Perhaps one of the most well-known fund managers of our generation, Bill Ackman has managed to grow Pershing Square into one of the world’s most acclaimed hedge funds. After receiving his MBA from Harvard University in 1992, Ackman wasted no time and founded Gotham Partners with fellow Harvard classmate David P. Berkowitz in March of 1993.

“One day I approached David with a copy of Seth Klarman's investing book ‘Margin of Safety,’ which I found fascinating. This book was the catalyst. When you read a book like Seth's and have some success in your own investing, you think, ‘God, we could do this.’”

The hedge fund started with $3 million in seed capital after contacting 100 potential investors. Of the 100 investors, only 6 of them offered Gotham capital. The seventh investor in the fund was Ackman’s father.

At the time, Ackman was 26 years old. After a 3% decline in the first month, the pair had returned 27.4% by February of 1994, outperforming the S&P 500’s return of 3.7%.

Gotham Partners

Two years later, Ackman teamed up with Leucadia National to make a bid for the Rockefeller Center in New York. The bid was unsuccessful, but generated a decent amount of buzz for the young fund manager. By 2000, Gotham had $300 million in assets under management (AUM).

However, things took a turn for the worst in the new century when Ackman found himself in legal trouble. In 2002, the New York Supreme Court blocked a merger between Gotham-backed Gotham Golf and First Union Real Estate due to a lawsuit filed by minority stockholders. Shareholders argued that the merger was not beneficial to First Union and would used to bail out the struggling Gotham Golf.

The events of the lawsuit and redemptions by investors led Ackman to announce that he was closing down Gotham Partners. By November, investors had requested to redeem $50 million out of Gotham's liquid $155 million fund.

The announcement came as a shock, as Gotham had returned about 20% annually since its inception. Later, a New York court ruled in Ackman’s favor and reversed the Supreme Court’s ruling.

The New York Times was quoted as saying:

"An examination of Gotham's activities in recent years shows a series of ill-timed bets, a surprising lack of diversification and a dangerous concentration in illiquid investments that could not easily be sold when investors wanted their money back."

The next year, New York Attorney General Eliot Spitzer began an investigation into Gotham after the fund published a bullish article on Pre-Paid Legal Services and then sold about 200,000 shares in the company out of a total position of 1 million shares. Ackman stated that the sale was due to the liquidation of Gotham. No charges were ever filed in relation with the investigation, although Ackman’s reputation took a hit.

"People look at you funny. I learned that it takes a lifetime to build a reputation, and someone can destroy it in a few days."

Pershing Square

By 2004, Ackman was ready to get back to business and founded Pershing Square with $54 million in seed capital from himself and Leucadia. The namesake of the fund was an ode to the public, square-shaped gathering place in front of Grand Central Station that was near Ackman’s original office.

His first major activist investment was Wendy’s WEN 0.00%↑ in early 2005. Ackman pushed the fast food chain to spin off its chain of Tim Horton’s restaurants, rationalizing that it would be valued more fairly as a separate entity. Wendy’s eventually caved in and spun off the chain through an IPO in 2006. Throughout the years, Ackman’s activist stance only continued to proliferate, with the fund manager purchasing substantial stakes in companies like Target TGT 0.00%↑, J.C. Penney, and Borders.

In 2012, Ackman achieved a major milestone after launching Pershing Square Holdings (PSH), a closed-end fund on Amsterdam’s Euronext exchange. A closed-end fund issues a fixed number of shares through an IPO. These shares can be traded, but no further shares will be issued or created. Shares held by insiders of company were subject to a 10-year lockup period starting in October of 2014. Today, PSH is the third largest closed-end fund in the world by market capitalization.

In 2020, Ackman made headlines after taking on a $27 million hedge against global investment-grade and high-yield credit indexes. If risk and volatility were to be heightened, which could result in wider credit spreads, then Pershing Square was set to make a massive profit. That’s exactly what happened. The events of the coronavirus pandemic sent the market into a frenzy, and Ackman’s $27 million hedge increased to a value of $2.6 billion. Ackman later stated that the hedge was purchased when Pfizer PFE 0.00%↑ released positive trial data for its coronavirus vaccine, which sent the market higher in response.

“The Greatest Moment in Financial Television”

After previous financial and legal skirmishes involving Herbalife, pyramid schemes, and schmuck insurance, Ackman stepped up to the plate with corporate raider Carl Icahn on CNBC’s ‘Halftime Report’ in 2013. What resulted was an epic showdown that consisted of vulgarities, accusations of pumping-and-dumping, and flared tempers, all on live television.

You can read more about the fiasco here:

The two fund managers have since made up (supposedly). In 2014, Ackman showed up as the surprise guest after Icahn gave a speech at the Delivering Alpha conference. The pair even received conciliatory t-shirts that said “Bill and Carl Reunited” after they hugged it out.

