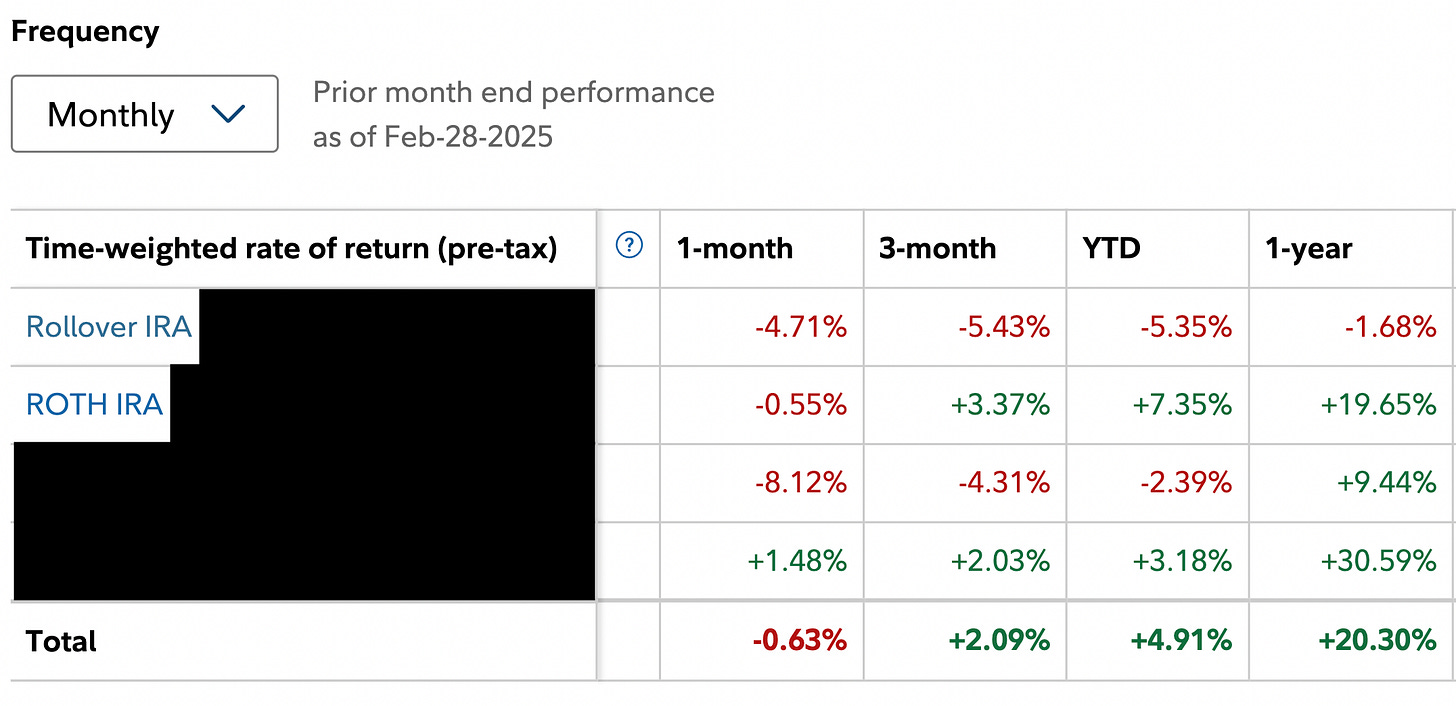

In February, the Hedge Vision portfolio fell by 0.63% compared to the S&P 500’s loss of 0.55% and the Nasdaq 100’s loss of 1.86%.

The portfolio has now returned 4.91% YTD while the S&P 500 and Nasdaq 100 have returned 1.67% and -0.33%, respectively.

February was a turbulent month with many momentum stocks facing severe pressure. This is a necessary reset that will help set the market up for its next leg higher as speculative investors get flushed out.

