“I was minding my own business in 2003. I get a call from this Ackman guy. And I’m telling you, he’s like the crybaby of the schoolyard.”

-Carl Icahn, Founder of Icahn Enterprises

Carl Icahn and Bill Ackman have been trading blows since as early as 2003. To truly understand this real life “Battle of the Billionaires,” we have to take a step back into the past.

Hallwood Realty

In 2003, Icahn and Ackman agreed to a “shmuck insurance” deal over Hallwood Realty. Gotham Partners, Ackman’s hedge fund at the time, was going through a rough stretch and desperately needed capital. Ackman believed shares of Hallwood were worth more than the current price of $60 and offered to sell his stake to Icahn for $80, with a contract set in place.

The contract stated that if Icahn were to sell his shares in Hallwood Realty within 3 years, while at least making a profit of 10%, half the proceeds of the sale would go to Ackman. Ackman and his lawyers drafted the 10-page contract in case Hallwood Realty got bought out, or if Icahn wanted to sell the company to another party. Icahn agreed to the terms. The full terms of the contract can be found here.

13 months later, HRPT Property Trust acquired Hallwood for $136.16/share in cash. According to the terms of the contract, Icahn owed 50% of his gains to Ackman and his investors, which amounted to roughly $4.5 million. Icahn refused to pay Ackman, saying he never sold his shares since the company was bought out in cash. Ackman had no choice but to take the matter to court.

“I was not in a very good place in my business. You know what, this guy is road kill on the hedge fund highway. I’m never going to have to worry about this kid again, he’s not even going to have the resources to sue me, so I’m just not gonna pay him.”

-Ackman on why he believes Icahn reneged on their agreement

In September 2005, the court awarded Gotham Partners summary judgement and found the terms of the contract to be “clear and unambiguous.” Again, Icahn refused to pay and appealed the judgement. Gotham won on appeal, and Icahn was forced to post a bond for what he owed. Icahn appealed again. In 2011, the court finally denied Icahn’s appeals and awarded Gotham Partners and their investors the original $4.5 million owed, plus 9% yearly interest, which roughly amounted to $9 million plus legal fees.

“After Carl paid my investors, he called me up, congratulated me on winning, and said that he wanted to be my friend. I told him that I had no interest in being his friend.”

-Ackman

Herbalife

The battle of the billionaires wasn’t finished just yet. In 2013, Ackman and Icahn resumed their spat, although this time it centered around Herbalife, a multi-level marketing company that produces and sells dietary supplements.