Pershing Square’s Portfolio & Performance

As of Q2, Pershing Square had $7.46 billion in 13F AUM split among 6 positions. The activist fund is highly concentrated and operates as a long term investor with an average holding period of 19.43 quarters, or 4.8 years, for its 13F holdings. Furthermore, the fund rarely holds more than 10 positions in its portfolio.

Ackman took on no new positions during Q2, instead lowering his exposure to CMG 0.00%↑, QSR 0.00%↑, and HLT 0.00%↑. Later on, the fund manager also exited stakes in NFLX 0.00%↑ , DPZ 0.00%↑ , and PSTH 0.00%↑ . Besides those three sales, Pershing Square's portfolio has largely remained the same since the beginning of the year, attributable to Ackman's belief that companies with predictable cash flows can sustain economic downturns.

Plans for special purpose acquisition company (SPAC) Pershing Square Tontine Holdings were scrapped after it failed to find a merger target in time, resulting in $4 billion of capital being returned to shareholders. The SPAC had been in talks with Universal Music Group (UMG), although the proposition ultimately fell through.

Ackman initially took on a new Netflix position during January, scooping up 3.1 million shares worth about $1.1 billion dollars. The purchase effectively made him a top-20 shareholder. At the time, Ackman stated that he had cut the fund’s interest rate hedge by 80%, generating proceeds of $1.25 billion to fund the purchase.

In April, just 3 months later, Ackman announced that Pershing had sold its entire NFLX stake, resulting in a loss of roughly $400 million and an overall YTD fund loss of 4%. He attributed the difficulty of predicting the streaming platform’s “future prospects” due to its plans to introduce ad-supported streaming plans and target non-paying customers:

Here are 5 of Pershing Square’s top equity positions as of June 30th, with added commentary from the hedge fund:

Lowe’s LOW 0.00%↑

“Lowe’s is a high-quality business with significant long-term earnings growth potential underpinned by a superb management team that is successfully executing a multi-faceted business transformation. Lowe’s is likely to generate a strong level of earnings growth over a multi-year period even if the industry and macroeconomic environment is weaker due to management’s strong execution of the company’s ongoing business transformation.”

Chipotle CMG 0.00%↑

“Chipotle’s economic model remains firmly intact, with restaurant-level margins in excess of 25% in the second quarter, up 0.8% year-over-year, and a consistent level of profitability expected for the current quarter. The company is debt-free and generates nearly all its sales in the U.S., insulating its earnings from the foreign currency headwinds facing many other large consumer companies.”

Restaurant Brands International QSR 0.00%↑

“QSR’s franchised business model is a high-quality, capital-light, growing annuity that generates high-margin brand royalty fees from its four leading brands: Burger King, Tim Hortons, Popeyes, and Firehouse Subs. QSR continues to trade at a discount to its peers and its intrinsic value. The company has repurchased more than 3% of its shares outstanding over the last twelve months, which when coupled with its 4% dividend yield, enables QSR to return approximately 7% of its market capitalization to shareholders on an annual basis.”

Hilton Hotels HLT 0.00%↑

“We expect demand to continue to strengthen from current levels as anticipated moderation in leisure occupancy is likely to be more than offset by improvements in corporate business transient and group business, both still below 2019 levels. Notably, the industrywide recovery is being led by an unprecedented surge in average daily rate (“ADR”).”

Howard Hughes HHC 0.00%↑

“HHC’s portfolio of well-located residential land and income-producing commercial assets continues to demonstrate resilient performance despite recent macro concerns of a slowdown in the housing market. The company’s advantaged business model of owning master planned communities (“MPCs”) provides HHC substantial control over the planning and release of land for sale and development, enabling it to take a long-term approach to maximizing the value of its portfolio.”

Interest rate swap option hedges have kept Pershing Square afloat this year, accounting for returns of 9.9% as of August 16th. Swap options grant a purchaser the right, but not the obligation, to pay a seller a fixed rate while the seller pays the purchaser a variable rate.