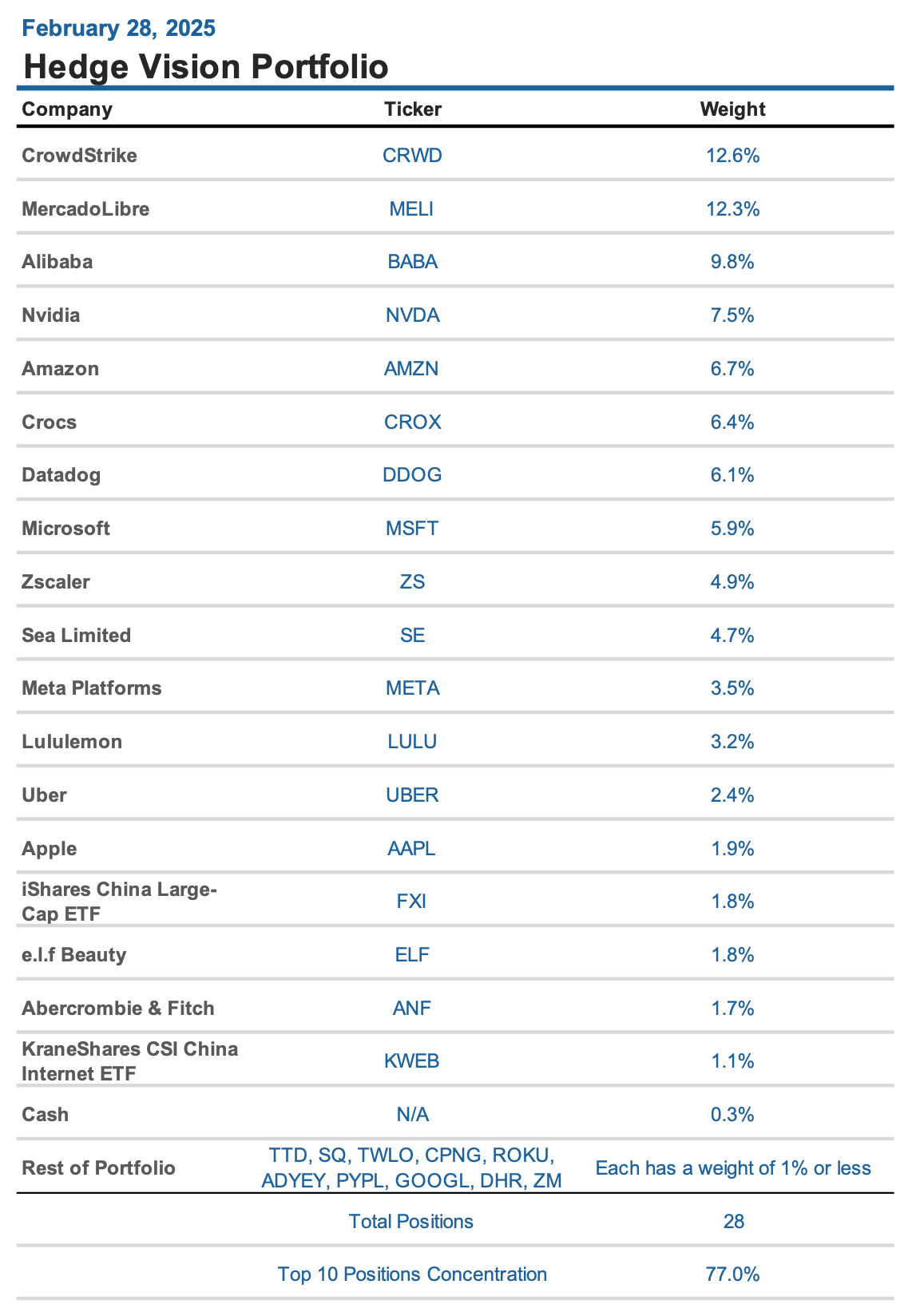

Meanwhile, Chinese stocks continued to surge higher. My monthly gains were led by Alibaba’s (BABA) 34% rise, bringing its YTD return to 56%. BABA now accounts for 9.8% of my portfolio with a $90.82 cost basis and a 46% gain.

Alibaba reported its earnings during February, providing a double beat and an acceleration in e-commerce, cloud, and international revenue. AI-related product revenue posted triple-digit growth for the sixth consecutive quarter.

Alibaba’s deal with Apple to supply its iPhones with AI features, alongside Baidu (BIDU), will only help keep that growth rate turbocharged. BABA trades at an affordable 13.2x forward P/E.

