No fund manager in recent history seems more primed for success than Alex Sacerdote.

After receiving his BA in Political Science from Hamilton College, Sacerdote worked as an investment banking analyst for Smith & Barney before moving on to becoming the VP of Finance for Interactive Imaginations, an internet advertising startup. Sacerdote spent 1 year at Interactive Imaginations before leaving to pursue his MBA from Harvard University.

While attending Harvard, Sacerdote secured an internship with Fidelity Investments and worked in the e-commerce sector.

“I was very fortunate because Fidelity provides their interns with a tremendous amount of responsibility. They said to me, “There is this new thing called the Internet. You know something about this. Why don’t you cover e-commerce for the summer?” I was in heaven. I travelled the country visiting the roughly ten internet companies that were public at the time and met the CEOs and founders. I was able to attend Amazon’s first investor day and had lunch with Jeff Bezos. He had the same laugh back then too!”

-Alex Sacerdote

Sacerdote, aided with a 25 page presentation, pitched Amazon as an investment idea to the entire Fidelity equity department during his internship. Despite the mixed response from his peers due to Amazon’s high valuation and losses at the time, Sacerdote was offered a full-time position upon receiving his MBA.

Sacerdote spent 6 more years at Fidelity Investments and was the sector portfolio manager for a large and small cap tech fund. In 2006, Sacerdote decided to head out on his own and founded Whale Rock Capital Management.

“Fidelity was really about running large pools of capital diversified across industries, and I viewed myself as a tech specialist. In the technology sector, it’s important to be a specialist. The long/short format is great for TMT because there are always winners and losers, and the ability to short can dampen inherent volatility.”

-Alex Sacerdote

Performance & Holdings Value

Whale Rock has returned an astonishing 594% since since Q3 of 2015, more than quadrupling the S&P 500’s return of 124%.

Whale Rock’s public holdings value ballooned to an all time high in Q2, sitting at $15.42 billion. Whale Rock increased their holdings value by 26.8% compared to Q1, signaling their bullish stance on the market. Their holdings value is greater than 99% of all hedge funds.

Sacerdote’s 3 Points

Whale Rock is a long/short fund primarily focused on the technology, media, and telecommunications (TMT) sector. Before making an investment, Sacerdote evaluates 3 major points:

S-Curve Adoption Rate & Position

The S-curve represents the growth of a successful company over time. Initially, a company will start out very slowly with little demand and high costs. After this initial infancy phase, if successful, a company will see increasing sales with lower costs due to factors like economies of scale or advances in logistics.

Sacerdote believes that the inflection point between infancy and expansion is the best time for an investor to make their entry. During the expansion/growth stage is when a company is most volatile, but with higher risk comes higher potential return. An investment made when a certain product or technology is expanding into the general majority at a high adoption rate can generate life-changing returns.

“All technology adoption starts very slowly. It can be held back for a variety of reasons: high price, complex products, lack of an ecosystem. At some point, these barriers are removed, and the technology moves on the S- curve from the early adopter phase into the majority phase. At that point a massive wave of demand kicks in, and you can see three to four years of incredible unit growth.”

-Alex Sacerdote

Competitive Advantage

After Sacerdote finds a company in an attractive position on the S-curve, he analyzes the strength of their competitive advantage. A competitive advantage is a factor that makes a company’s products or services superior to their competitors. There are generally 4 types of competitive advantages:

Cost Leadership: A company sets low prices in comparison with competitors due to lower cost of resources. Lower cost of resources can result from economies of scale, proprietary technology, government subsidies, etc.

Cost Focus: Same as cost leadership, but operating in a much smaller market, or niche.

Differentiation: A company has a unique product or service that its competitors cannot replicate. Since the product/service is unique, it can command a premium price. A product/service can be unique due to patents, intellectual property, customer loyalty, etc.

Differentiation Focus: Same as differentiation, but operating in a much smaller market, or niche.