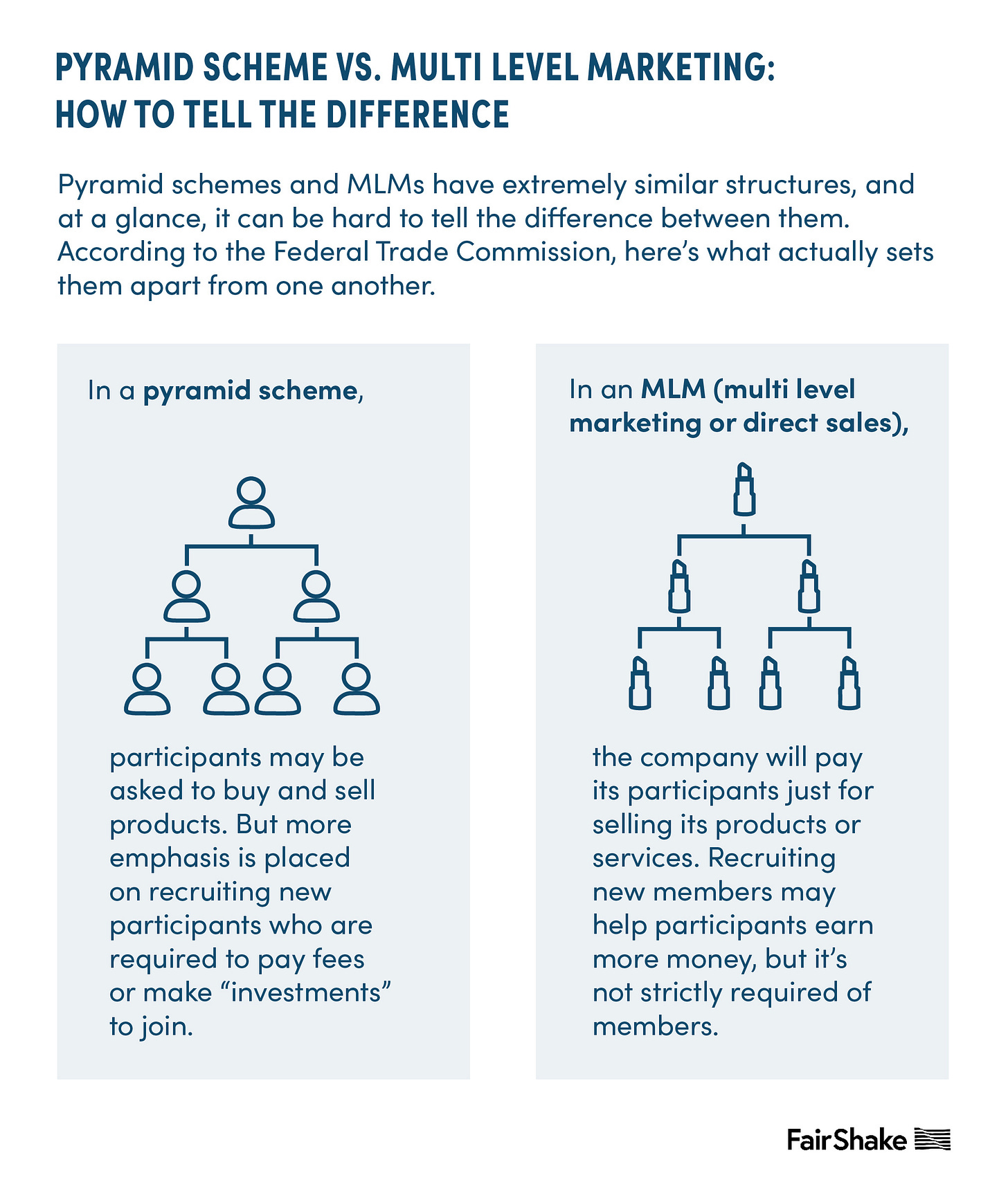

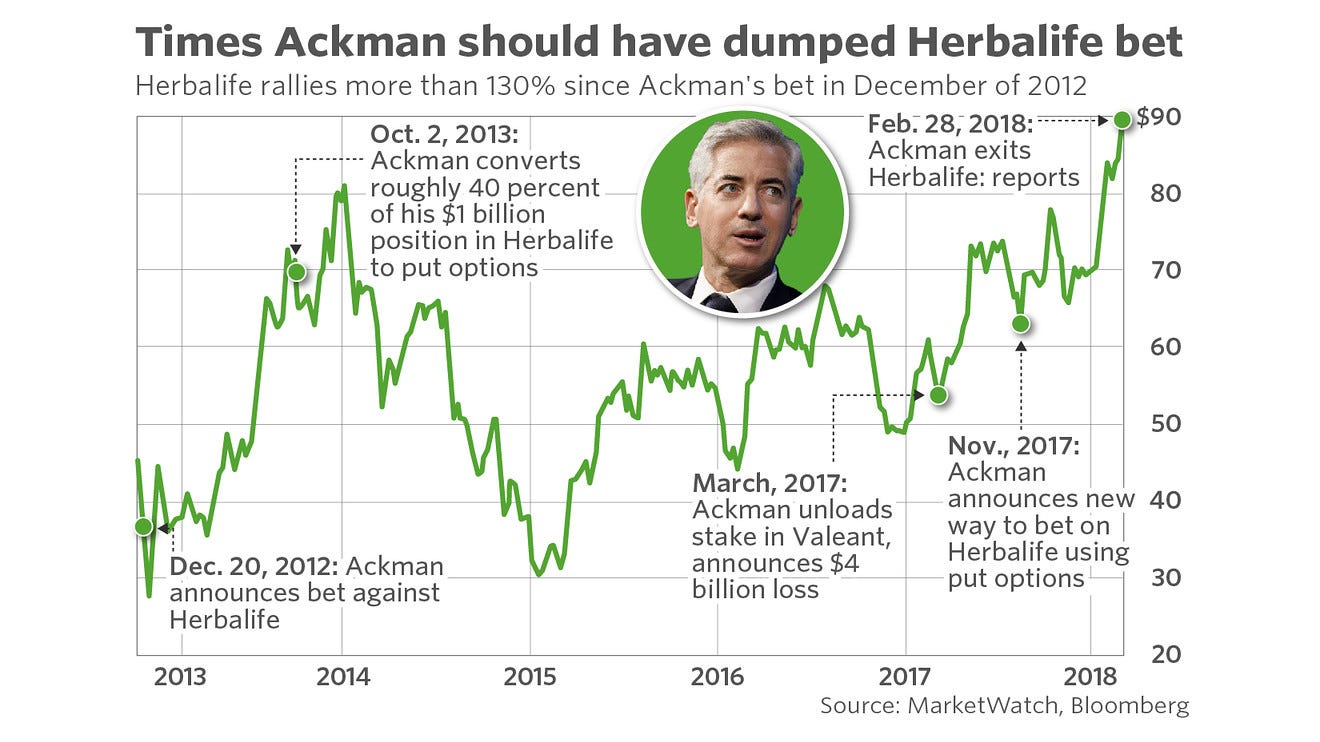

Ackman published a short report during December 2012 that announced his $1 billion short bet against Herbalife, calling their multi-level marketing strategy a “pyramid scheme.” He also gave a 3 hour presentation at the Sohn Investment Conference, highlighting that “the stock would go to zero.” Ackman claimed that distributors of Herbalife earned more money by bringing in additional distributors and earning a commission, rather than selling to interested customers.

Herbalife plunged 20% three days after Ackman’s public short announcement. However, a few months later, Herbalife’s stock price took a turn upwards after Icahn challenged Ackman’s short report and bought shares of the company as an activist investor. By May 2013, Icahn owned 16.5% of all shares outstanding. Whether Icahn actually liked the company, or if he was just adding fuel to him and Ackman’s feud is unknown, although the latter is certainly a reasonable possibility in supporting the former.

Looking back today, Icahn was the clear victor of the Herbalife feud. Ackman completely converted his short position to put options during November of 2017, then exited his entire Herbalife position during Q1 of 2018. His estimated loss was reportedly close to $1 billion. Ackman used the proceeds from his loss to buy stock in United Technologies.

Icahn sold all his shares of Herbalife during Q2 of this year. Earlier in January, Icahn reduced his stake of shares outstanding from 16% to 6%, a $600 million sale, stating that the company no longer needed his activist support.

