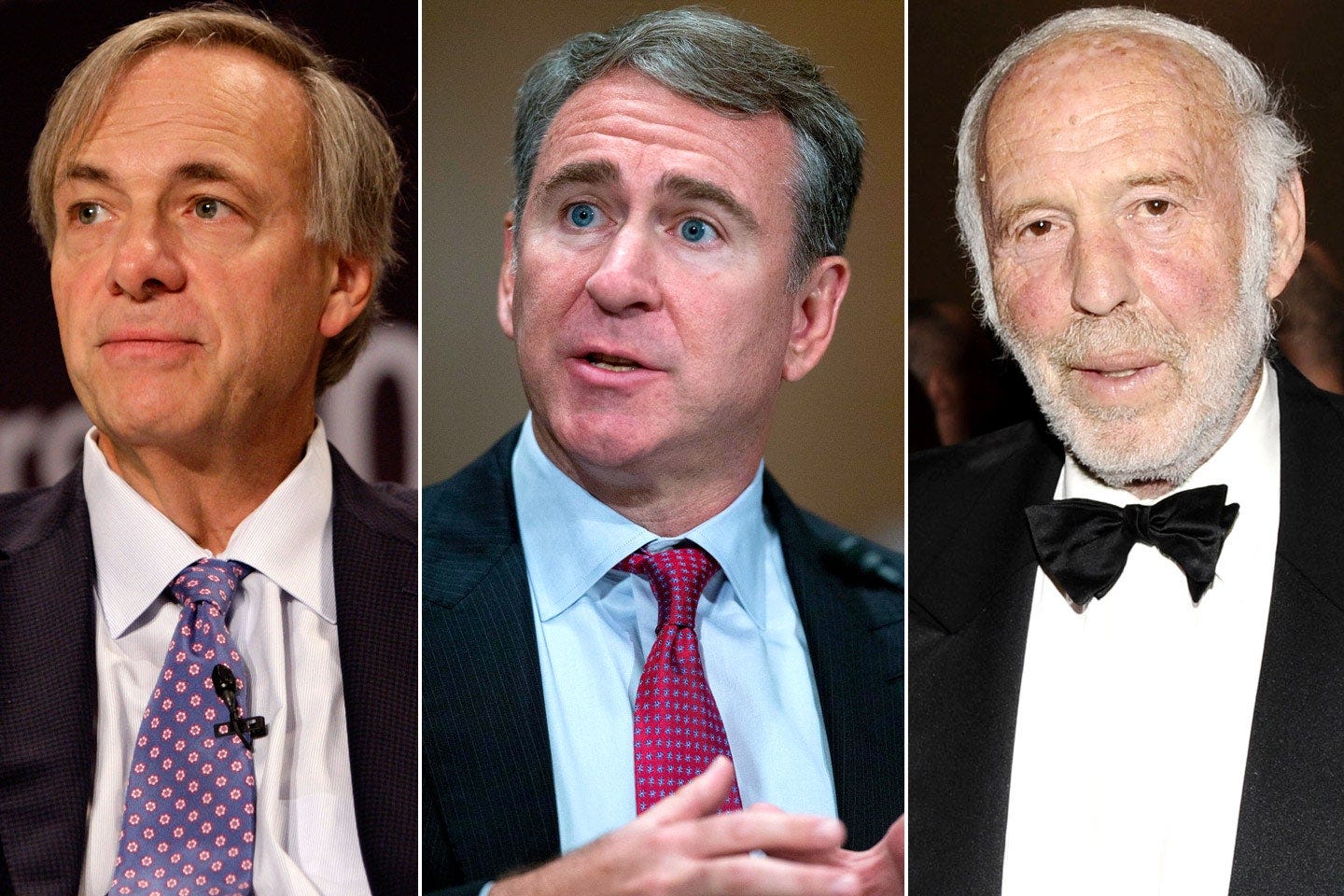

2022 marked an opportunistic year for hedge funds focused on macroeconomic trends. Veteran fund managers, like Citadel’s Ken Griffin, posted standout returns in a time when hedge funds invested in individual equities experienced significant setbacks.

During 2022, the S&P 500 declined by 19.44%, which marked the index’s worst year since 2008 when it fell by 38.49%. According to the HFRI 500 Fund Weighted Composite Index, the average hedge fund declined by 4.25%. Equity-based hedge funds faced a decline of 10.37%, while crypto hedge funds were hammered with losses of 55.08%. Macro hedge funds took home the first place award with an average return of 9.31%.

Meanwhile, all four of Citadel’s main funds outperformed the S&P 500’s loss by a wide margin:

Wellington Fund (Flagship): 38.1%

Global Fixed Income Fund: 32.58%

Tactical Trading Fund: 26.49%

Equities Fund: 21.4%

As of January 1st, Citadel had $54.5 billion in AUM after returning $8.5 billion in profits to clients at the end of 2022. In fact, profits were so plentiful for Citadel that the firm paid for an all-inclusive 3-day trip to Disney World for 10,000 of its employees and their families.

Citadel Securities, which is the market-making subsidiary of Citadel, pulled in record revenue of $7.5 billion, up 7.1% YoY from $7 billion. Citadel Securities handles about 40% of all U.S. retail trading volume and serves more than 1,600 institutional clients.

Quant hedge fund AQR Capital posted its best year since its inception in 1998. Led by Founder and CIO Cliff Asness, the fund’s Absolute Return strategy fund rose by 55% before fees or 43.5% after fees. A source close to AQR disclosed that at least a dozen of its funds returned record gains and that its Global Macro strategy fund gained 42% after fees. As of November, AQR had an AUM of about $100 billion.

Tiger Cubs Suffer Significant Losses

For the Tiger Cubs, or students of hedge fund pioneer Julian Robertson, the pain started early on and only got worse throughout the year. The group’s poor performance was exasperated by a concentration in similarly-held technology names that witnessed severe multiple compression in a high interest rate environment:

Tiger Global’s Chase Coleman certainly felt the heat. Tiger Global had fallen by 54% as of November 30, wiping out all of the fund’s dollar gains since 2018 and bringing its 2-year drawdown to 57%. As with its public investments, its private investments, such as BlockFi, Stripe, and Stash, also suffered major losses.

Light Street’s Glen Kacher saw his fund lose 51.6% through July 2022 after suffering a 26% drawdown in 2021.

The Top Performing Hedge Funds of 2022 - Honorable Mention

Chris Rokos’ Rokos Macro Fund tallied in at #4, surging 51% after losing 26% in 2021 and gaining 43.8% in 2020. Rokos got caught up in controversy in 2021 after paying himself and his partners $1.2 billion right before the fund suffered its worst year of losses since its inception in 2015. In 2022, Rokos made all that back and more, rewarding the investors who stuck around.

Overall, a majority of the top ten managers placed an emphasis on macroeconomic trend following. It’s safe to assume that many of these managers will continue to employ the same strategy in 2023.

As Aspect Capital Director of Investment Solutions Razvan Remsing puts it:

"The removal of the Fed Put during 2022 has resulted in significant directional moves in the markets. Some of the best opportunities have materialized on the short side of fixed-income."

None of the top 10 performers from 2021 made the cut, except for Citadel’s Ken Griffin. Top performers from that year included Third Point’s Dan Loeb, Pershing Square’s Bill Ackman, and SRS Investment Management’s Karthik Sarma.

Now, let’s get on to the top 3 performing hedge funds of 2022.