Philippe Laffont, a Tiger Cub and computer science graduate of MIT, manages Coatue Management with a current AUM of $18.24B. Laffont has returned 294% since Q3 of 2015 versus the S&P 500’s return of 107%.

Red Line: Coatue Management Cumulative Returns

Blue Line: S&P 500 Cumulative Returns

Coatue’s AUM is greater than 99% of other hedge fund managers, which makes his phenomenal returns even more impressive. Coatue is founder-led, and Laffont has increased his holdings value by $18.17B, or 26,556.40%, since 2003.

Historically, founder-led companies on average have performed better than non founder-led companies; I believe a parallel can be drawn for hedge funds as well. This article from the Harvard Business Review explains this in greater detail.

Coatue’s top 3 positions by value are DASH, SNOW, and DIS. It is important to note that its top 5 positions are all somewhat similar by percentage portfolio allocation, as they are all within +/-0.7% of 6%.

Shares of SNOW are still down 10% YTD as Coatue increased its current position by 28% at an estimated average price of $255.34, likely taking advantage of the price drop. SNOW share prices peaked at $429 in Dec. of 2020 and are now sitting at $251.45.

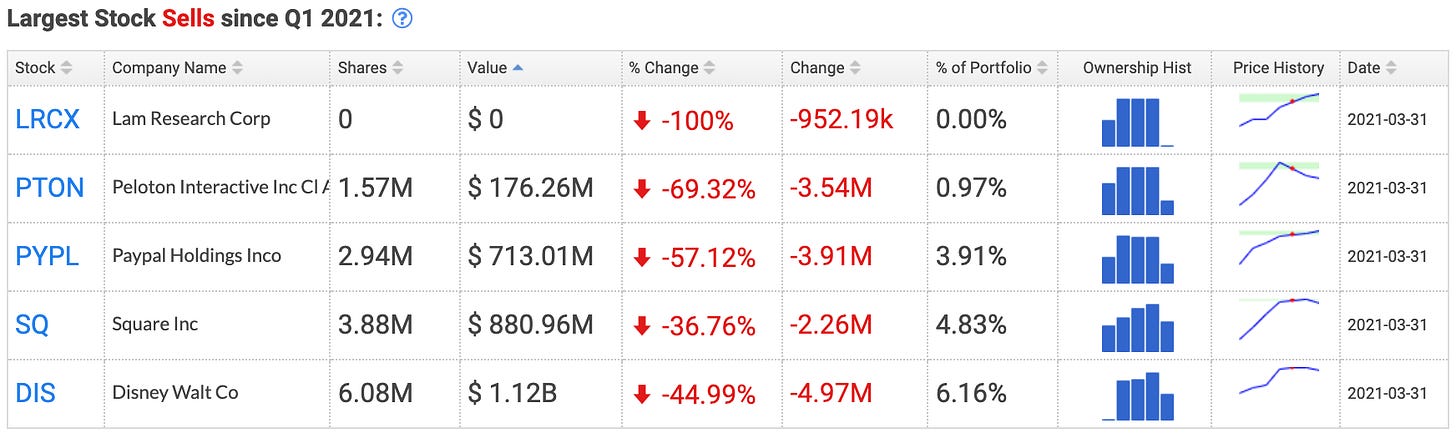

Coatue was a heavy seller in Q1, cutting its total dollar amount invested by $8.49B, or 31.8%, compared to Q4 of 2020.

Coatue’s largest sells came from trimming positions in PYPL, DIS, SQ, and PTON. Coatue completely cut its stake in LRCX as well.

Coatue’s DIS position was almost cut in half in Q1 of 2021 after first being acquired in Q3 of 2019.

It seems the companies that Coatue trimmed were heavy beneficiaries from the coronavirus pandemic:

PTON (Up 117.47% past year): At-home gym equipment that includes stationary bikes and treadmills.

SQ (Up 135% past year) and PYPL (Up 68.22% past year): Online/mobile payment systems. Online payment transactions flourished during the pandemic as consumers ordered more items online and less in person at retail locations.

DIS (Up 45.36% past year): With the addition of Disney+, a new competitor to Netflix was born. What’s better to do when staying at home than putting on your favorite movie or TV show? However, with quarantine easing off, people will be spending less time at home and more time hanging out with friends, shopping, going out to eat, etc.

Coatue added 16 new positions and increased 17 current positions in Q1. Its largest buy was SNOW, and Coatue added 1.17 million shares to its existing position.

Coatue increased its AMZN position by 56.32K shares in Q1, possibly theorizing that while the coronavirus pandemic benefited e-commerce sales, it is still extremely likely that AMZN will continue to outperform after the pandemic, as they are a reputable, household name with an extremely efficient logistics network.

Coatue also increased its LI and XPEV positions by 766% and 57%, respectively, giving them a bullish stance on the Chinese EV market.

Additionally, Coatue started a new position in FTCH, the luxury e-commerce company based in London, scooping up 2.79M shares worth $148.18M.

Hedge Vision - Institutional Insights

Please don’t hesitate to send me topic recommendations, suggestions, or general questions. You can contact me by email: HedgeVisions@gmail.com, or by Twitter messages @HedgeVision