"They talked to a number of companies in China. In the end, they chose to do business with us. They want to use our AI to power their phones. We feel extremely honored to do business with a great company like Apple.”

-CEO Joe Tsai, February 2025

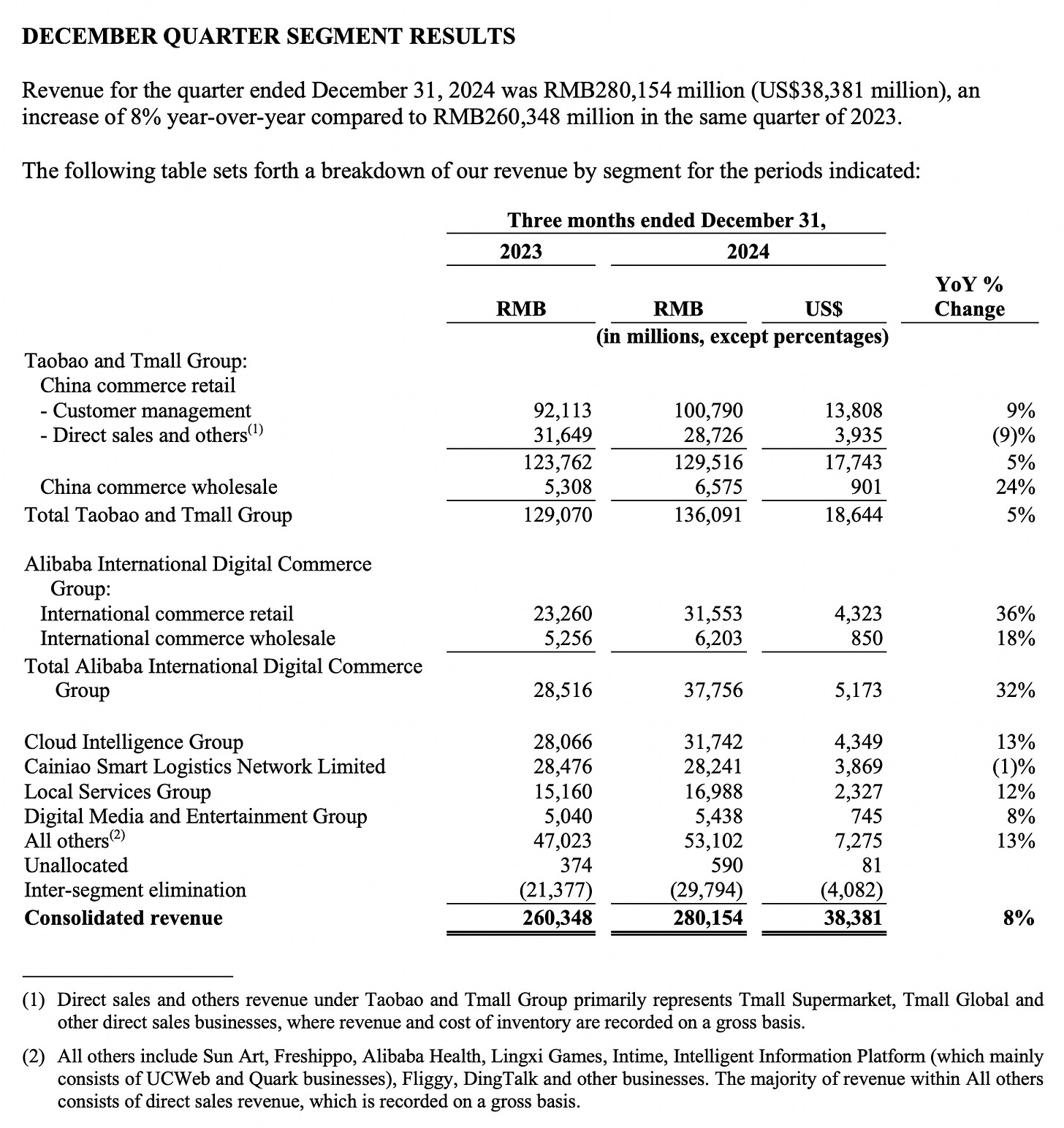

Revenue: ¥280.15B vs est. ¥277.37B, +8% YoY compared to 5% last quarter

Taobao & TMall Revenue: ¥136.09B, +5% YoY compared to +1% last quarter

Cloud revenue: ¥28.06B, +13% YoY compared to 7% last quarter

