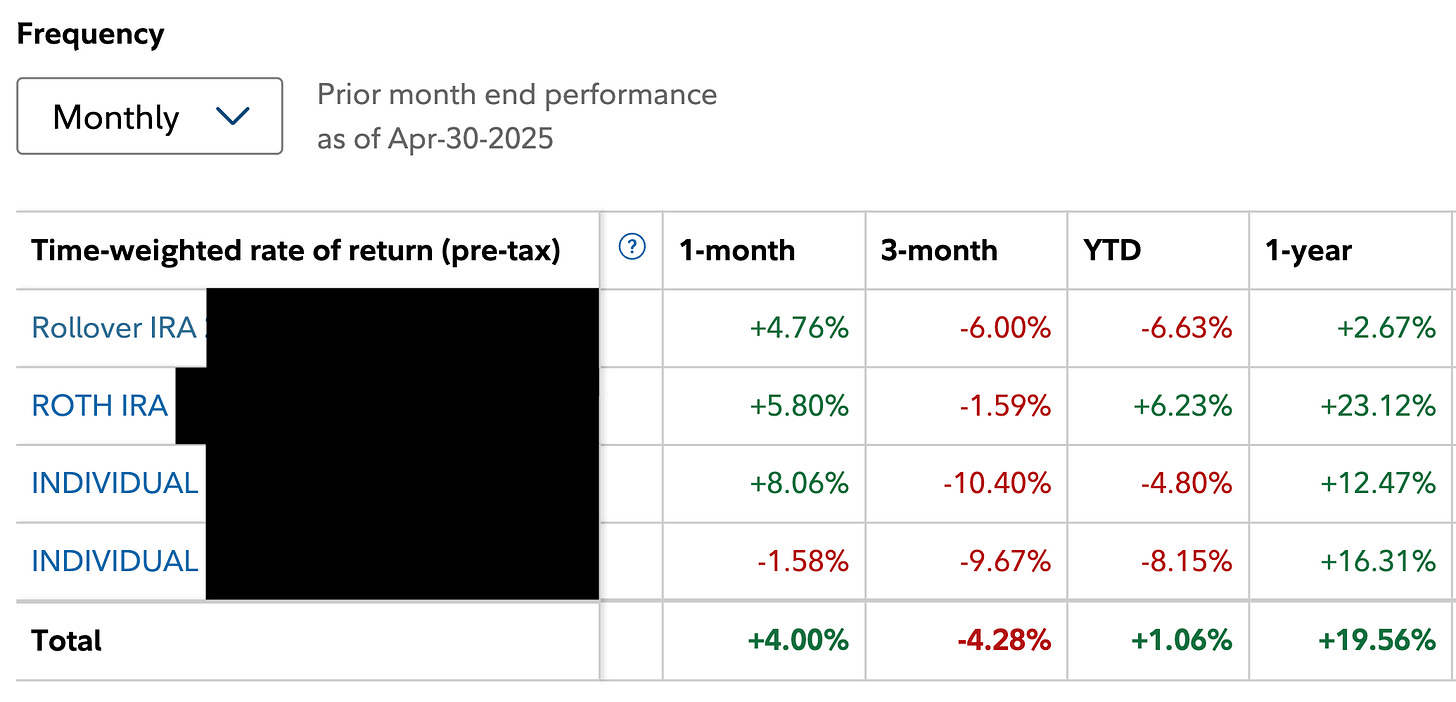

In April, the Hedge Vision portfolio increased by 4.00%. In comparison, the S&P 500 declined by 0.43% while the Nasdaq 100 increased by 1.97%

The portfolio has now returned 1.06% YTD while the S&P 500 and Nasdaq 100 have lost 4.71% and 6.48%, respectively.

April was another volatile month for the markets as the global economy continues to digest the effects of the tariffs. However, the realized effects of these policies are just starting to show.

Gene Soroka, the Port of Los Angeles’ Executive Director, noted that shipping volumes to the port are expected to drop by a significant 35% next week as many companies that import from China halt shipments. Soroka also expects a 25% ship cancellation rate compared to the usual amount in May. China shipments account for 45% of the port’s business.

Consumers will likely begin feeling the impact of tariffs in May. The uncertainty from these policies will be felt by the market. Volatility will only continue to rise if the Trump administration continues to flip-flop on its actions.

So, who will be the first country to sign a trade deal? For now, it seems that India, South Korea, and Japan are the front runners, according to Trump and Treasury Secretary Scott Bessent.

