Stanley Druckenmiller, the hedge fund legend famous for betting against the British pound and collecting a $1 billion paycheck, hasn’t had a down year in over 4 decades. Druckenmiller caught the eye of George Soros during his storied career and collaborated with Soros’ Quantum Fund for 12 years.

An average annual return of 30% for 30 years illustrates the true power of compound interest. To put this into perspective, if you had invested $10,000 with Druckenmiller at the beginning of his 30 year run, you would end up with $26,199,957 at the end of his run.

Druckenmiller left the Quantum Fund in 2000 to focus on his own fund, Duquesne Capital, which became a family office in 2010. He is a concentrated, high conviction investor, and his AUM of $3.88B contains 60 holdings as of Q1 of 2021. His top position, Microsoft, represents 12.93% of his portfolio. Additionally, his top 10 positions represents 52.38% of his portfolio.

Druckenmiller’s significant buys include Citigroup and Palantir. These are new positions that Druckenmiller added in Q1, so it seems he is forecasting a big future move as both positions are in his top 10 holdings.

Druckenmiller decreased his current MSFT position by 509,320 shares, or 19.31%, at an estimated average price of $229.10 in Q1. The consistent technology cash-cow reported revenues of $41.7B in Q1, beating consensus revenue estimates for the 9th quarter in a row. Duquesne has a long history with MSFT, first purchasing shares in Q2 of 2015.

Druckenmiller’s new position in ON may signal that he is bullish on the semiconductor industry. It’s interesting why he chose ON over more widely accepted competitors, such as NVDA, AMD, or TSM. Potential future revenue growth and expansion may be a reason, as ON has a market cap of $16B, while the competitors mentioned above have much greater market caps.

ON: $16B Market Cap

TSM: $562B Market Cap

NVDA: $434 Market Cap

AMD: $99B Market Cap

ON has the lowest EV (Enterprise Value)/NTM (Next Twelve Months) Sales multiple when compared against competitors by a wide margin.

However, this can be partly explained by ON’s relatively slow revenue CAGR (Compounded Annual Growth Rate) when compared against AMD and NVDA. ON and TSM are growing revenue at similar CAGRs, and ON has a much lower EV/NTM Sales multiple, which may have influenced Druckenmiller’s decision. It’s also interesting to note that ON, AMD, and NVDA have grown revenues consistently since Q3 of 2019, while TSM has seen little growth since then.

See below for Druckenmiller’s largest buys in Q1:

Druckenmiller’s Palantir purchase is in contrast with his old partner, Soros, as Soros liquidated his entire Palantir position (18.46 million shares) in Q1.

See below for Soros’ largest sells in Q1:

Significant sells of Duquesne Family Office in Q1 include Disney, Carvana, and Nuance Communications. In regards to Disney’s ownership history (see graphic below), it seems Duquesne loaded up big in Q4 of 2020 on the Disney+ hype, then sold the entire position for a nice gain in one quarter’s time.

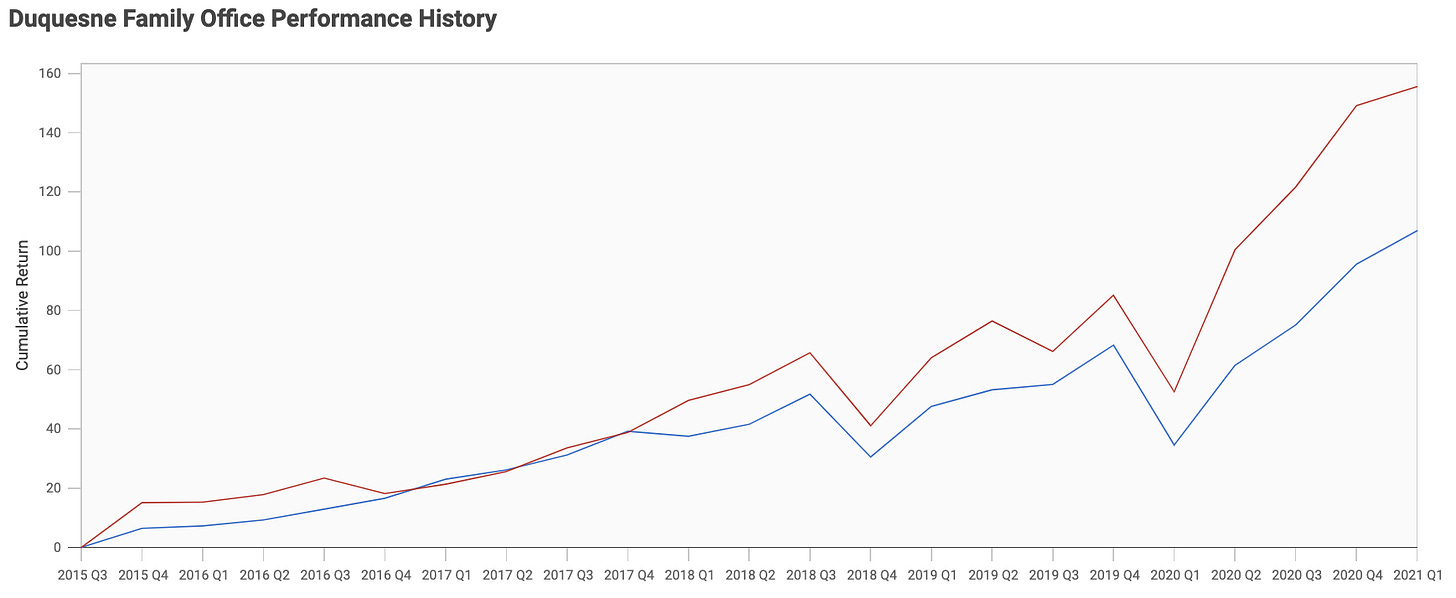

Duquesne Family Office is undoubtedly a fund to keep track of, as they hold a limited number of high conviction positions that historically have performed very well. From 2015 to 2021, Duquesne boasted cumulative returns of 156%, beating the S&P 500’s 107% by 49%. Druckenmiller even returned 11% in the midst of the 2008 Financial Crisis.

Red Line: Duquesne Family Office Returns

Blue Line: S&P 500 Returns

Hedge Vision - Institutional Insights

Thanks for reading!

📖 Join the conversation on Substack Chat

🕊️ Get real-time insights on X/Twitter: @HedgeVision

📧 Old school is cool too: HedgeVisions@gmail.com

One of the greatest of all time. Thanks for this, love your charts by the way.