International revenue: ¥37.75B, +32% YoY compared to +29% last quarter

Adj. EPS: ¥21.39 vs est. ¥19.12, +12.76% YoY

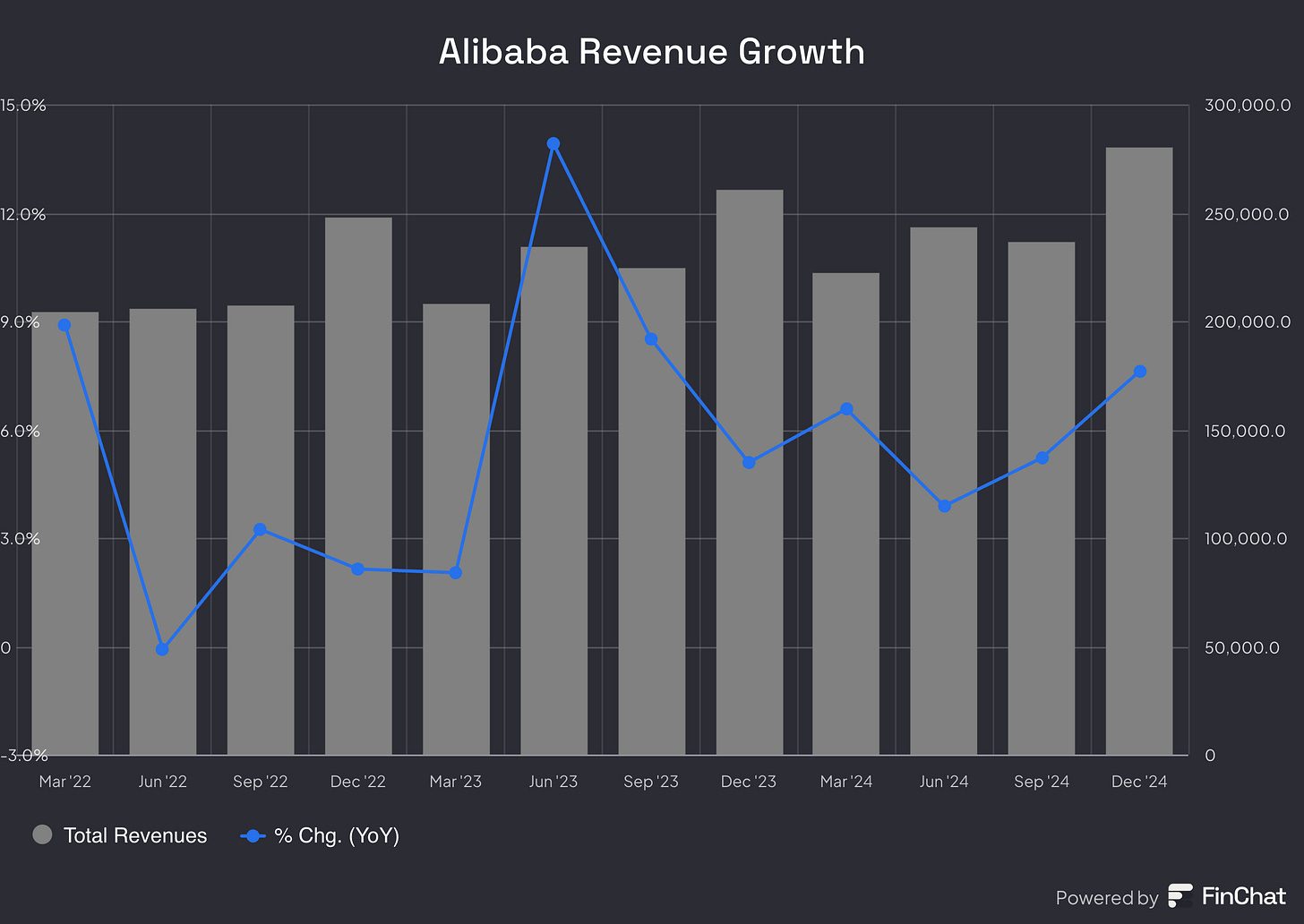

Alibaba has now accelerated its revenue growth rate for two consecutive quarters following a bottom in Q2 2024. More growth and higher multiples are likely on the way for the cloud and e-commerce leader as China works to pick itself back up. The country has experienced a massive surge in value and interest since the successful release of DeepSeek’s AI model.

