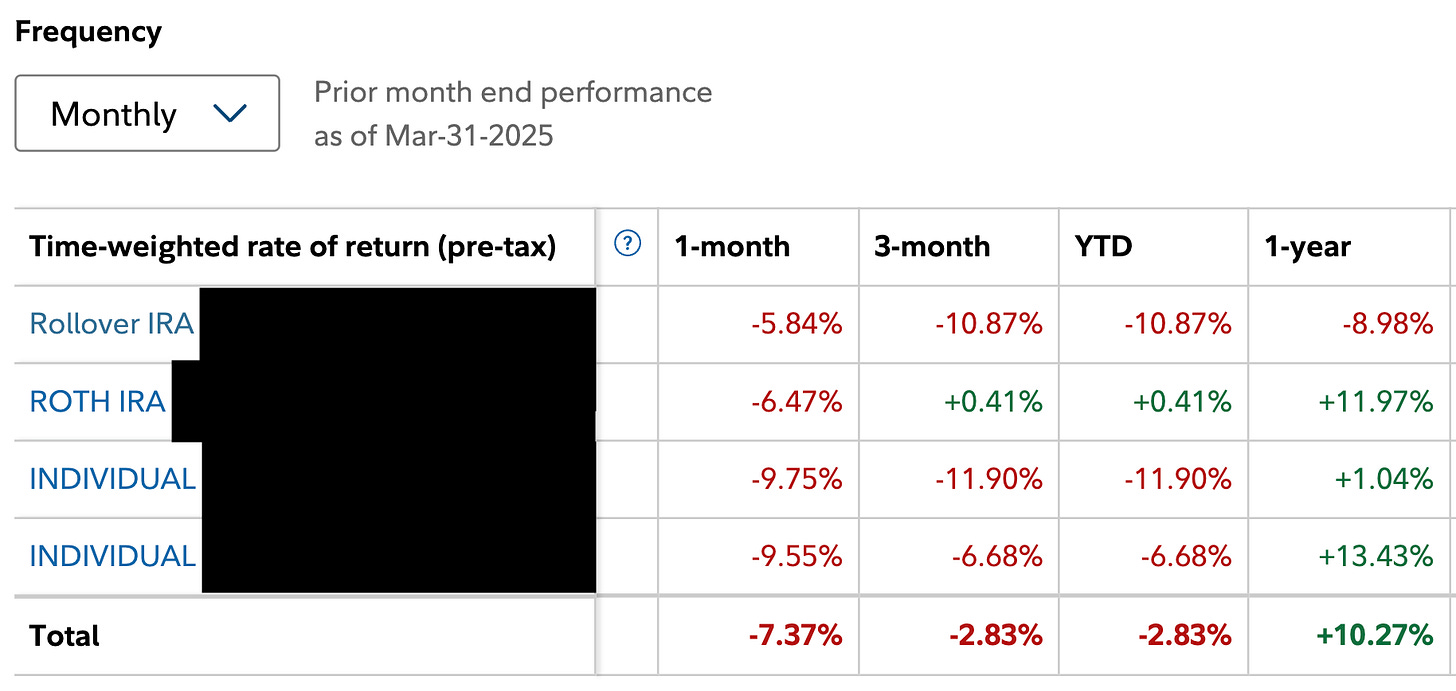

During Q1, the Hedge Vision portfolio fell by 2.83%. In comparison, the S&P 500 declined by 4.06% while the Nasdaq 100 fell by 7.91%.

Here’s my portfolio from March 31, 2024 for comparison:

If you made it through the quarter without a significant drawdown, congrats!

Q1 2025 was the fifth worst first quarter of all time, trailing behind the losses of 2001, 2008, 2020, and 2022. Sentiment has clearly soured as fear returns to the market.

Whatever you do, don’t panic.

Selling high-conviction stocks in a time like this is possibly the worst thing an investor can do to interrupt the compounding process. I haven’t sold a single penny of any of my top 10 stocks this year.

With the S&P 500 down by 8.6% from its peak, valuations are starting to become more reasonable. It’s a great time to begin dollar-cost averaging into positions that were too expensive during the past two years. At the same time, I wouldn’t say it’s time to go “all-in,” as the index is still trading at a forward P/E of 21.2x compared to its 10-year average of 19.1x.