“I enjoy a good fight, especially when I win it. On paper I made a billion [in Herbalife].”

-Icahn

“The Greatest Moment in Financial Television”

Icahn and Ackman’s live, on-air showdown on CNBC’s “Halftime Report” in January of 2013 left viewers with jaws wide-open and traders on the NYSE with whoops of delight. Icahn and Ackman were originally brought on the show to discuss their opposing Herbalife positions, but things quickly took a turn when Ackman called out Icahn over their 2003 Hallwood feud. Trust me, if you haven’t watched the entire 27 minute showdown, it is absolutely worth sitting down for. Keep in mind that Ackman is 30 years junior to Icahn. Tempers were flared and curse words were thrown around on live television. You can watch the full showdown here.

A few quotes from Icahn and Ackman during the verbal brawl:

“As far as I’m concerned, the guy [Ackman] is a major loser.”

“I wouldn’t invest with you [Ackman] if you were the last man on earth.”

“Ackman has done pump-and-dump, he’s got one of the worst reputations on Wall Street.”

“I had with dinner with him [Ackman], and I gotta tell you, I left, I couldn’t figure out if he was the most sanctimonious guy I’ve ever met in my life, or the most arrogant.”

-Icahn

“What I can you is, this is not an honest guy [Icahn], this is not a guy that keeps his word, and this is a guy that takes advantage of little people.”

“Now, I was concerned about dealing with Carl Icahn because, unfortunately, he does not have a good reputation for being a handshake guy.”

“Carl has been maligning my reputation, so it’s very important we get to the facts.”

-Ackman

Friends?

