Eashwar Krishnan is the CEO, Portfolio Manager, and co-founder of Tybourne Capital, a $4.7 billion fund based in Hong Kong that invests in US exchange-listed equities. Krishnan received his MA in Natural Sciences from Cambridge University in 1998 and his BS in Physics from St. Stephen’s College in 1996. After working as an analyst at Goldman Sachs for 2 years, Krishnan joined Lone Pine Capital and was mentored by legendary Tiger Cub, Stephen Mendel. Krishnan learned and worked alongside Mendel for 11 years before leaving to launch Tybourne Capital with Tanvir Ghani, a Goldman Sachs executive.

Tybourne submitted their 13F quarterly portfolio update early on July 22nd, way before the 13F form deadline for institutional investors on August 16th. As of Q2 2021, Tybourne’s top industries are:

Information Technology, 38.56% portfolio weight

Communications, 21.81% portfolio weight

Consumer Discretionary, 18.22% portfolio weight

Tybourne’s portfolio consists of a top 10 holdings concentration of 66.23% and a top 15 holdings concentration of 86.33%, making them an extremely concentrated fund.

Performance & Holdings Value

Red Line: Tybourne Capital Cumulative Return (422%)

Blue Line: S&P 500 Cumulative Return (107%)

Tybourne has returned an astonishing 422% since Q3 of 2015, beating the S&P 500’s return of 107% by almost 4x!

Tybourne’s holdings value has gone up by 925.40% since their inception in 2012. Their holdings value is currently near an all-time-high, signaling a bullish stance on future market performance.

*Please note that Tybourne’s performance and holdings value are accurate as of Q1 2021. Graphics for Q2 have not updated yet. However, Tybourne’s portfolio below is accurate as of Q2 2021.

Current Portfolio

Tybourne’s #1 position is KE Holdings, which owns subsidiaries Beike and Lianjia. Beike is a digital real-estate brokerage platform for housing transactions, rentals, and other services, while Lianjia is China’s leading real estate brokerage brand. The Chinese real-estate market is ripe for disruption, and Tybourne is betting their money on BEKE to emerge successful.

BEKE IPO’d in the US on August 13th, 2020, so Tybourne wasted no time picking up shares and establishing BEKE as their top position. Tybourne increased their existing BEKE position by 2.84 million shares, or 44%, in Q2.

BEKE has consistently beat EPS and revenue estimates by a wide margin since their IPO. However, BEKE is down 63% YTD due to the threat of Chinese government regulation policies. The worst case scenario for this situation would lead to Chinese equities being delisted on US exchanges (possible, but not likely).

Chinese State Media released a report on July 27th that sought to reassure Chinese equity investors. The report stated that the recent decline “to an extent, reflected the misreading of policies and venting of sentiment by some funds. They added that “economic fundamentals are unchanged and the market may stabilize at any time.” This report relays the message that the Chinese government may be taking a step back from their recent regime of strict regulations, most likely influenced by the fact that Chinese equities have lost over $1 trillion in market cap in recent weeks.

On the other hand, China is also clamping down on real estate speculation. In the past few weeks, China has promised to accelerate government subsidized rental housing and increase regulations on a variety of housing-related matters. Vice Premier Han Zheng stated that the housing sector shouldn’t be used as a short-term tool to stimulate the economy and that “housing is for living in and not for speculation.”