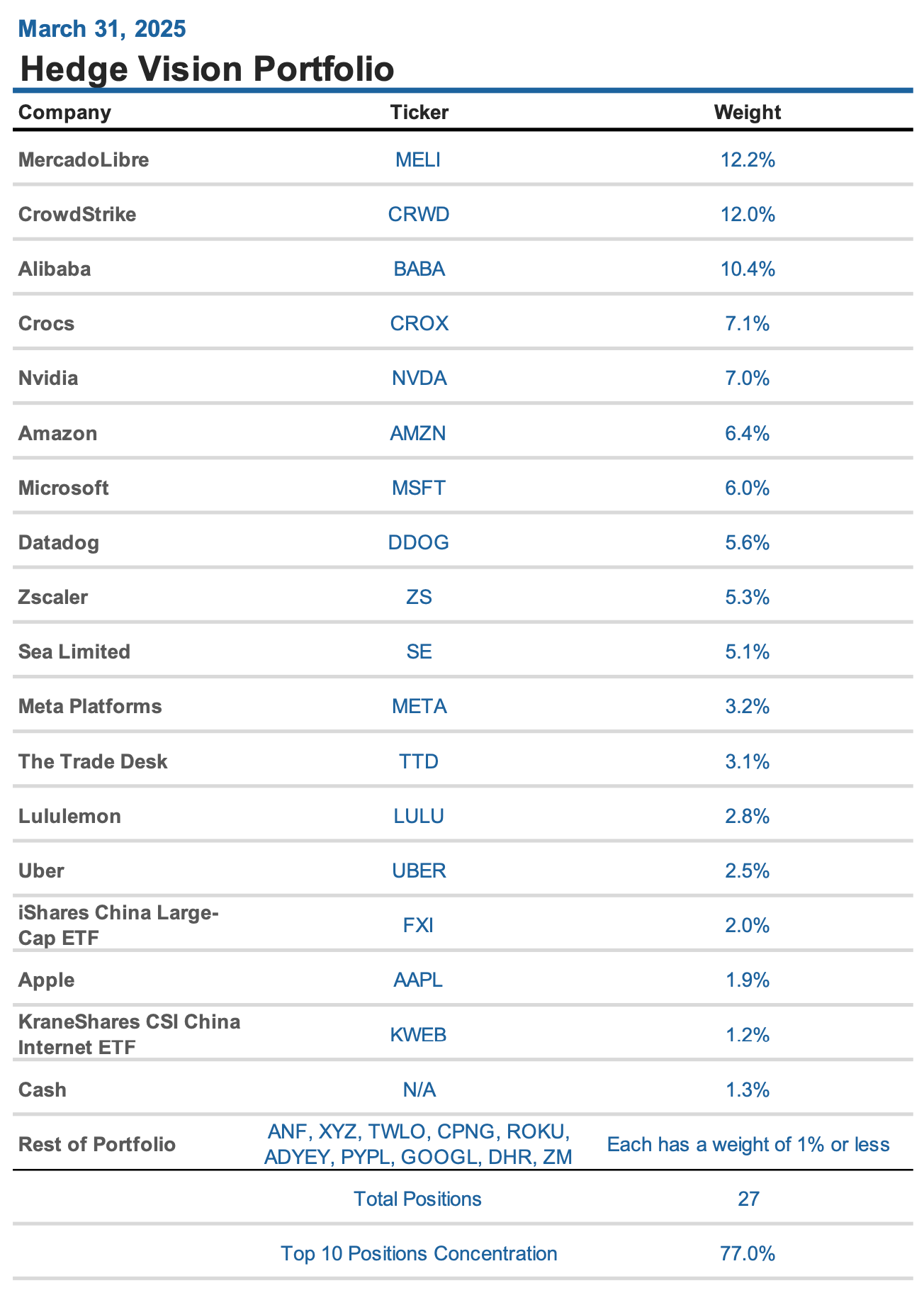

International stocks have been key to beating the market this year and currently make up ~30% of my portfolio. Alibaba (BABA), my third-largest position, has returned 55% YTD while MercadoLibre (MELI), my largest position, is up by 10%.

U.S. stocks still make up the remaining ~70% of my portfolio as it is still, without a doubt, the best place in the world to invest for the long-term.

March 2025 Buys

New Positions: None

Increased Positions: The Trade Desk (TTD)

I’ve been steadily increasing my stake in TTD during the past two months as the demand-side ad platform grapples with a 60% drawdown, one of the worst in its publicly traded history. TTD’s forward P/E has also come down to a more reasonable 30x, which still isn’t considered cheap. The trade-off is that quality comes at a price. TTD is now 3.1% of my portfolio.

March 2025 Sales

Exited Positions: e.l.f. Beauty (ELF)

Reduced Positions: Abercrombie & Fitch (ANF)

Both ELF and ANF plummeted following earnings, and I was forced to limit my losses. The disappointing results come amid falling consumer sentiment and rising tariffs, along with increased inflation expectations. These factors have spooked both producers and consumers alike as uncertainty looms ahead.

Consumer discretionary was the worst sector in the S&P 500 during Q1 with an 11% loss, even worse than tech at -10.5%. I have significantly reduced my consumer discretionary exposure since the beginning of the year.

My buys and sales in real time, as well as further analysis and commentary, are shared with contributing members on Substack Chat:

Outlook for Q2

As the panic settles, I believe the current drawdown will just be a correction that doesn’t exceed a loss of 15%. On top of that, I don’t expect the trade war against Canada and Mexico, or any major trading partner, to last more than a few months. The two countries will likely give in to trade negotiations given how dependent their economies are on importing goods to the U.S.

China is a different story, although the Hang Seng Index hasn’t exactly responded negatively to the tariffs with an 18% YTD return.

Prior to the correction, the U.S. market had been on an explosive 2.5-year run. If it wasn’t for the tariffs as a negative catalyst, it would have eventually been something else. Nothing goes up forever. Valuations are being adjusted lower, which long-term investors will know to take advantage of.

Hedge Vision

Thanks for reading!

📖 Join the conversation on Substack Chat

🕊️ Get real-time insights on X/Twitter: @HedgeVision

📧 Old school is cool too: HedgeVisions@gmail.com