“I would rather be lucky than be smart. But you have to be smart enough to put yourself in a position to be lucky.”

– David Tepper, CEO & Founder of Appaloosa Management

David Tepper, billionaire, philanthropist, and owner of the Carolina Panthers, has had a storied career to say the least. After receiving a bachelor’s degree in economics from the University of Pittsburgh and an MBA from Carnegie Mellon University, Tepper worked several finance stints before finding himself at Goldman Sachs. Within six months, Tepper was promoted to head junk bond trader.

Tepper played a key role in keeping Goldman Sachs afloat after the 1987 market crash. Tepper purchased junk bonds in financial institutions that were hit hardest by the crash that subsequently skyrocketed as the market recovered.

In 1992, Tepper decided to head off on his own after being passed on twice for the opportunity to become a Goldman Sachs partner. Tepper began aggressively trading his own money from the desk of Michael Price, a mutual-fund manager and Goldman Sachs client. Tepper was able to turn $3 million into $7 million in less than a year. Boosted with confidence, Tepper managed to collect $50 million from outside investors and founded Appaloosa Management in 1993 with $57 million in initial AUM (assets under management). By 1996, Appaloosa had $800 million in AUM.

“Everyone was doing Greek gods back then. ‘Pegasus’ was taken, they wanted $300 to sell it to me, I said no way.” Looking for other equine names, he settled on Appaloosa. The “A” name was strategically brilliant: “Information used to be sent out from the brokerage firms by faxes, so if you were at the beginning of the alphabet, you got it 15 minutes faster.”

-David Tepper via The Reformed Broker

In 2019, Tepper announced that Appaloosa would be returning investor’s money and convert into a family office. This explains why their holdings value has decreased significantly over the past few years. Tepper cited that he wanted to spend more time managing the Carolina Panthers, which he purchased for $2.2 billion in 2018.

Tepper’s Strategy

Have Confidence in your Greatest Conviction Ideas

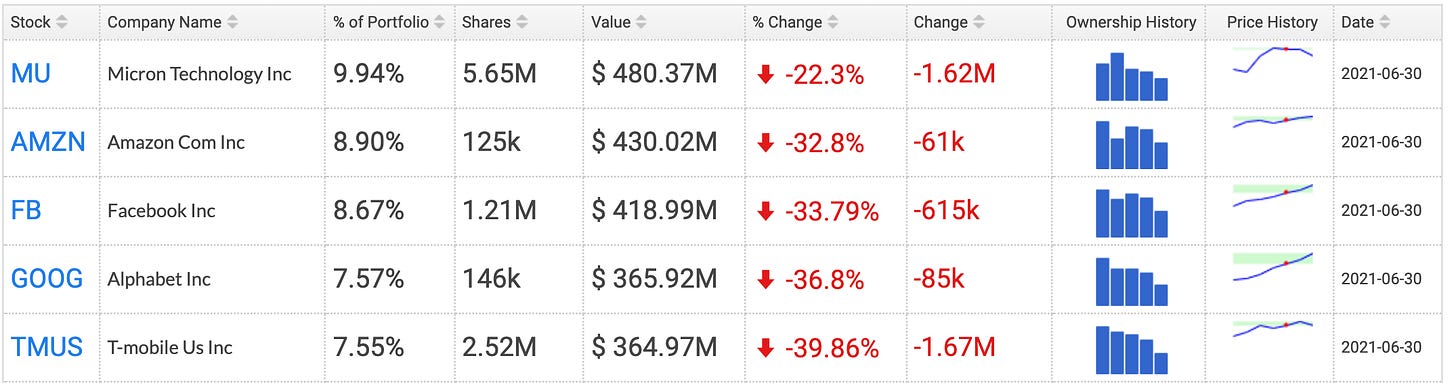

Tepper echoes Buffett’s approach to invest heavily in your greatest conviction ideas. Appaloosa’s current top 5 positions all have a weighting greater than 7.5%.

From Q2 of 2016 to Q2 of 2021, Appaloosa owned an average of 41.5 positions in their portfolio per quarter.

Buy When Others are Fearful

“We have this saying: The worst things get, the better they get. When things are bad, they go up.”

-DT

Tepper is aware that asset prices don’t always reflect their true intrinsic value. When most investors capitulate and convert their assets to cash, Tepper is buying.

1987: Purchased junk bonds in financial institutions after Black Monday, helping Goldman Sachs’ recovery effort.

