Bill Ackman, the Harvard alum and famed hedge fund manager, is an extremely concentrated investor with only 7 holdings in his multibillion dollar portfolio. Managing an AUM of $10.46B, Ackman is what’s known as an activist investor, or someone who buys a large stake in a company for the purpose of influencing how the company operates, ideally in a positive manner. Ackman founded Pershing Square in 2004 with $54M of initial seed money and his own personal funds.

Purple Line= S&P 500 Cumulative Returns

Circled Blue Line: Pershing Square Cumulative Returns

You may be eyeing Ackman’s recent performance and wondering why many believe he is one of the best fund managers in the game. The majority of Ackman’s big wins came between 2004 (inception of Pershing Square) and 2014.

On an annualized basis, Ackman has failed to outperform the S&P 500 on a 3, 5, and 10 year basis (using data from 2004-2019). However, Ackman outperformed the S&P 500 on a 15 year cumulative and annualized basis, as the bulk of his returns came in the early years of the fund. Ackman is a long term investor, usually holding a position for 15.7 quarters, or roughly 3.5 years on average before selling out.

Ackman’s holdings value peaked in 2014 around $16 billion. Today, Ackman is playing catch up with a holdings value of $10.46 billion.

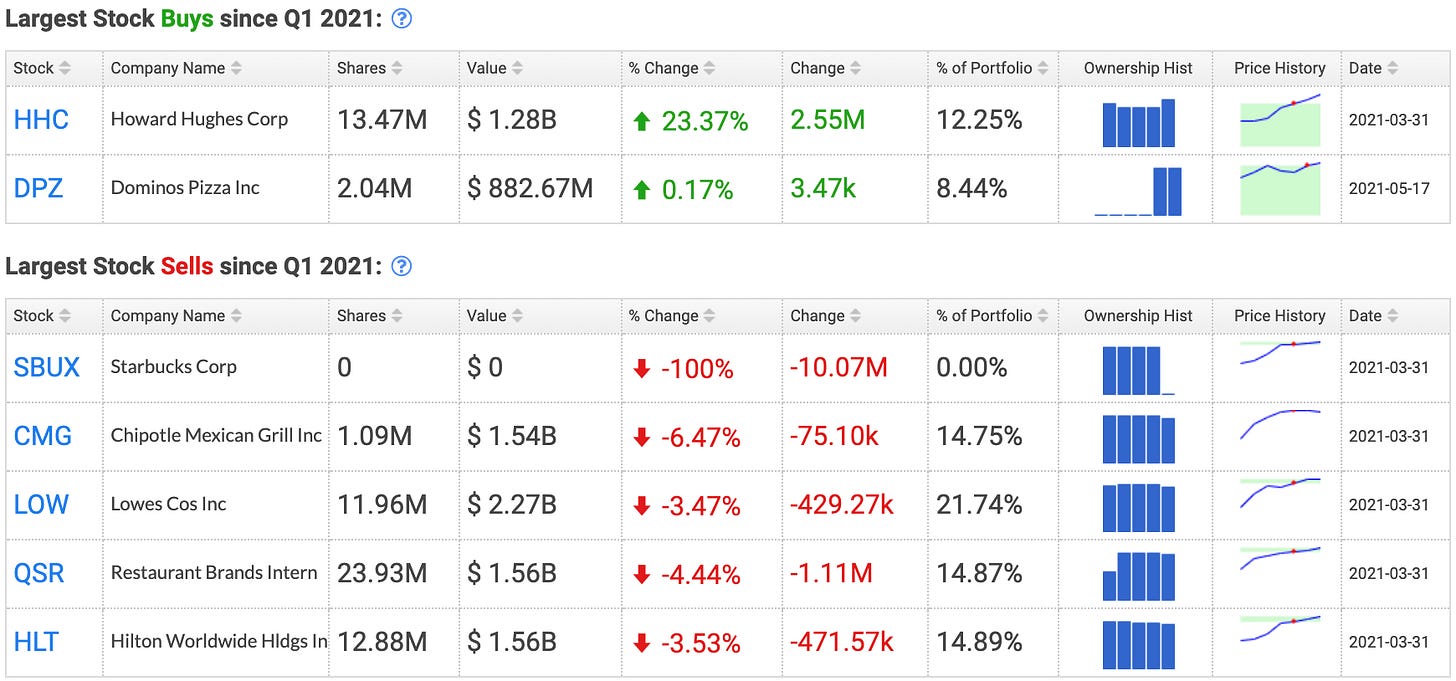

Ackman was a net buyer in Q1 of 2021, increasing his holdings value by $457M.

Ackman first bought shares in LOW, his largest position with a portfolio weight of 21.74%, during Q2 of 2018 at an estimated price of $95. Worth $2.27B today, Ackman holds 1.667% of shares outstanding. LOW has appreciated 98.73% to $188.79 in 3 years since Ackman purchased his first batch of shares.

Ackman is also an activist investor in HLT and QSR, holding 4.639% and 7.794% of shares outstanding, respectively.

HLT was first added to Ackman’s portfolio in Q4 of 2018 at an estimated price of $70.98. Today, HLT is sitting at $128.42, a 80.88% gain from the date of initial purchase.

CMG has been one of Ackman’s best performers over the past few years. First purchased in Q3 of 2016 at an estimated price of $386.20, CMG has ballooned higher by 261.27% to $1,395.25, as US consumers can’t get enough of the savory burrito bowls that Chipotle offers. Ackman owns 3.859% of shares outstanding, although he reduced his position by 75,096 shares in Q1. In fact, Ackman has been steadily reducing his CMG position since Q2 of 2018, which signals that he believes his capital can perform better elsewhere.

Ackman added no new positions in Q1, instead opting on increasing his current stakes in companies already invested in. SBUX was completely liquidated in Q1 after first being bought in Q4 of 2018 for an estimated price of $65.02; Ackman sold 100% of his position at an estimated price of $109.27, collecting a gain of 68.05%.

Ackman’s most significant buy in Q1 was HHC, a real estate development company. Ackman owns 24.43% of shares outstanding, so its safe to say Ackman is taking an activist stance and has major influence on the company’s long-term plans and goals. Ackman added 2.55M shares in Q1, making HHC his 6th largest position.

Hedge Vision - Institutional Insights

Please don’t hesitate to send me topic recommendations, suggestions, or general questions. You can contact me by email: HedgeVisions@gmail.com, or by Twitter messages @HedgeVision

Great read, and straight to the point! I'll definitely be checking out Lowes after this.