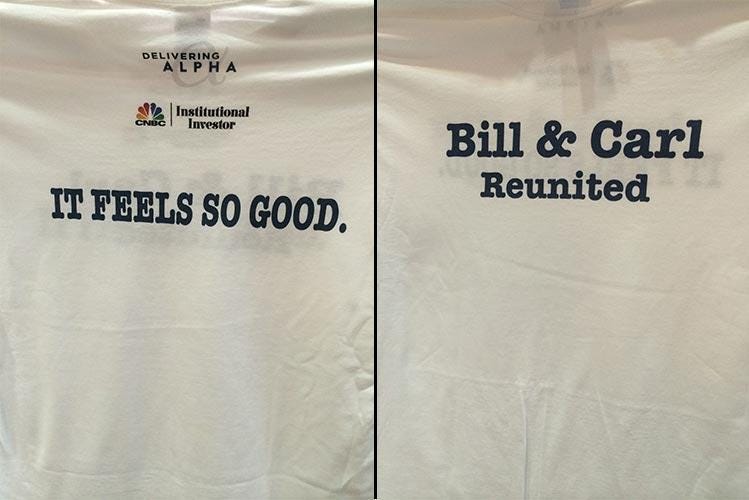

In 2014, Ackman appeared as the surprise guest at the Delivering Alpha conference after Icahn’s speech panel. It was reported that they had made up prior to the event after Ackman called Icahn to “forgive him.” The pair even received conciliatory t-shirts that said “Bill and Carl Reunited” after they hugged it out.

Ackman’s Portfolio

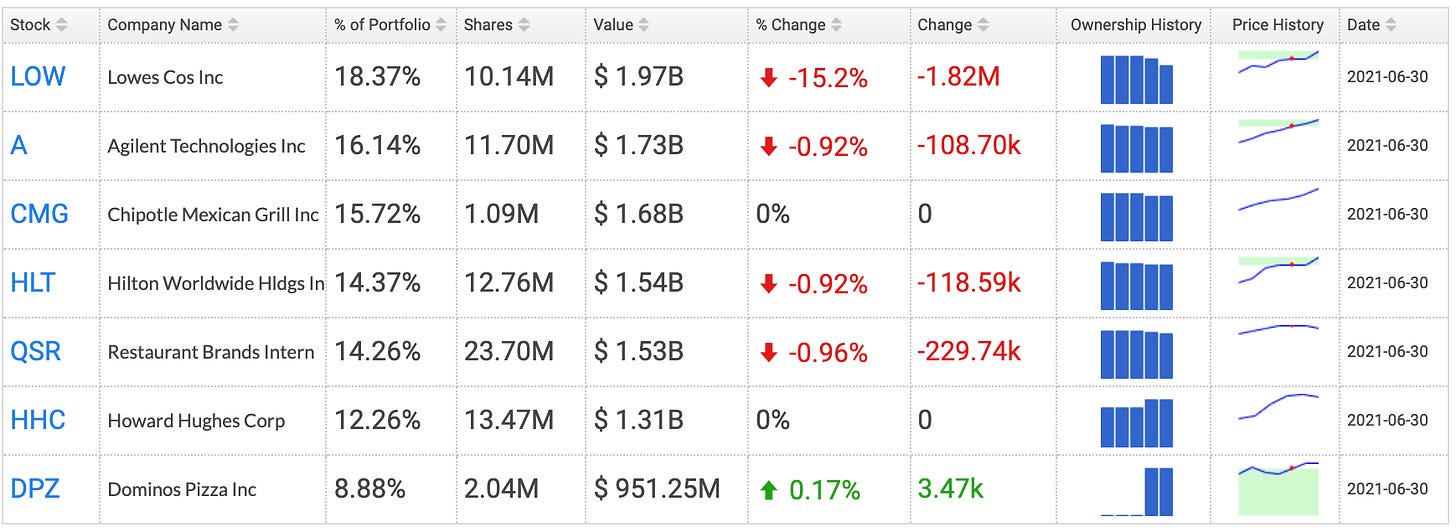

As an activist investor, Ackman runs an extremely concentrated portfolio with $10.71 billion AUM and only 7 total positions. Lowes is his largest position, although exposure to the company was reduced by 15% during Q2.