I’ve partnered with FinChat, an AI prompt-based research platform that provides charts, data, and answers. I started using FinChat a few months ago, and since then, it’s quickly grown to be one of my favorite research tools.

For example, the chart above was made with this simple prompt: Make a chart of Alibaba's quarterly revenue growth.

Click the button below to receive a 15% discount on your first year when signing up:

*As an affiliate partner, I earn a commission on qualifying purchases.

For more on my China investment thesis:

February 2025 Buys

New Positions: The Trade Desk (TTD)

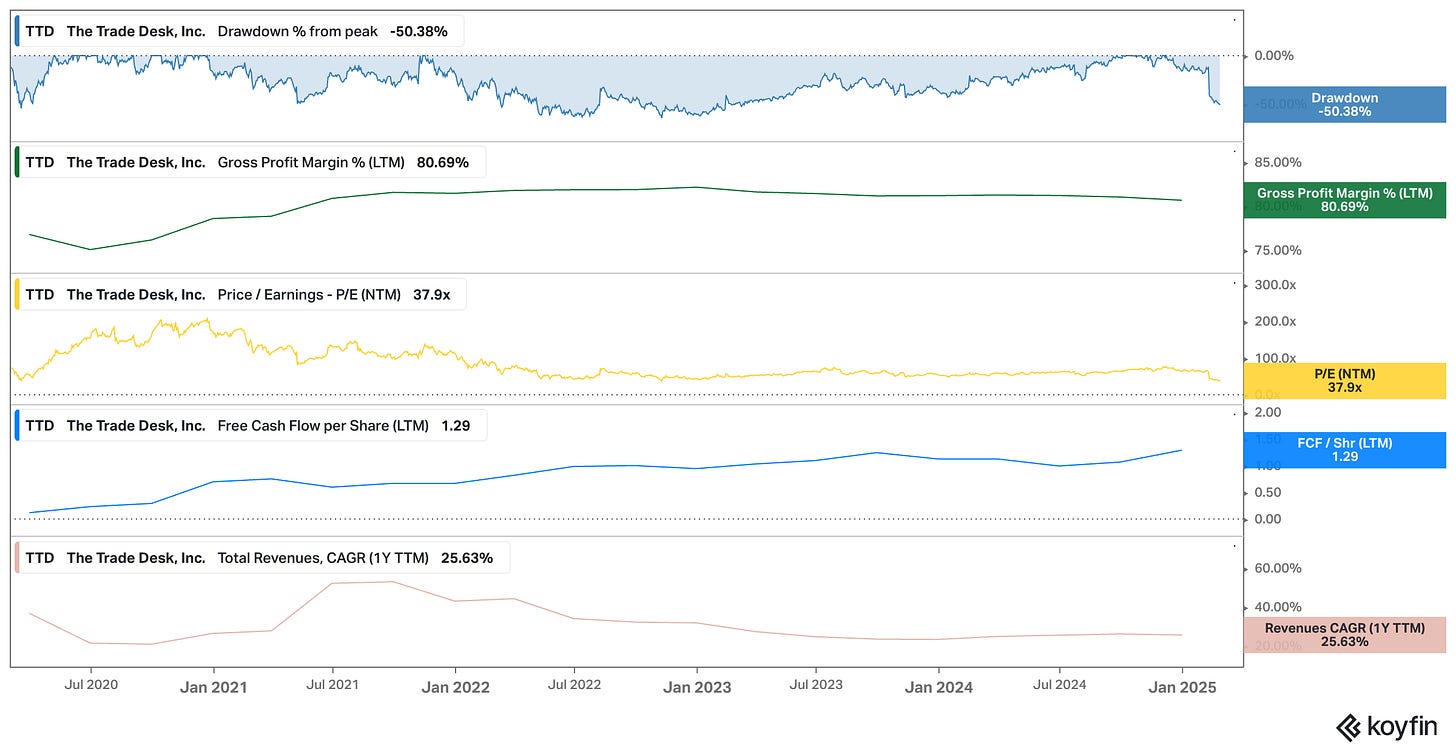

The Trade Desk fell by 40% in February following the ad platform’s first sales guidance miss in 33 quarters. The drop is a golden opportunity to begin building out a position in a fast-growing company that has managed to compete with the likes of Google, Amazon, and Facebook over the years.

