A Schedule 13D and 13G is what institutional investors file to the SEC in order to comply with SEC regulations regarding holdings transparency. An institutional investor is defined as a company or entity that invests money on behalf of its clients, such as a hedge fund, mutual fund, pension fund, bank, etc.

These investors must file either a 13D or 13G form when they own more than 5% of a class of securities. A 13D filing indicates active ownership, which means that the acquirer seeks to involve itself with the decisions of the company. On the other hand, a 13G form indicates a passive ownership, which means that the acquirer does not seek to involve itself with the decisions of the company.

Meanwhile, company insiders must file a Form 4 to the SEC when buying or selling shares of their own company. Company insiders are classified as a company’s officers, directors, and any shareholder that owns at least 10% of a company’s shares outstanding. As a result, an institutional investor can be considered an insider if they buy 10% of a company’s shares.

However, there’s more to these forms than just the surface-level explanations.

13D/G forms do not provide as many details as a Form 4. For example, a Form 4 states the average purchase price of the shares purchased, while a 13D/G form does not. Meanwhile, both forms are required to be filed in a certain time period after the date of the transaction.

However, all 3 of these forms are generally filed more commonly than the 13F form, which details an institutional investor’s holdings as of the end of each quarter. The 13F form is required by the SEC to be filed once per quarter. The deadline to file the form is 45 days after the end of each quarter.

Filing Rules for 13D and 13G Forms

Initial 13D: Within 10 calendar days after acquiring 5% of a company’s shares outstanding. No differences between qualified institutional investors* and regular institutional investors.

13D Amendment: Within 10 calendar days after making a 1% or greater position change.

13D forms are relatively simple, although the 13G forms get a bit more difficult.

Initial 13G for Qualified Institutional Investors (QII): Within 45 calendar days after year-end in which an institutional investor’s ownership exceeds 5%.

Initial 13G for Regular Institutional Investors: Within 10 calendar days after acquiring 5% of all shares outstanding.

13G Amendment for Qualified Institutional Investors: If before year-end, the qualified institutional investor’s ownership exceeds 10%, the investor must file an amended 13G within 10 days after the end of the month in which ownership exceeds 10%.

If position exceeds 10% and the QII makes a purchase or sale of 5% or more, it must notify the SEC within 10 days after the end of the month in which the transaction occurred.

13G Amendment for Regular Institutional Investors: Any change after acquiring 5% of shares outstanding must be reported within 45 calendar days after the year-end in which the transaction occurred.

If position exceeds 10% and the investor makes a purchase or sale of 5% or more, it must notify the SEC within 10 days after the end of the month in which the transaction occurred.

If exceeding 10% ownership, the investor must report within 10 calendar days.

*Qualified institutional investor definition. Examples: Goldman Sachs, JP Morgan.

Once 10% ownership is surpassed by any institutional investor, all further transactions of any change must be reported via a Form 4 since 10%+ ownership implies insider ownership. A Form 4 must be submitted within 2 days following the transaction date.