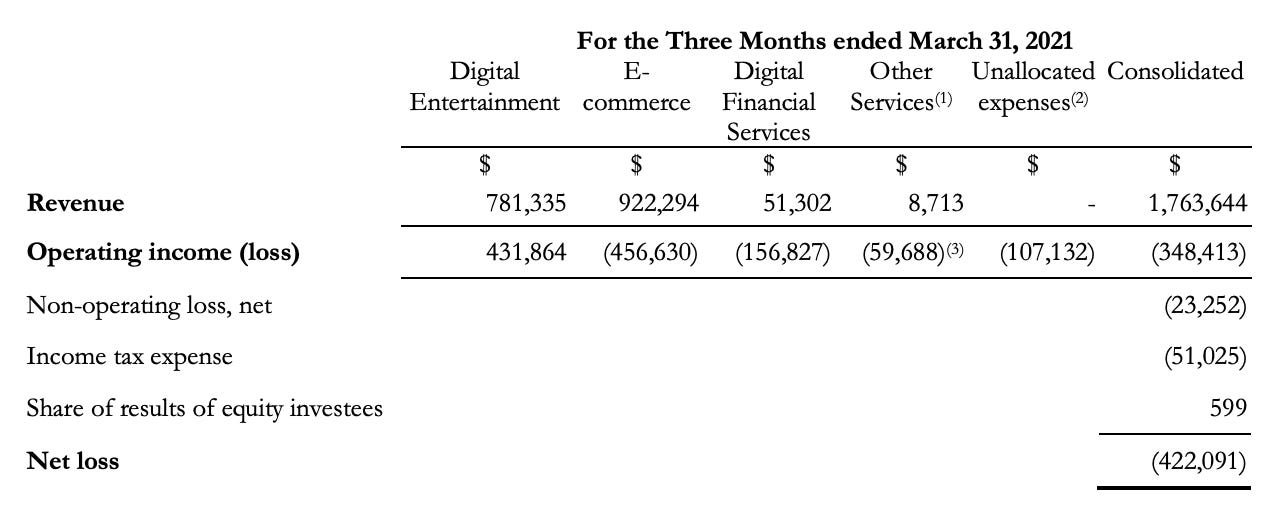

Sea Limited (SE) is Tybourne’s second largest position and is an obvious hedge fund favorite, although Tybourne decreased their position by 23% in Q2. Prominent fund managers who also own SE include Chase Coleman, Glen Kacher, and Jeffrey Wang, among others. SE is based in Singapore and operates under 3 segments:

Digital Entertainment: Garena

E-commerce: Shopee

Fintech: SeaMoney & ShopeePay

Q1 2021 Highlights:

Revenue: $1.76 billion, up 146% YoY

Gross Profit: $645.4 million, up 212% YoY

E-commerce Revenue: $922.2 million, up 250% YoY

Digital Entertainment Bookings: $1.1 billion, up 117% YoY

SE has beaten consensus revenue estimates 12 times out of the past 13 quarters, only falling short after reporting earnings on Nov. 2020. As of today, SE is still unprofitable, although the path to profitability is clearly visible as evidenced by their consistent earnings growth.

Tybourne’s third largest position is MercadoLibre (MELI), which translates to “free market” in Spanish. MercadoLibre is the largest e-commerce and payments platform in Latin America. Tybourne increased their current position by 40%, or 67,900 shares, in Q2.

MercadoLibre’s target market of Latin America consists of 30 countries that are still in the early stages of the digital revolution. MELI reported Q2 earnings yesterday (August 4th, 2021) and the stock price subsequently responded by increasing 13%. Here are some key stats:

Total Revenue: $1.7 billion, up 93.9% YoY

Total Active Users: 75.9 million, up 47.4% YoY

Gross Merchandise Volume (GMV): $7 billion, up 46.1% on a FX neutral basis.

MercadoLibre has now beaten consensus revenue estimates for 13 quarters in a row. The last time they missed on revenue was when they reported earnings during Q2 of 2018.

MercadoLibre has invested in cryptocurrency as well, announcing last May that they had invested $7.8 million into Bitcoin. MercadoPago, the payments system, began accepting Bitcoin payments in 2015.

“The crypto positions that our treasury has been purchasing are not usage of ours. This is U.S. dollars that we are purchasing crypto with. I think this has multiple objectives.

One of them is we've always been long-term thinkers, and we believe this is a good use of long-term store value for our treasury at the right amount and at the prudent amounts. But it's also us making sure that we are quickly moving up the learning curve in terms of understanding crypto and making sure that opportunities that we are sure will arise, we are able to move into them and have a good understanding of what's going on.”