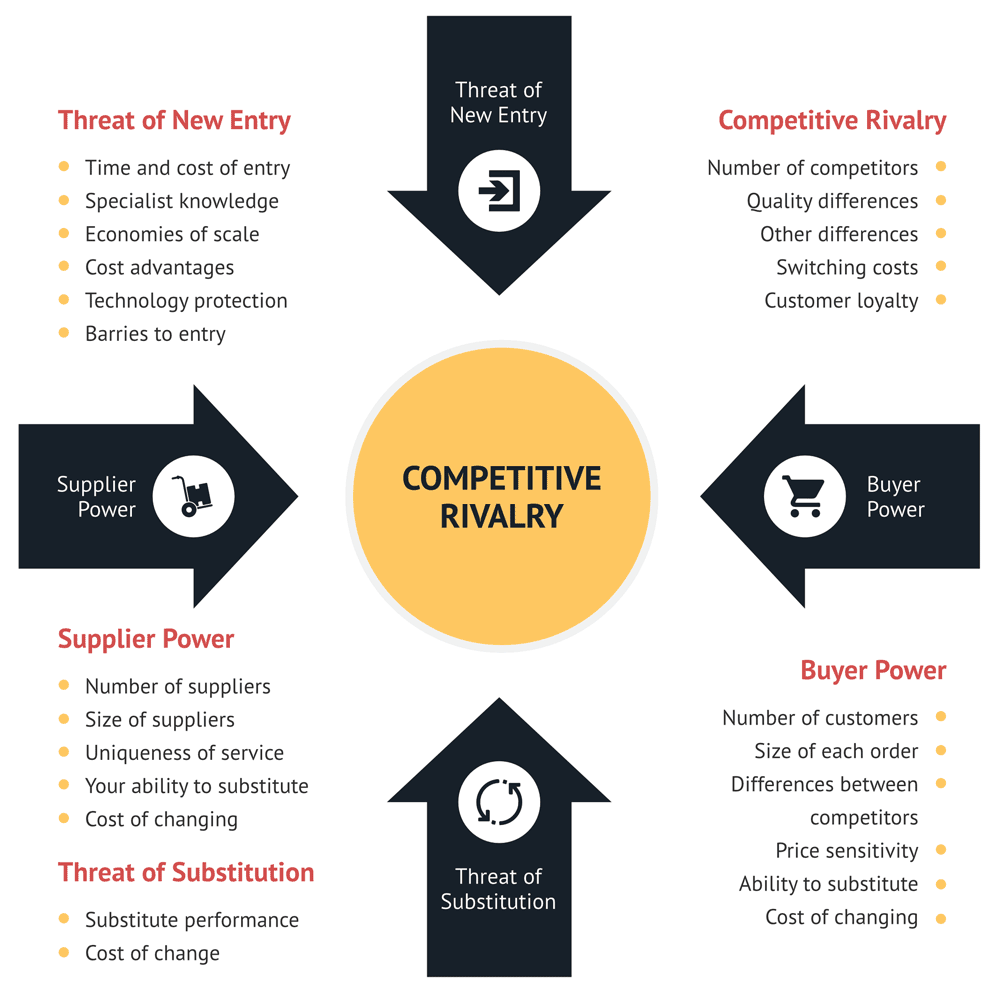

Porter’s Five Forces Model can be helpful when analyzing a company’s strengths and weaknesses within their competitive environment. The Five Forces Model is named after famed Harvard Business School professor, Michael Porter. The threat of new entrants and substitution, supplier power, and buyer power make up the competitive rivalry environment.

“Growth investors will occasionally find an attractive S-curve, but the important piece really is competitive advantage and operational abilities. In smartphones, Apple created half a trillion dollars in wealth but HTC, RIM, Nokia, Motorola, and LG destroyed value. Several went bankrupt and didn’t make a dime out of the smartphone S-curve.”

-Alex Sacerdote

Valuation

There are a multitude of ways to value a company and no specific method is completely accurate or used universally. Commonly accepted methods include the discounted cash-flow (DCF) model, enterprise value (EV) multiples compared against sales, gross profit, or EBITDA, and comparable company analysis.

“We don’t just invest blindly when we think we have found a winner. We need to see long term under-appreciated earnings power. When you have an S-curve in combination with a really strong competitive advantage, the earnings can grow exponentially. If we have a lot of confidence in both the S-curve and the competitive position, we are able to model out the business with a high degree of confidence and ensure we are buying at reasonable long term multiples.”

-Alex Sacerdote

As a multi-billion dollar hedge fund, Whale Rock has access to financial resources that aren’t accessible to the average retail investor. One example is having unlimited access to travel in order to properly interview top executives and understand a business’s structure.

“We do 1,000 face to face meetings a year despite being only a team of five. I think we travelled something like 250k miles last year. We go to Asia three or four times a year. We recently travelled to India to meet with 30 private and public Indian internet companies.”

-Alex Sacerdote

Current Portfolio

Sacerdote has remained loyal to his 20+ year old Amazon pitch during his time as a Fidelity intern, as Amazon is currently Whale Rock’s largest position out of 62 total. The position was increased by 14% during Q2, proving that Whale Rock believes Amazon still has room to grow.

Compared with FAANGM peers, Amazon has returned the least in percentage during 2021, and by a wide margin as well. Google leads the pack with an incredible 61.90% YTD performance, while Amazon sits in last place at 0.99%.

Zooming out on Amazon’s price chart tells the true story. Amazon tends to trade in a range, or base, for years at a time before breaking out explosively to new highs. In the end, patient shareholders are rewarded generously, as Amazon has returned 329% throughout the past 5 years.