My TTD cost basis is at $71.42 with a 0.9% portfolio weight, and I’d like to buy more if the price falls to the low/mid $60 range. The company has an industry-leading gross profit margin of 80.69% while sustaining a gross retention rate above 95% for 11 consecutive quarters. It’s expected to grow sales by 18.41% this year and 20.19% in 2026.

Growth like this doesn’t come cheap with TTD’s forward P/E at 37.9x, which is still the lowest since November 2022.

Increased Positions: None

February 2025 Sales

Exited Positions: None

Reduced Positions: e.l.f. Beauty (ELF)

My buys and sales in real-time, as well as further analysis and commentary, are shared with contributing members on Substack Chat:

Outlook for March

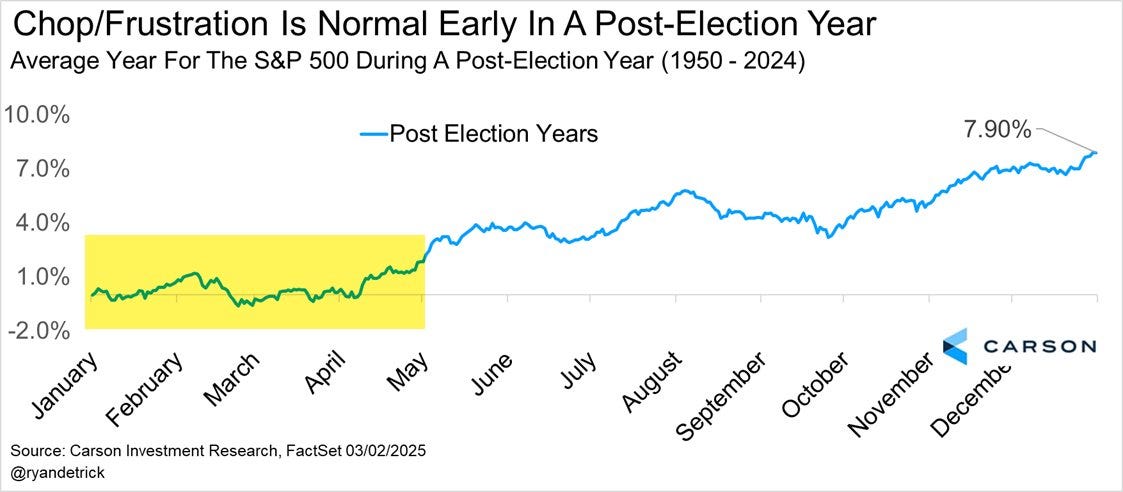

The start of 2025 has proven to be volatile following the inauguration of President Trump. This is normal.

In post-election years, the market has historically traded in a range until the beginning of May before breaking out.

