sacerdote

Number of Positions: 32

Top New Positions: PI, BE, MDB, COMP, MPWR

Top Buys: MSFT, OKTA, PI, FN, BE

Top Sales: TOST, AVGO, CRM, AMZN, RDDT

Average 13F Holding Period: 7.56 quarters

Octahedron Capital - Ram Parameswaran

Number of Positions: 19

Top New Positions: TSM, MNDY, DDOG, INTC calls

Top Buys: TSM, MDB, CVNA, MNDY, GTLB

Top Sales: CPNG, W, YUM, MSFT, LRCX

Average 13F Holding Period: 4.53 quarters

TCI Fund - Chris Hohn

Number of Positions: 10

Top New Positions: None

Top Buys: MSFT, GE

Top Sales: GOOG, GOOGL, CNI, V, MCO

Average 13F Holding Period: 23.3 quarters

Dorsey Asset Management - Pat Dorsey

Number of Positions: 11

Top New Positions: AER, BKNG, ASML

Top Buys: AER, BKNG, DHR, ASML, META

Top Sales: SMAR, HRI, UPWK, WIX, PYPL

Average 13F Holding Period: 13.09 quarters

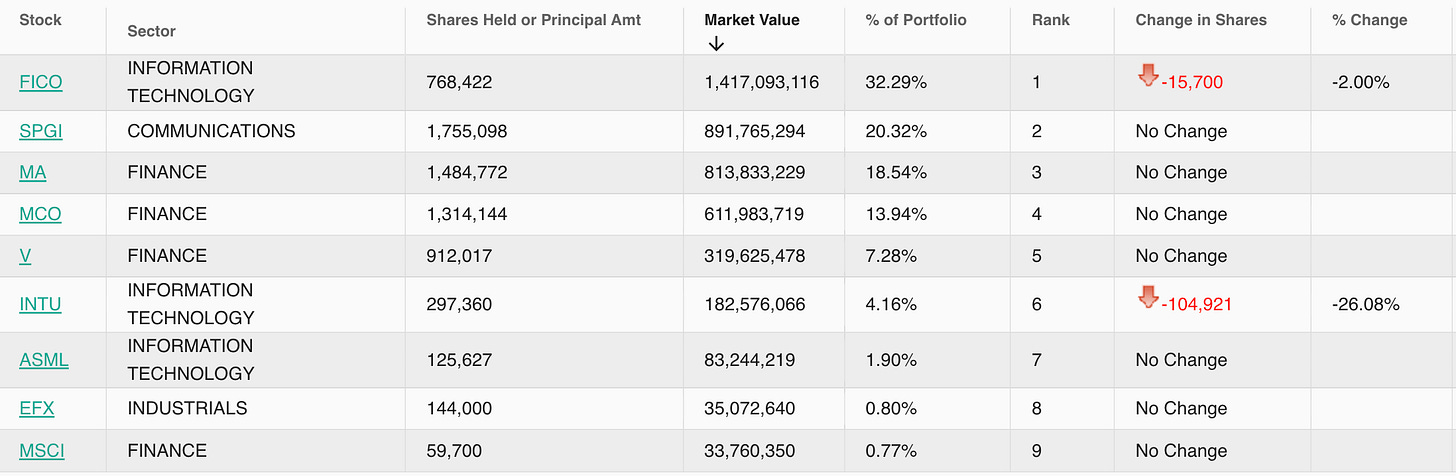

Valley Forge Capital - Dev Kantesaria

Number of Positions: 9

Top New Positions: None

Top Buys: None

Top Sales: INTU, FICO

Average 13F Holding Period: 22.33 quarters

Punch Card Management - Norbert Lou

Number of Positions: 4

Top New Positions: None

Top Buys: PDD

Top Sales: BRK

Average 13F Holding Period: 14.75 quarters

Hedge Vision - Institutional Insights

Thanks for reading!

📖 Join the conversation on Substack Chat

🕊️ Get real-time insights on X/Twitter: @HedgeVision

📧 Old school is cool too: HedgeVisions@gmail.com

His name is not Norbert Lao, it's Norbert Lou

Excellent breakdown of what hedge funds bought in Q1!