Performance

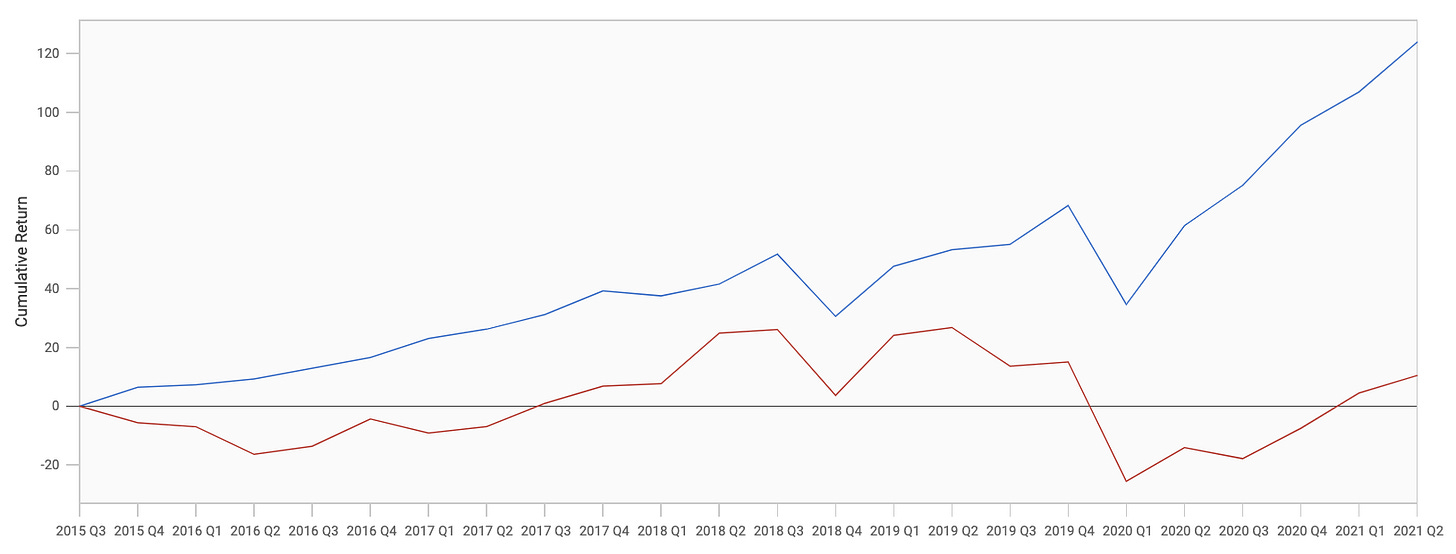

Red Line: Pershing Square Cumulative Return (88.3%)

Blue Line: S&P 500 Cumulative Return (124%)

You may be eyeing Ackman’s recent performance and wondering why many believe he is one of the best fund managers in the game. The majority of Ackman’s big wins came between 2004 (inception of Pershing Square) and 2014. Additionally, Pershing Square returned 70% in 2020 (not shown in the graphic below) and 44% in 2019.

On an annualized basis, Ackman has failed to outperform the S&P 500 on a 3, 5, and 10 year period (using data from 2004-2019). However, Ackman outperformed the S&P 500 on a 15 year cumulative and annualized basis, as the bulk of his returns came in the early years of the fund. Ackman is a long term investor, usually holding a position for 16.71 quarters, or roughly 4.2 years on average before selling out.

Icahn’s Portfolio

To avoid confusion: Icahn’s hedge fund: Icahn Enterprises, has the same name as his holding company.

Like Ackman, Icahn is an activist investor as well and runs an extremely concentrated portfolio with $24.29 billion AUM and 17 total positions. His top position at a 53.80% portfolio weight is Icahn’s own holding company, Icahn Enterprises. The company operates as a conglomerate that has various investments in energy, automative, food packaging, real estate, and more. Icahn Enterprises (the fund, not the company) stopped collecting capital from outside investors in 2011, although investors can invest in his publicly tradable holding company.

Performance

Red Line: Icahn Enterprises Cumulative Return (10.5%)

Blue Line: S&P 500 Cumulative Return (124%)

Since 2015, Icahn has massively underperformed the S&P 500. Much of it is due to the fact that Icahn Enterprises (IEP) has only returned 18% the past 5 years. However, the outperform in IEP stock is less severe when you factor its current 15.09% dividend yield.

It seems the scoreboard is 1-1 between Icahn and Ackman’s decades-long feud. I’ll be anxiously waiting on the sidelines to see who takes best out of three if Icahn and Ackman ever decide to trade blows again. The investment world and media will certainly be waiting as well.

Hedge Vision - Institutional Insights

Please don’t hesitate to send me topic recommendations, suggestions, or general questions. You can contact me by email: HedgeVisions@gmail.com, or by Twitter messages @HedgeVision

Source 1 - Herbalife Feud on CNBC