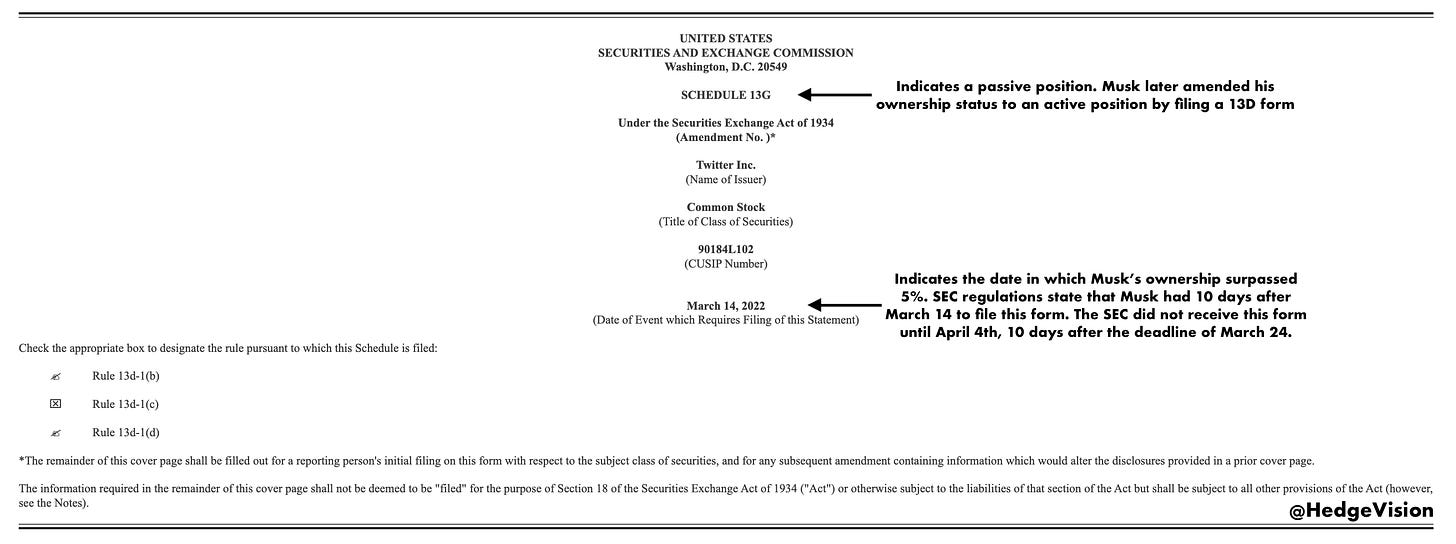

Example: 13D Form from Elon Musk

Musk made two mistakes when filing his initial 13G form. First, he was 10 days late. SEC regulations state that an institutional investor must file a 13D/G form within 10 days of exceeding 5% ownership. Musk is classified as a regular institutional investor. Therefore, the deadline to file the 13G form was March 24; Musk filed the form on April 4th.

Musk allegedly made $156 million due to his late disclosure. If Musk had made his disclosure on time, chances are he would have to buy further shares at higher prices due to his effect on the stock price.

Second, the amount of shares directly owned by Musk was overstated. He filed an amended 13D form the next day on April 5th to correct this. With the 13D filing, the Tesla CEO also converted his position status from passive to active.

Initial 13G Filing on April 4th: 73.48 million shares.

Amended 13D Filing on April 5th: 73.11 million shares.

Example: 13G Form from Vanguard (QII)

Once a QII crosses the 10% threshold, they must file a 13D/G form to the SEC. However, the deadline to submit the form differs under certain circumstances as well. Additionally, the position size change thresholds to trigger a 13D and 13G amendment differ. Besides that, the two forms are, for the most part, similar. Let’s get into the details.

Pictured below is the cover page of an amended 13G form depicting Vanguard’s acquisition of Twitter during March of 2022. Vanguard is a passive investor and holds Twitter across its ETFs. Vanguard is classified as a qualified institutional investor (QII), so the circumstances for it to file a 13D or 13G form are different from regular institutional investors. QII’s include pension funds, banks, investment advisors, insurance companies, etc.

The “Date of Event Which Requires Filing of this Statement” of March 31st, 2022 may be the most misleading statement on the cover page. This date does not indicate the actual date of transaction. Rather, it discloses the date that triggered the filing.

Recall:

13G Amendment for Qualified Institutional Investors: If before year-end, the qualified institutional investor’s ownership exceeds 10%, the investor must file an amended 13G within 10 days after the end of the month in which ownership exceeds 10%.

The exact date(s) that Vanguard purchased TWTR stock to cause it to own a 10% stake is unknown. However, it was some time during March.

The SEC received Vanguard’s amended 13G form on April 8th and subsequently disclosed it to the public.

Take a look at Vanguard’s transactions for the past 3 months. All the filings fall within the first 10 days of the month.

Let’s go to the next page, which provides all of the details of the transaction:

Vanguard’s holdings of TWTR stock are over 10%, which triggered this filing. See #11.

This page is pretty clean-cut and details Vanguard’s voting power, number of shares owned, and any joint ownership. #9 and #11 are what I usually look for. Since this is a passive 13G filing, it means that Vanguard does not seek to influence Twitter’s business decisions. For its ETF holdings, Vanguard sometimes has voting power and generally sides with the company’s management during voting events.

13F Deadline For Q1

The deadline for institutional investors to file a 13F filing for Q1 is May 16th. Get ready!

Hedge Vision - Institutional Insights

📖 Join the conversation on Substack Chat

🕊️ Get real-time insights on X/Twitter: @HedgeVision

📧 Old school is cool too: HedgeVisions@gmail.com