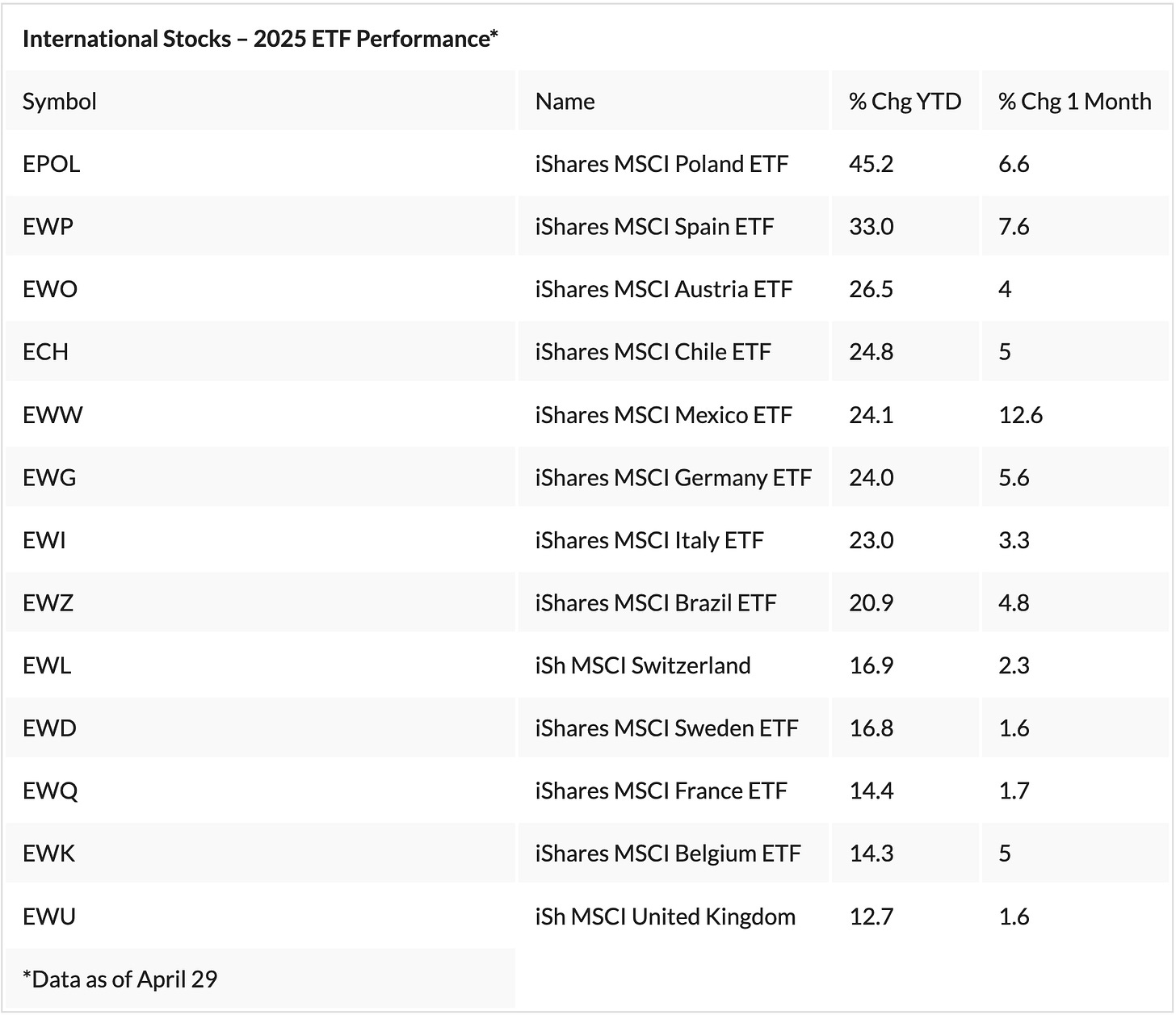

Meanwhile, international stocks continue to outperform the U.S in a rare showing. In fact, U.S. stocks have outperformed international stocks for over 16 years, according to Creative Planning’s Charlie Bilello. This year is shaping up to be very different.

International stocks currently make up about 30% of my portfolio and are largely responsible for my outperformance. MercadoLibre (MELI), my second-largest position at 12.7%, has returned 32% YTD. Alibaba, my third-largest position at 9.0% and my biggest purchase of 2024, is up by 41% YTD. Sea Limited (SE) at 4.7% of my portfolio has returned 28%.

Is the U.S. the best place to invest right now? Probably not. Is the U.S. the best place to invest for the long-term? Absolutely, without a single shred of doubt.

At the beginning of April, I made a large cash deposit to my account equivalent to 6.67% of my portfolio as of month-end. My cash position would have been 2.53% excluding the deposit.