-Pedro Arnt, MercadoLibre CFO, Q1 Earnings Call

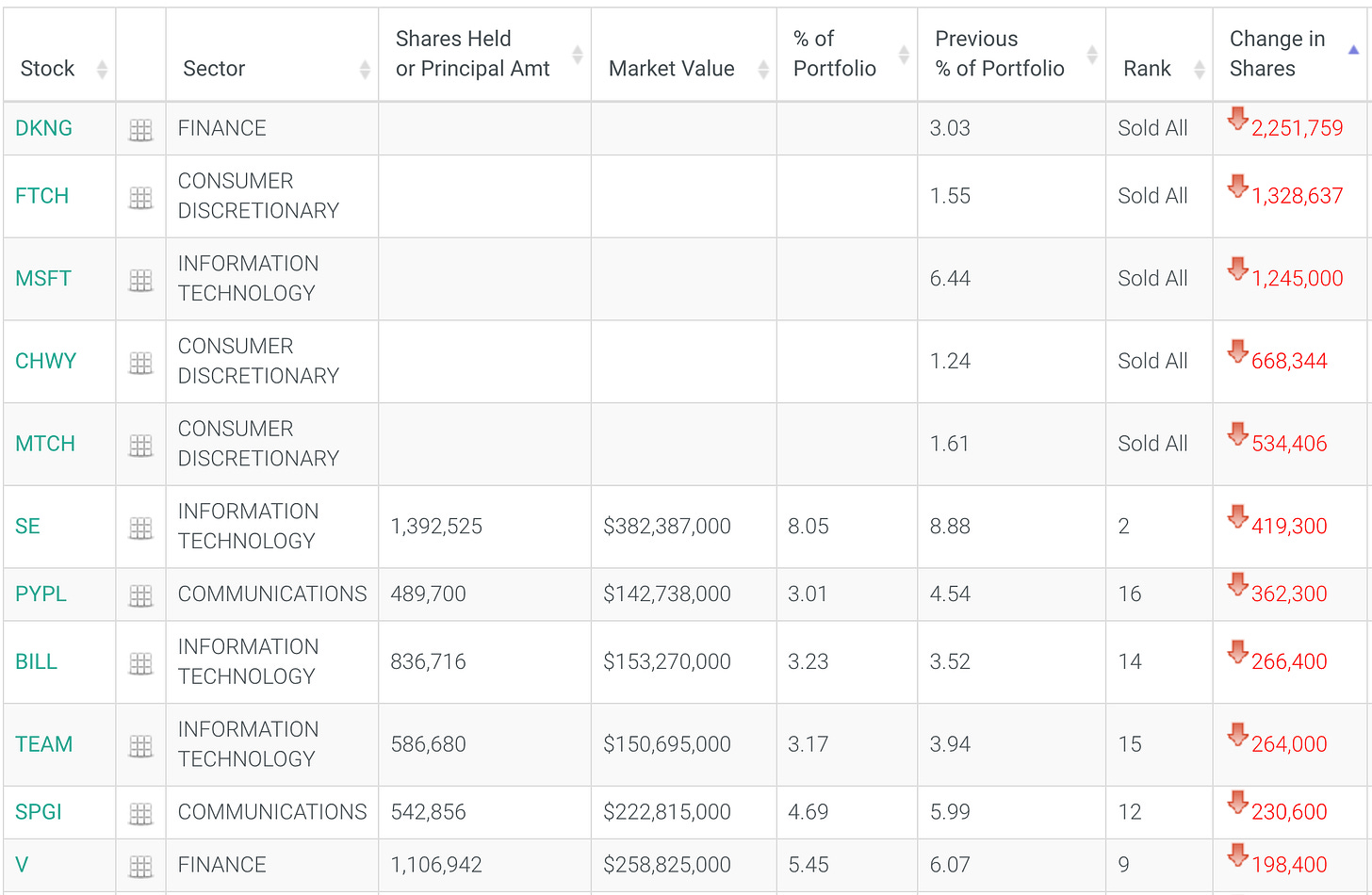

Significant Portfolio Changes

Tybourne added 2 new positions in Q2, COUP and RPHM. They aggressively increased their PTON position by 97% and their AMZN position by 83%. BEKE became Tybourne’s largest position this quarter, and it appears that Tybourne believes the Chinese government will take a step back after enforcing harsh regulatory policies this year.

In Q2, Tybourne completely sold out of DKNG, FTCH, MSFT, CHWY, and MTCH. DKNG, FTCH, CHWY, and MTCH were all companies that enjoyed generous price increases during the height of the coronavirus pandemic, signaling that Tybourne may be rotating out of these pandemic-driven names.

Tybourne’s average holding period for a stock is 4.28 quarters, so their turnover rate compared with other funds of their size is quite high. The average time a position is held in their top 10 holdings is 1.80 quarters, while the average time held for a top 20 position is 2.65 quarters. Tybourne isn’t afraid to take short-term gains, making them an exciting fund to analyze each quarter.

Hedge Vision - Institutional Insights

Please don’t hesitate to send me topic recommendations, suggestions, or general questions. You can contact me by email: HedgeVisions@gmail.com, or by Twitter messages @HedgeVision

Disclosure: Of the equities mentioned above, I own BEKE, SE, MELI, MSFT, AMZN, PTON, PYPL, and TWLO via common shares.

Source 1 - Eashwar Krishnan LinkedIn Profile

Source 3 - Chinese State Media Seeks to Calm Investor’s Nerves

Source 4 - Tybourne Capital - SEC

Source 5 - MercadoLibre Buys $7.8M of Bitcoin

Source 6 - MercadoLibre Brings Bitcoin Payments to 7,000 Merchants

Didn’t know of this fund so thanks for posting this. Their largest position in BEKE is certainly interesting given the current climate, but their conviction is definitely strong!