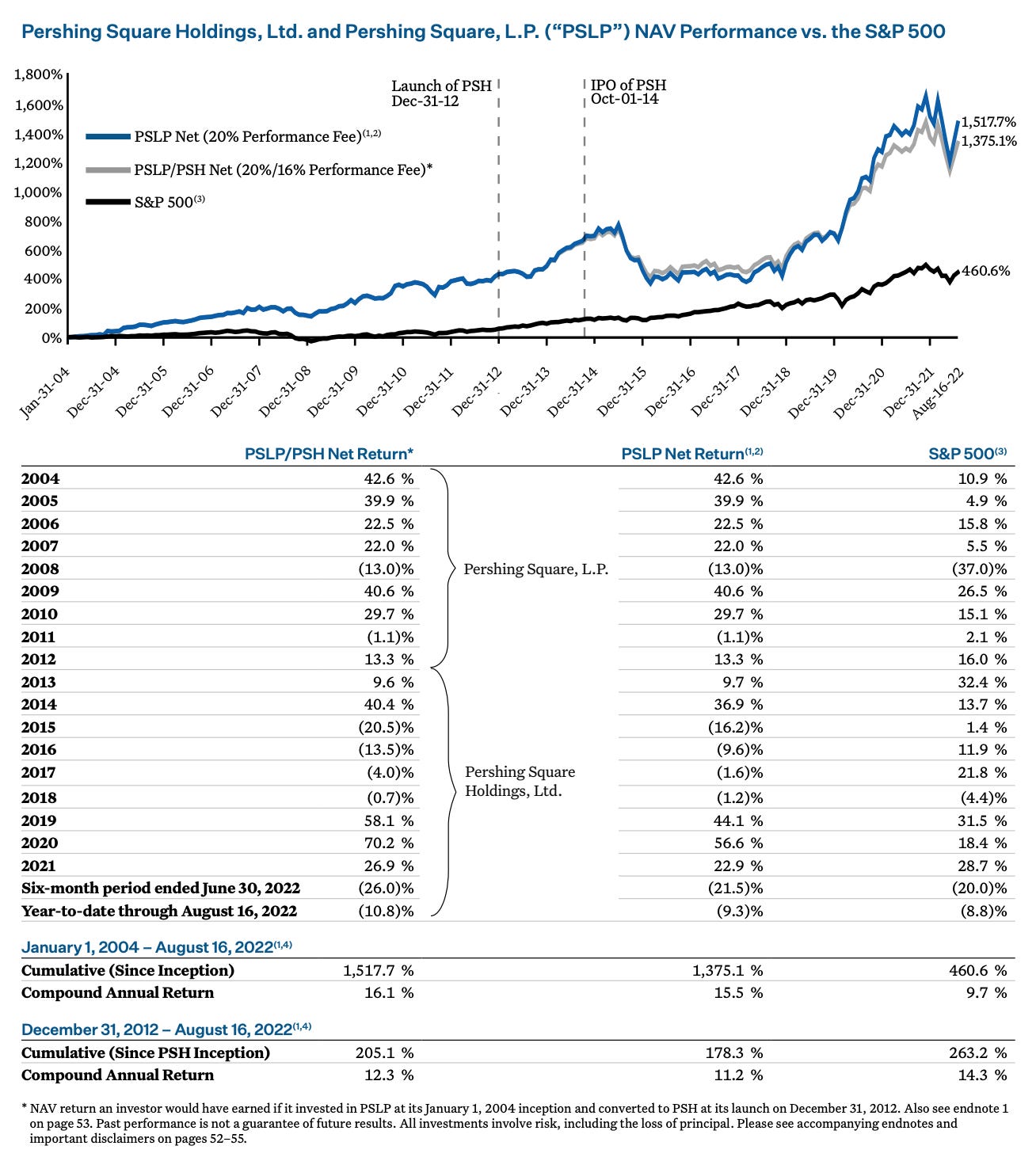

Since its launch in 2004, Pershing Square has returned a cumulative 1,517.7%, equivalent to a compound annual return of 16.1% per year. In comparison, the S&P 500 has returned a cumulative return of 460.6% and a compound annual return of 9.7%. Last year marked the fourth straight year of outperformance, a streak highlighted by a 70.2% return during 2020. As of August 16, the fund has a YTD loss of -10.8%, versus the S&P 500’s loss of 9.3%.

Ackman’s Outlook

By September of next year, Ackman expects YOY inflation to cool down to between 3.5% and 4%. In addition, he expects the Fed to raise interest rates to at least 4% and keep them there for about a year in order to combat inflation and meet his one-year inflation target. In an interview with CNBC’s ‘Squawk Box,’ Ackman stated that there are already indications that inflation is cooling down.

In Pershing’s interim report, the veteran fund manager noted that the investment management industry was a large contributor to the drawdown this year due to its short-term nature:

Meanwhile, Ackman hinted that PSH may eventually list publicly in the US and take a majority stake in a company:

Finally, Ackman announced succession plans “if the pie truck were to run me over tomorrow.” Ryan Israel, who joined the fund in 2009, was recently promoted to CIO and also as the replacement for Ackman himself.

“My decision to announce Ryan as CIO should in no way suggest to you that I am heading for the hills. I love this business and intend to stay active until they carry me out, and I am a heavy lift. I don’t expect that our investment team will function differently beginning the day after this announcement. Ryan has already for some time been unofficially serving in this role.”

Hedge Vision - Institutional Insights

Please don’t hesitate to send me topic recommendations, suggestions, or general questions. You can contact me by email: HedgeVisions@gmail.com, or by Twitter messages @HedgeVision