Base 1: 16 months

Base 2: 28 months

Base 3: ?

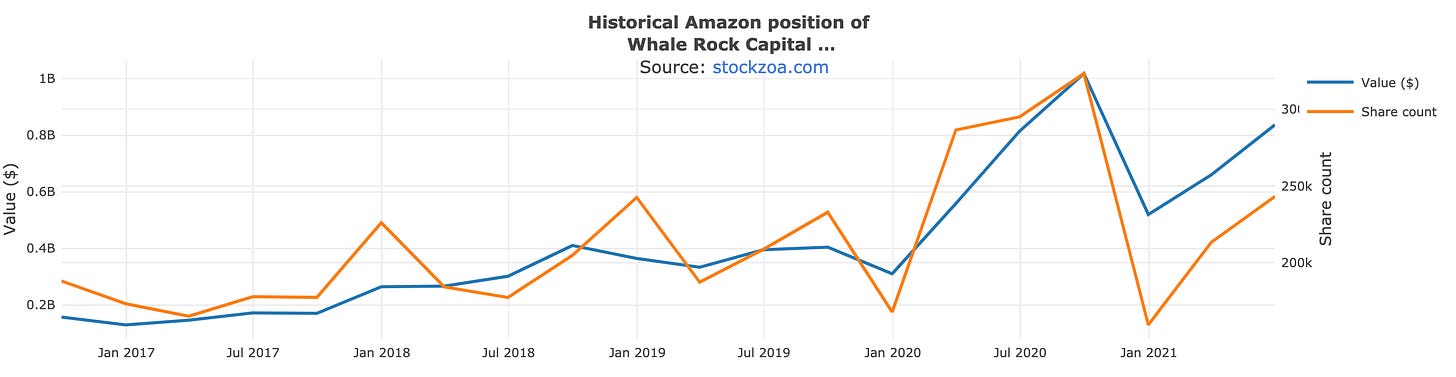

Whale Rock first purchased Amazon during Q1 of 2015 at an estimated price of $2188.98. They reduced their position dramatically during Q4 of 2020 but have since bought back shares.

Whale Rock’s second largest position is Shopify, the cloud based e-commerce platform. I have personally used Shopify before for over a year and was extremely impressed with their platform. Their customer service department is also speedy and polite with responses, which is always a plus for any business to have. Shopify charges a monthly fee depending on which plan you select and includes inventory and email services, a variety of payment processors, template website design, fraud detection, and much more.

Whale Rock increased their Shopify position by 27% during Q2. They first purchased shares during Q4 of 2015 at an estimated price of $416.21 and have traded SHOP extensively since.

Whale Rock increased their CrowdStrike exposure by 44.99% in Q2, making it their third largest position. Crowdstrike offers cloud-delivered endpoint detection for clients through their platform, CrowdStrike Falcon. Falcon’s purpose is to stop breaches “via a unified set of cloud-delivered technologies that prevent all types of attacks — including malware and much more.” Whale Rock’s purchase was timely, as Crowdstrike was recently added to the Nasdaq-100 index and has increased 28% during the past 3 months. Maxim Integrated Products (MXIM) was the unlucky recipient to be booted off the index.

Whale Rock first purchased shares of CrowdStrike during Q2 of 2019. Their estimated cost basis is $130.84, giving them a gain of 107% from today’s price of $272.09.

Significant Portfolio Changes

During Q2, Whale Rock initiated new positions in ROKU, ZM, RBLX, and HUBS and increased their existing DASH position by 448%. It’s evident from Whale Rock’s recent purchases that they are bullish on screen-time and communication providers.

Whale Rock completely liquidated their ORCL, DIS, TWTR, and SMAR positions while drastically reducing their PINS position by 80%. Whale Rock isn’t afraid to cut a position quickly and they have an average holding period of 4.89 quarters for any position they own. The average time a company is held in their top 10 positions is 5.10 quarters, while the average time held for a top 20 position is 3.75 quarters.

Alex Sacerdote is an exceptional fund manager to track, as he has created an absolute powerhouse in Whale Rock over the past decade. Sacerdote credits his father, who was the chairman of the private equity group at Goldman Sachs, as having the greatest influence on him “as an investor and a human being.”

Hedge Vision - Institutional Insights

Please don’t hesitate to send me topic recommendations, suggestions, or general questions. You can contact me by email: HedgeVisions@gmail.com, or by Twitter messages @HedgeVision

Sources

Source 1 - Porter’s Competitive Advantages

Source 2 - Porter’s Five Forces Model

Looks like Alex finally hopped on the Roku train! Was really excited to see that move personally, been holding since 2018. This is easily a $200 billion dollar company IMO. Roku is building the foundations for an ad giant with their current offerings.