2001: Appaloosa returned 61% due to Tepper’s focus in distressed bonds.

2009: Appaloosa returned over $7 billion by buying distressed companies like Bank of America for ~$3.72/share and Citi for $0.79/share.

2018: Tepper states that the bull market still has room to grow and refutes the claim that the stock market is overvalued. Tepper claims that “There's no inflation. The market coming into this year doesn't look rich; in fact, it looks almost as cheap as coming into last year.”

Adapt with the Market

The market is constantly changing, and so has Tepper’s focus on which stocks to buy. Below is Tepper’s portfolio in 2009. You can tell that he primarily invested in financial institutions and retail stores. The only technology company in Appaloosa’s portfolio was Microsoft.

Today, Appaloosa’s portfolio is unrecognizable compared to 2009. Appaloosa’s top 5 positions are all technology-based.

It’s imperative that the rationale investor adapts along with the market. Many of the hedge funds who performed well in the late 90’s and early 2000’s have lost their touch due to their inability to adapt with the market. These include Ray Dalio (Bridgewater), David Einhorn (Green Light Capital), and John Paulson (Paulson & Co.). All 3 renowned managers have underperformed the S&P 500 since 2015.

Holdings Value

Appaloosa reduced their holdings value by 30.6% compared to Q1. It has been reported that Tepper has completed the family office process and has returned all outside investor’s money.

“Executives at Appaloosa have “discussed several scenarios” for returning outside capital either at the end of this year or over several years. But the report said that it is more likely that Tepper, who is 61 years old, will finish returning client capital over several years.”

-Wall Street Journal, May 2019

“The plan will return 90% of investor’s capital, starting in January 2020. The bulk of the money remaining will be returned by the spring.”

-Bloomberg, Oct. 2019

The withdrawal of external investors may not explain the reduction in holdings value since a large sum of external capital has reportedly been returned. However, the exact plan and details to convert Appaloosa into a family office does not have to be made public, and it is entirely possible that Appaloosa is still returning money to external investors.

This may signal that Tepper believes we may soon experience a period of economic uncertainty that will reflect in the markets. This certainly wouldn’t be surprising after the historic run-up from the March 2020 lows. The S&P 500 has gained 97% since then, while the Nasdaq-100 has gained 123%.

Additionally, the S&P 500 has yet to see a 5% correction this year. According to LPL Research, the average year for the S&P 500 sees three separate 5% or more pullbacks. The S&P 500 hasn’t experienced a 5% pullback since October of 2020. Past performance does not determine future performance, but this is certainly something to be aware of.

Current Portfolio

Appaloosa reduced their market exposure massively during Q2; it’s not fully known whether Appaloosa actually reduced their exposure or is still in the process of returning external capital (or a combination of both). I would hypothesize that Appaloosa has finished returning external capital since the announcement was made over two years ago.

Appaloosa uses a concentrated, high-conviction investing strategy. They have a top 10 holdings concentration of 57.44% and a top 15 holdings concentration of 67.42%.

Significant Changes

Appaloosa picked up shares in UBER, PHM, and MOS, among others, in Q2. PHM is the third largest home construction company in the US, while MOS is the largest producer of potash and phosphate fertilizer in the US. Appaloosa also purchased FCX, which mines copper, gold, and molybdenum. It’s apparent that Tepper sees some value in the commodity industry.

Appaloosa decreased their CHK position by 85% in Q2 after buying a lump sum position in Q1. They also decreased their exposure to TMUS, AMZN, FB, and GOOG, all companies which fall in their top 5 positions.

The average time a position is held in Appaloosa’s portfolio is 4.83 quarters. For a top 10 position, the average time is 7.3 quarters; for a top 20 position, the average time is 6.7 quarters. Tepper is willing to hold high conviction ideas longer than low conviction ideas.

Tepper is undoubtedly one of the most successful hedge fund managers of all time. Appaloosa’s consistent returns have been guided by Tepper’s philosophy of constantly adapting to the market and not letting emotions get in the way of investment decisions.

Hedge Vision - Institutional Insights

Please don’t hesitate to send me topic recommendations, suggestions, or general questions. You can contact me by email: HedgeVisions@gmail.com, or by Twitter messages @HedgeVision

Disclosure: Of the equities mentioned above, I am long AMZN, FB, MSFT, and BABA via common shares.

Source 1 - Appaloosa to become a Family Office