April 2025 Buys

New Positions: None

Increased Positions: Alibaba (BABA), KraneShares CSI China Internet ETF (KWEB)

April 2025 Sales

Exited Positions: Lululemon (LULU)

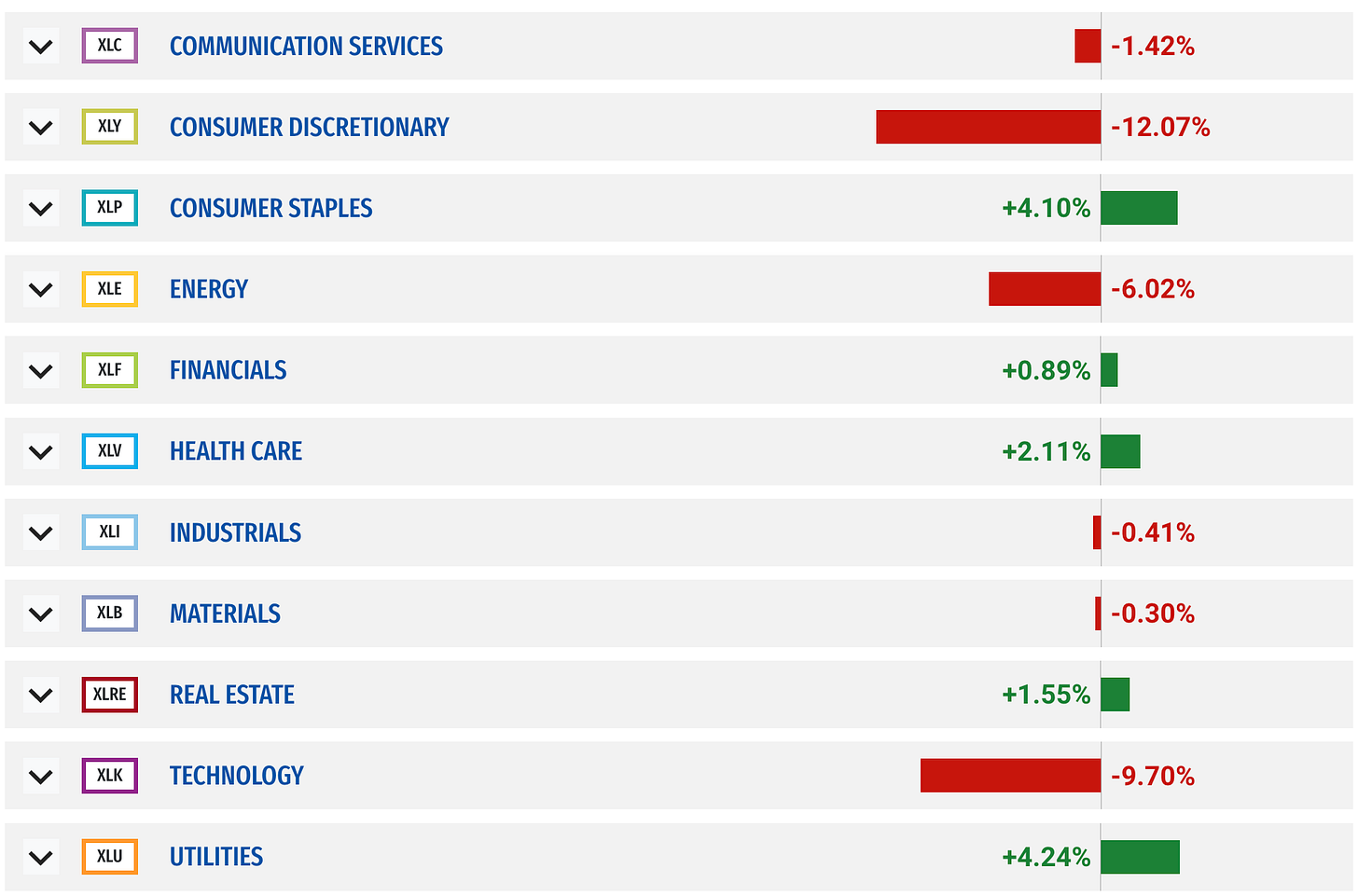

Consumer discretionary has been the hardest hit sector within the S&P 500 this year. With falling sentiment and supply chain disruptions, I have drastically reduced my exposure to the sector since the beginning of the year, also exiting e.l.f Beauty (ELF) and cutting down my Abercrombie & Fitch (ANF) position. Lululemon was next on the chopping block given a disappointing earnings report. I sold my LULU position for a negligible loss at $276.10 compared to my cost basis of $276.49.

Reduced Positions: None

My buys and sales in real time, as well as further analysis and commentary, are shared with contributing members on Substack Chat:

Outlook for May

I will admit, I am much more bearish compared to my stance a few months ago. At the same time, I have cash ready to deploy and have continued to add to my high conviction positions.

According to the chart above, which defines a bear market as the S&P 500 below the 200-day moving average, which it is, the next few months won’t be pretty. I believe a retest of the low, which is at $4,835, is very much possible. While earnings from the Magnificent 7 companies have been better than expected, the effects from the tariffs won’t be realized until late Q2 and Q3.

Hedge Vision

Thanks for reading!

📖 Join the conversation on Substack Chat

🕊️ Get real-time insights on X/Twitter: @HedgeVision

📧 Old school is cool too: HedgeVisions@gmail.com