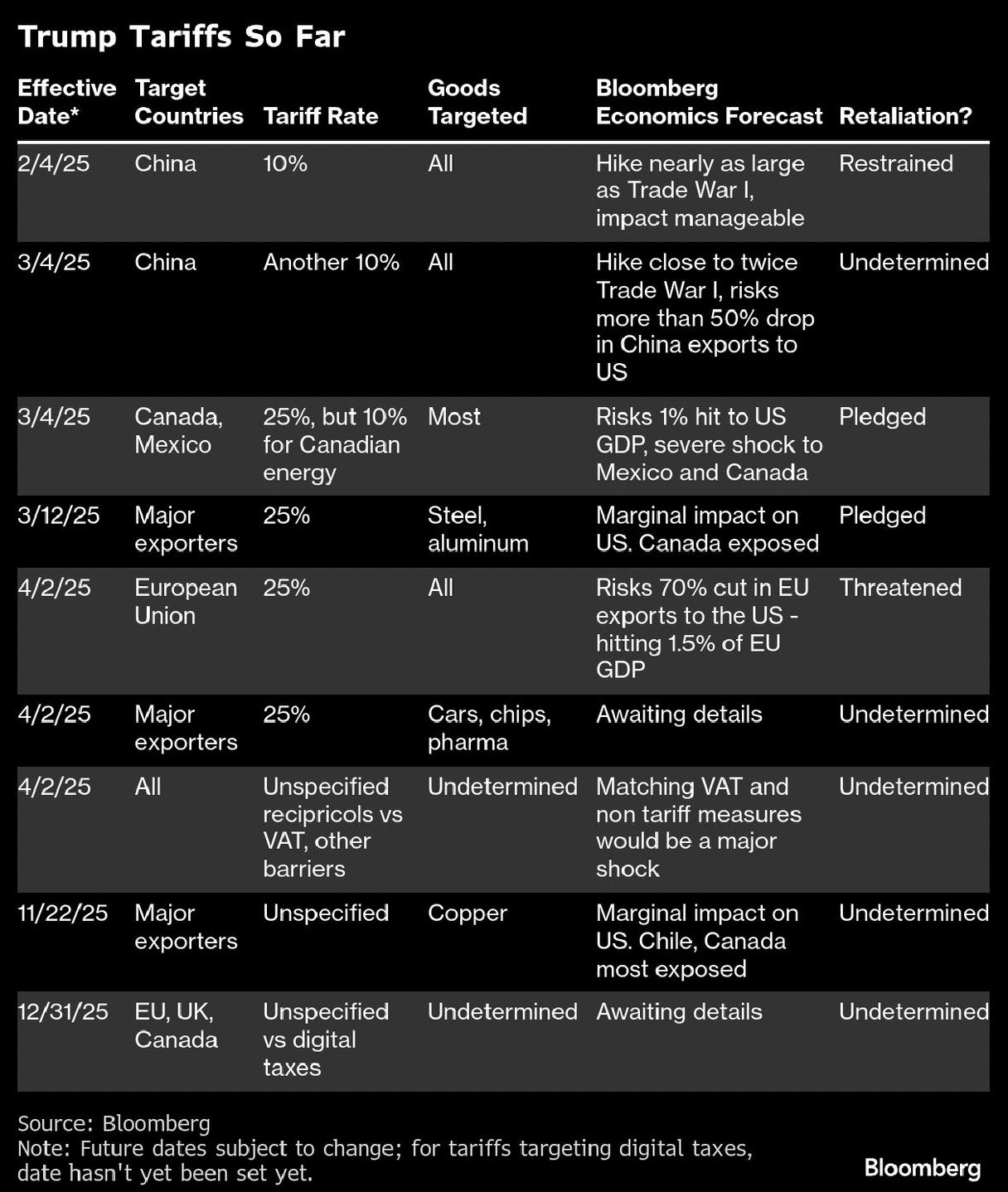

What isn’t normal, however, is significant tariffs on our largest trading partners. These tariffs will have little effect on my Chinese positions (BABA, FXI, KWEB) because the U.S. accounts for an insignificant portion of their revenue.

The tariffs’ effects on domestic consumer spending and GDP pose a clear negative, while retaliatory tariffs will also hurt the consumer. The market has been reeling from these uncertainties as the beginning of a potential trade war begins to unravel.

Given Trump’s history, the tariffs appear to be bargaining chips and could be temporary or scaled back. He’s accused all three countries of allowing drugs to flow into the U.S. and has called for more U.S. border protection measures in Canada and Mexico. He’s also emphasized reducing the U.S. trade deficit.

Trump is highly focused on the stock market, whether he likes to admit it or not. Any real market crash will quickly result in the support of his administration, which includes pressuring the Fed to ease conditions.

The next FOMC meeting is coming up on March 19. A rate cut then is very unlikely and is currently priced at an 8% chance.

For March, my main focus is to build out my TTD position to 3-4%. I also have Datadog (DDOG) and Uber (UBER) at the top of my watchlist. As a long-term investor, my focus is on buying companies at opportunistic valuations, not predicting how world leaders will enact economic policies.

Hedge Vision

Thanks for reading!

📖 Join the conversation on Substack Chat

🕊️ Get real-time insights on X/Twitter: @HedgeVision

📧 Old school is cool too: HedgeVisions@gmail.com